Question: The question is below the Individual assignment, only questions 1 & 2 need to be answered. COMPANY PROFILE SIC/NAICS Codes 2413, 3442, 5031, 3433, 3567

The question is below the Individual assignment, only questions 1 & 2 need to be answered.

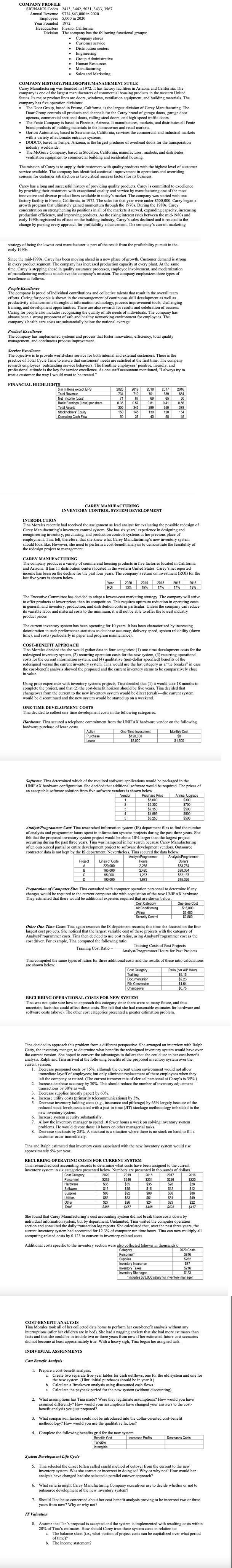

COMPANY PROFILE SIC/NAICS Codes 2413, 3442, 5031, 3433, 3567 Annual Revenue $734,843,000 in 2020 Employees 5,000 in 2020 Year Founded 1972 Headquarters Fresno, California Division The company has the following functional groups: Company stores Customer service Distribution centers Engineering Group Administrative Human Resources Manufacturing Sales and Marketing COMPANY HISTORY/PHILOSOPHY/MANAGEMENT STYLE Carey Manufacturing was founded in 1972. It has factory facilities in Arizona and California. The company is one of the largest manufacturers of commercial housing products in the western United States. Its major product lines are doors, windows, ventilation equipment, and building materials. The company has five operation divisions: The Door Group, based in Fresno, California, is the largest division of Carey Manufacturing. The Door Group controls all products and channels for the Carey brand of garage doors, garage door The Femie Company is based in Pheonix, Arizona. De manufactures, markets, and distributes all Fenic brand products of building materials to the homeowner and retail markets. Gorton Automatics, based in Sacramento, California, services the commercial and industrial markets with a variety of automatic entrance systems. DODCO, based in Tempe, Arizona, is the largest producer of overhead doors for the transporation industry worldwide. The McGuire Company, based in Stockton, California, manufactures, markets, and distributes ventilation equipment to commercial building and residential housing. The mission of Carey is to supply their customers with quality products with the highest level of customer service available. The company has identified continual improvement in operations and overriding concern for customer satisfaction as two critical success factors for its business. Carey has a long and successful history of providing quality products. Carey is committed to excellence by providing their customers with exceptional quality and service by manufacturing one of the most innovative and diverse product lines available in today's market. The company was started with one factory facility in Fresno, California, in 1972. The sales for that year were under $500,000. Carey began a growth program that ultimately gained momentum through the 1970s. During the 1980s, Carey concentration on strengthening its positions in all of the markets it served, expanding capacity, increasing production efficiency, and improving products. As the rising interest rates between the mid-1980s and carly 1990s registered its effects on the building industry, Carey's sales declined and it reacted to the change pursing every approach for profitability enhancement. The company's current marketing strategy of being the lowest cost manufacturer is part of the result from the profitability pursuit in the carly 1990s. Since the mid-1990s, Carey has been moving ahead in a new phase of growth. Customer demand is strong in every product segment. The company has increased production capacity at every plant. At the same time, Carey is stepping ahead in quality assurance processes, employee involvement, and modernization of manufacturing methods achieve the company's mission. The company emphasizes three types of excellence as follows. People Excellence The company is proud of individual contributions and collective talents that result in the overall team efforts. Caring for people is shown in the encouragement of continuous skill development as well as productivity enhancements throughout information technology, process improvement tools, challenging training, and development opportunities. There are also rewards for results and celebration of success. Caring for people also includes recognizing the quality of life needs of individuals. The company has always been a strong proponent of safe and healthy networking environment for employees. The company's health care costs are substantially below the national average. Product Excellence The company has implemented systems and process that foster innovation, efficiency, total quality management, and continuous process improvement. Service Excellence The objective is to provide world-class service for both internal and external customers. There is the practice of Total Cycle Time to ensure that customers' needs are satisfied at the first time. The company rewards employees' outstanding service behaviors. The frontline employees' positive, friendly, and professional attitude is the key for service excellence. As one staff accountant mentioned, "I always try to treat a customer the way I would want to be