Question

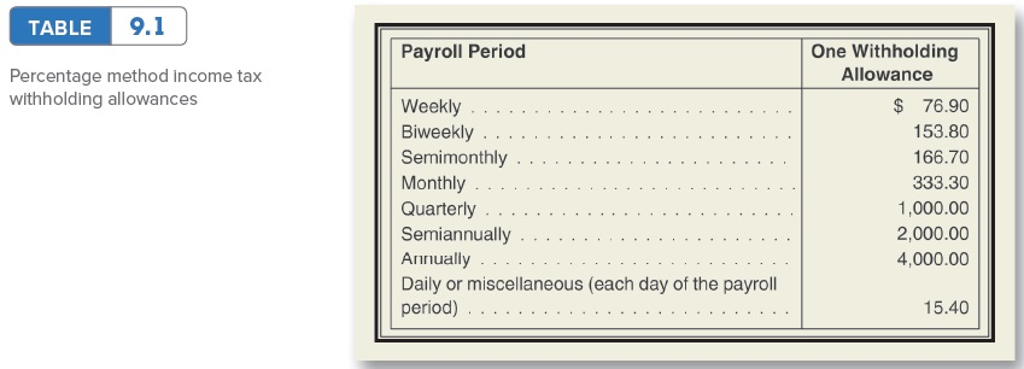

THE QUESTION IS ALL THE WAY AT THE BOTTOM :) TABLES BELOW ARE NECESSARY FOR THE PROBLEM: Table 9.1 Withholding allowance Take the weekly total

THE QUESTION IS ALL THE WAY AT THE BOTTOM :) TABLES BELOW ARE NECESSARY FOR THE PROBLEM:

Table 9.1 Withholding allowance

Take the weekly total pay and Multiply the number of 1 allowance by $76.90. One Weekly allowance is $76.90. (Ex. Allowances claimed: 2. So you take 2 x $76.90 = $153.80 - Weekly Pay= amount and take it from table 9.2)

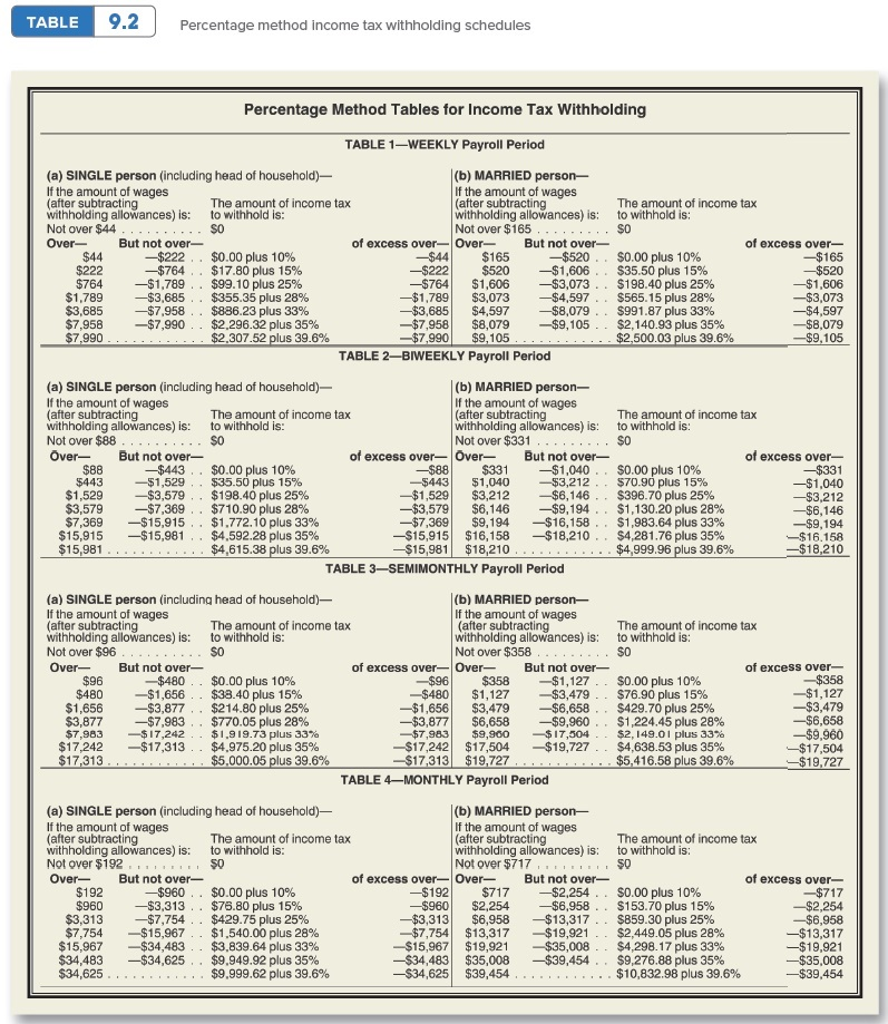

Table 9.2:

**QUESTION: "Assume a tax rate of 6.2% on $118,500 for Social Security and 1.45% for Medicare. No one will reach the maximum for FICA. Complete the following payroll register. Assume payroll period: weekly. (Use the percentage method to calculate FIT for this weekly period.) (Use Table 9.1 and Table 9.2). (Do not round intermediate calculations. Round your final answers to the nearest cent.)

|

|

|

|

|

| FICA |

| |

| Employee | Marital status | Allowances claimed | Gross pay | FIT | S.S. | Med. | Net pay |

| Mike Rice | M | 2 | $1,600 | $ | $ | $ | $ |

TABLE 9.1 TABLE One Withholding Allowance Payroll Period Weekly . . . . Semimonthly Percentage method income tax withholding allowances $ 76.90 153.80 166.70 333.30 1,000.00 2,000.00 4,000.00 Monthly Annually Daily or miscellaneous (each day of the payroll period) 15.40

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started