treated." FINANCIAL HIGHLIGHTS $ in milions except EPS Total Revenue Net Income (Loss) Basic Earnings (Loss) per share Total Assets Stockholders' Equity Operating Cash Flow 2020 734 71 0.35 300 150 50 2019 710 87 0.57 345 145 36 2018 701 69 0.81 299 139 40 2017 689 65 0.41 350 120 58 2016 654 50 0.56 378 154 45 CAREY MANUFACTURING INVENTORY CONTROL SYSTEM DEVELOPMENT INTRODUCTION Tina Morales recently had received the assignment as lead analyst for evaluating the possible redesign of Carey Manufacturing's inventory control system. She has six years' experience in designing and reengineering inventory, purchasing, and production controls systems at her previous place of employment. Tina felt, therefore, that she knew what Carey Manufacturing's new inventory system should look like. However, she need to perform a cost-benefit analysis to demonstrate the feasibility of the redesign project to management, CAREY MANUFACTURING The company produces a variety of commercial housing products in five factories located in California and Arizona. It has 11 distribution centers located in the western United States. Carey's net reported income has been on the decline for the past four years. The company's return on investment (ROI) for the last five years is shown below. Year 2020 2019 2018 2017 2016 ROI | 13% 15% 17% 17% 19% The Executive Committee has decided to adapt a lowest-cost marketing strategy. The company will strive to offer products at lower prices than its competition. This requires optimum reduction in operating costs in general, and inventory, production, and distribution costs in particular. Unless the company can reduce its variable labor and material costs to the minimum, it will not be able to offer the lowest industry product prices The current inventory system has been operating for 10 years. It has been characterized by increasing deterioration in such performance statistics as database accuracy, delivery speed, system reliability (down time), and costs (particularly paper and program maintenance). COST-BENEFIT APPROACH Tina Morales decided the she would gather data in four categories: (1) one-time development costs for the redesigned inventory system, (2) recurring operation costs for the new system, (3) recurring operational costs for the current information system, and (4) qualitative (non-dollar specified) benefits of the redesigned versus the current inventory system. Tina would use the last category as a "tie breaker" in case the cost-benefit analysis showed the proposed and the current inventory stems to be comparatively close in value. Using prior experience with inventory systems projects, Tina decided that (1) it would take 18 months to complete the project, and that (2) the cost-benefit horizon should be five years. Tina decided that changeover from the current to the new inventory system would be direct (crash)-the current system would be discontinued and the new system would be started up on a weekend. ONE-TIME DEVELOPMENT COSTS Tina decided to collect one-time development costs in the following categories: Hardware: Tina secured a telephone commitment from the UNIFAX hardware vendor on the following hardware purchase of lease costs. Action One-Time Investment Monthly Cost Purchase $120.000 SO Lease $5,000 $1,500 Software: Tina determined which of the required software applications would be packaged in the UNIFAX hardware configuration. She decided that additional software would be required. The prices of an acceptable software solution from five software vendors is shown below. Vendor Purchase Price Annual Upgrade $8,000 $300 $5.300 $700 3 $7,350 $500 $4,999 $800 5 $6,250 $500 Analyst/Programmer Cost: Tina researched information system (IS) department files to find the number of analysts and programmer hours spent in information systems projects during the past three years. She felt that the proposed inventory system project would be about 10% larger than the largest project occurring during the past three years. Tina was hampered in her search because Carey Manufacturing often outsourced partial or entire development project to software development vendors. Outsource contractor data is not kept by the IS department. Nevertheless, Tina secured the data below: Analyst Programmer Analysts/Programmer Project Lines of Code Hours Dollars 220,000 2.265 $83.76 B 165,000 2,420 $99.364 95.000 1,237 $62,137 190,000 1,673 $75,326 D Preparation of Computer Site: Tina consulted with computer operation personnel to determine if any changes would be required to the current computer site with acquisition of the new UNIFAX hardware. They estimated that there would be additional expenses required that are shown below: Cost Category One-time Cost Air Conditioning Wiring $3,400 Security Control $2,500 $16.000 Other One-Time Costs: Tina again research the IS department records, this time she focused on the four largest cost projects. She noticed that the largest variable cost of these projects with the category of Analyst/Programmer costs. Tina then decided to use cost ratios, using Analyst/Programmer cost as the cost driver. For example, Tina computed the following ratio: Training Costs of Past Projects Training Cost Ratio Analyst/Programmer Hours for Past Projects Tina computed the same types of ratios for three additional costs and the results of these ratio calculations are shown below: Cost Category Ratio (per AP Hour) Training $5.15 Documentation $2.23 File Conversion $1.64 Changeover $0.75 RECURRING OPERATIONAL COSTS FOR NEW SYSTEM Tina was not quite sure how to approach this category since there were so many future, and thus uncertain, facts that could affect these costs. She felt that she had reasonable estimates for hardware and software costs (above). The other cost categories presented a greater estimation problem. 3 4 Tina decided to approach this problem from a different perspective. She arranged an interview with Ralph Getty, the inventory manger, to determine what benefits the redesigned inventory system would have over the current version. She hoped to convert the advantages to dollars that she could use in her cost-benefit analysis. Ralph and Tina arrived at the following benefits of the proposed inventory system over the current version: 1. Decrease personnel costs by 15%, although the current union environment would not allow immediate layoff of employees; but only eliminate replacement of these employees when they left the company or retired. (The current turnover rate of clerical personnel at Carey's is 35%.) 2. Increase database accuracy by 30%. This should reduce the number of inventory adjustment transactions by 30% as well Decrease supplies (mostly paper) by 60%. Increase utility costs (primarily telecommunications) by 5%. 5. Decrease inventory holding costs (c.g., insurance and pilferage) by 65% largely because of the reduced stock levels associated with a just-in-time (JIT) stockage methodology imbedded in the new inventory system. 6. Increase system security substantially. 7. Allow the inventory manager to spend 10 fewer hours a week on solving inventory system problems. He would devote those 10 hours on other managerial tasks. 8. Decrease stockouts by 25%. A stockout is a situation where there is no stock on hand to fill a customer order immediately. Tina and Ralph estimated that inventory costs associated with the new inventory system would rise approximately 5% per year. RECURRING OPERATING COSTS FOR CURRENT SYSTEM Tina researched cost accounting records to determine what costs have been assigned to the current inventory system in six categories presented below. Numbers are presented in thousands of dollars. Cost Category 2019 2018 2017 Personnel $262 $234 $226 Hardware $28 Software $15 $15 $15 $12 Supplies $88 Utilities $53 $53 $51 $51 $49 Other $26 $24 $23 Total $498 $467 $448 $428 $417 2020 $246 $35 $35 $35 2016 $22 $28 $12 $86 $96 $92 $89 $27 $22 She found that Carey Manufacturing's cost accounting system did not break these costs down by individual information system, but by department. Undaunted, Tina visited the computer operation section and consulted the daily transaction log reports. She calculated that, over the past three years, the current inventory system had accounted for 12.3% of computer run time hours. Tina can now multiply all computing-related costs by 0.123 to convert to inventory-related costs. Additional costs specific to the inventory section were also collected (shown thousands): Category 2020 Costs Personnel $816 Supplies $262 Inventory Insurance $87 Inventory Taxes $216 Inventory Shorlages $123 *Includes $83,000 salary for inventory manager COST-BENEFIT ANALYSIS Tina Morales took all of her collected data home to perform her cost-benefit analysis without any interruptions (after her children are in bed). She had a nagging anxiety that she had more estimates than facts and that she could be in trouble two or three years from now if her estimated future cost scenarios did not become at least approximately true. With a heavy sigh, Tina began her assigned task. INDIVIDUAL ASSIGNMENTS Cost Benefit Analysis 1. Prepare a cost-benefit analysis, a. Create two separate five-year tables for cash outflows, one for the old system and one for the new system. (Hint: initial purchases should be in year 0.) b. Calculate a Breakeven analysis using discounted cash flows. c. Calculate the payback period for the new system (without discounting). What assumptions has Tina made? Were they legitimate assumptions? How would you have assumed differently? How would your assumptions have changed your answers to the cost- benefit analysis you just prepared? 3. What comparison factors could not be introduced into the dollar-oriented cost-benefit methodology? How would you use the qualitative factors? 4. Complete the following benefits grid for the new system. Benefits Grid Increases Profits Decreases Costs Tangible Intangible System Development Life Cycle 5. Tina selected the direct (often called crash) method of cutover from the current to the new inventory system. Was she correct or incorrect in doing so? Why or why not? How would her analysis have changed had she selected a parallel cutover approach? 6. What criteria might Carey Manufacturing Company executives use to decide whether or not to outsource development of the new inventory system? 7. Should Tina be so concerned about her cost-benefit analysis proving to be incorrect two or three years from now? Why or why not? IT Valuation 8. Assume that Tin's proposal is accepted and the system is implemented with resulting costs within 20% of Tina's estimates. How should Carey treat these system costs in relation to: The balance sheet (i.c., what portion of project costs can be capitalized what period of time)? b. The income statement? COMPANY PROFILE SIC/NAICS Codes 2413, 3442, 5031, 3433, 3567 Annual Revenue $734,843,000 in 2020 Employees 5,000 in 2020 Year Founded 1972 Headquarters Fresno, California Division The company has the following functional groups: Company stores Customer service Distribution centers Engineering Group Administrative Human Resources Manufacturing Sales and Marketing COMPANY HISTORY/PHILOSOPHY/MANAGEMENT STYLE Carey Manufacturing was founded in 1972. It has factory facilities in Arizona and California. The company is one of the largest manufacturers of commercial housing products in the western United States. Its major product lines are doors, windows, ventilation equipment, and building materials. The company has five operation divisions: The Door Group, based in Fresno, California, is the largest division of Carey Manufacturing. The Door Group controls all products and channels for the Carey brand of garage doors, garage door The Femie Company is based in Pheonix, Arizona. De manufactures, markets, and distributes all Fenic brand products of building materials to the homeowner and retail markets. Gorton Automatics, based in Sacramento, California, services the commercial and industrial markets with a variety of automatic entrance systems. DODCO, based in Tempe, Arizona, is the largest producer of overhead doors for the transporation industry worldwide. The McGuire Company, based in Stockton, California, manufactures, markets, and distributes ventilation equipment to commercial building and residential housing. The mission of Carey is to supply their customers with quality products with the highest level of customer service available. The company has identified continual improvement in operations and overriding concern for customer satisfaction as two critical success factors for its business. Carey has a long and successful history of providing quality products. Carey is committed to excellence by providing their customers with exceptional quality and service by manufacturing one of the most innovative and diverse product lines available in today's market. The company was started with one factory facility in Fresno, California, in 1972. The sales for that year were under $500,000. Carey began a growth program that ultimately gained momentum through the 1970s. During the 1980s, Carey concentration on strengthening its positions in all of the markets it served, expanding capacity, increasing production efficiency, and improving products. As the rising interest rates between the mid-1980s and carly 1990s registered its effects on the building industry, Carey's sales declined and it reacted to the change pursing every approach for profitability enhancement. The company's current marketing strategy of being the lowest cost manufacturer is part of the result from the profitability pursuit in the carly 1990s. Since the mid-1990s, Carey has been moving ahead in a new phase of growth. Customer demand is strong in every product segment. The company has increased production capacity at every plant. At the same time, Carey is stepping ahead in quality assurance processes, employee involvement, and modernization of manufacturing methods achieve the company's mission. The company emphasizes three types of excellence as follows. People Excellence The company is proud of individual contributions and collective talents that result in the overall team efforts. Caring for people is shown in the encouragement of continuous skill development as well as productivity enhancements throughout information technology, process improvement tools, challenging training, and development opportunities. There are also rewards for results and celebration of success. Caring for people also includes recognizing the quality of life needs of individuals. The company has always been a strong proponent of safe and healthy networking environment for employees. The company's health care costs are substantially below the national average. Product Excellence The company has implemented systems and process that foster innovation, efficiency, total quality management, and continuous process improvement. Service Excellence The objective is to provide world-class service for both internal and external customers. There is the practice of Total Cycle Time to ensure that customers' needs are satisfied at the first time. The company rewards employees' outstanding service behaviors. The frontline employees' positive, friendly, and professional attitude is the key for service excellence. As one staff accountant mentioned, "I always try to treat a customer the way I would want to be treated." FINANCIAL HIGHLIGHTS $ in milions except EPS Total Revenue Net Income (Loss) Basic Earnings (Loss) per share Total Assets Stockholders' Equity Operating Cash Flow 2020 734 71 0.35 300 150 50 2019 710 87 0.57 345 145 36 2018 701 69 0.81 299 139 40 2017 689 65 0.41 350 120 58 2016 654 50 0.56 378 154 45 CAREY MANUFACTURING INVENTORY CONTROL SYSTEM DEVELOPMENT INTRODUCTION Tina Morales recently had received the assignment as lead analyst for evaluating the possible redesign of Carey Manufacturing's inventory control system. She has six years' experience in designing and reengineering inventory, purchasing, and production controls systems at her previous place of employment. Tina felt, therefore, that she knew what Carey Manufacturing's new inventory system should look like. However, she need to perform a cost-benefit analysis to demonstrate the feasibility of the redesign project to management, CAREY MANUFACTURING The company produces a variety of commercial housing products in five factories located in California and Arizona. It has 11 distribution centers located in the western United States. Carey's net reported income has been on the decline for the past four years. The company's return on investment (ROI) for the last five years is shown below. Year 2020 2019 2018 2017 2016 ROI | 13% 15% 17% 17% 19% The Executive Committee has decided to adapt a lowest-cost marketing strategy. The company will strive to offer products at lower prices than its competition. This requires optimum reduction in operating costs in general, and inventory, production, and distribution costs in particular. Unless the company can reduce its variable labor and material costs to the minimum, it will not be able to offer the lowest industry product prices The current inventory system has been operating for 10 years. It has been characterized by increasing deterioration in such performance statistics as database accuracy, delivery speed, system reliability (down time), and costs (particularly paper and program maintenance). COST-BENEFIT APPROACH Tina Morales decided the she would gather data in four categories: (1) one-time development costs for the redesigned inventory system, (2) recurring operation costs for the new system, (3) recurring operational costs for the current information system, and (4) qualitative (non-dollar specified) benefits of the redesigned versus the current inventory system. Tina would use the last category as a "tie breaker" in case the cost-benefit analysis showed the proposed and the current inventory stems to be comparatively close in value. Using prior experience with inventory systems projects, Tina decided that (1) it would take 18 months to complete the project, and that (2) the cost-benefit horizon should be five years. Tina decided that changeover from the current to the new inventory system would be direct (crash)-the current system would be discontinued and the new system would be started up on a weekend. ONE-TIME DEVELOPMENT COSTS Tina decided to collect one-time development costs in the following categories: Hardware: Tina secured a telephone commitment from the UNIFAX hardware vendor on the following hardware purchase of lease costs. Action One-Time Investment Monthly Cost Purchase $120.000 SO Lease $5,000 $1,500 Software: Tina determined which of the required software applications would be packaged in the UNIFAX hardware configuration. She decided that additional software would be required. The prices of an acceptable software solution from five software vendors is shown below. Vendor Purchase Price Annual Upgrade $8,000 $300 $5.300 $700 3 $7,350 $500 $4,999 $800 5 $6,250 $500 Analyst/Programmer Cost: Tina researched information system (IS) department files to find the number of analysts and programmer hours spent in information systems projects during the past three years. She felt that the proposed inventory system project would be about 10% larger than the largest project occurring during the past three years. Tina was hampered in her search because Carey Manufacturing often outsourced partial or entire development project to software development vendors. Outsource contractor data is not kept by the IS department. Nevertheless, Tina secured the data below: Analyst Programmer Analysts/Programmer Project Lines of Code Hours Dollars 220,000 2.265 $83.76 B 165,000 2,420 $99.364 95.000 1,237 $62,137 190,000 1,673 $75,326 D Preparation of Computer Site: Tina consulted with computer operation personnel to determine if any changes would be required to the current computer site with acquisition of the new UNIFAX hardware. They estimated that there would be additional expenses required that are shown below: Cost Category One-time Cost Air Conditioning Wiring $3,400 Security Control $2,500 $16.000 Other One-Time Costs: Tina again research the IS department records, this time she focused on the four largest cost projects. She noticed that the largest variable cost of these projects with the category of Analyst/Programmer costs. Tina then decided to use cost ratios, using Analyst/Programmer cost as the cost driver. For example, Tina computed the following ratio: Training Costs of Past Projects Training Cost Ratio Analyst/Programmer Hours for Past Projects Tina computed the same types of ratios for three additional costs and the results of these ratio calculations are shown below: Cost Category Ratio (per AP Hour) Training $5.15 Documentation $2.23 File Conversion $1.64 Changeover $0.75 RECURRING OPERATIONAL COSTS FOR NEW SYSTEM Tina was not quite sure how to approach this category since there were so many future, and thus uncertain, facts that could affect these costs. She felt that she had reasonable estimates for hardware and software costs (above). The other cost categories presented a greater estimation problem. 3 4 Tina decided to approach this problem from a different perspective. She arranged an interview with Ralph Getty, the inventory manger, to determine what benefits the redesigned inventory system would have over the current version. She hoped to convert the advantages to dollars that she could use in her cost-benefit analysis. Ralph and Tina arrived at the following benefits of the proposed inventory system over the current version: 1. Decrease personnel costs by 15%, although the current union environment would not allow immediate layoff of employees; but only eliminate replacement of these employees when they left the company or retired. (The current turnover rate of clerical personnel at Carey's is 35%.) 2. Increase database accuracy by 30%. This should reduce the number of inventory adjustment transactions by 30% as well Decrease supplies (mostly paper) by 60%. Increase utility costs (primarily telecommunications) by 5%. 5. Decrease inventory holding costs (c.g., insurance and pilferage) by 65% largely because of the reduced stock levels associated with a just-in-time (JIT) stockage methodology imbedded in the new inventory system. 6. Increase system security substantially. 7. Allow the inventory manager to spend 10 fewer hours a week on solving inventory system problems. He would devote those 10 hours on other managerial tasks. 8. Decrease stockouts by 25%. A stockout is a situation where there is no stock on hand to fill a customer order immediately. Tina and Ralph estimated that inventory costs associated with the new inventory system would rise approximately 5% per year. RECURRING OPERATING COSTS FOR CURRENT SYSTEM Tina researched cost accounting records to determine what costs have been assigned to the current inventory system in six categories presented below. Numbers are presented in thousands of dollars. Cost Category 2019 2018 2017 Personnel $262 $234 $226 Hardware $28 Software $15 $15 $15 $12 Supplies $88 Utilities $53 $53 $51 $51 $49 Other $26 $24 $23 Total $498 $467 $448 $428 $417 2020 $246 $35 $35 $35 2016 $22 $28 $12 $86 $96 $92 $89 $27 $22 She found that Carey Manufacturing's cost accounting system did not break these costs down by individual information system, but by department. Undaunted, Tina visited the computer operation section and consulted the daily transaction log reports. She calculated that, over the past three years, the current inventory system had accounted for 12.3% of computer run time hours. Tina can now multiply all computing-related costs by 0.123 to convert to inventory-related costs. Additional costs specific to the inventory section were also collected (shown thousands): Category 2020 Costs Personnel $816 Supplies $262 Inventory Insurance $87 Inventory Taxes $216 Inventory Shorlages $123 *Includes $83,000 salary for inventory manager COST-BENEFIT ANALYSIS Tina Morales took all of her collected data home to perform her cost-benefit analysis without any interruptions (after her children are in bed). She had a nagging anxiety that she had more estimates than facts and that she could be in trouble two or three years from now if her estimated future cost scenarios did not become at least approximately true. With a heavy sigh, Tina began her assigned task. INDIVIDUAL ASSIGNMENTS Cost Benefit Analysis 1. Prepare a cost-benefit analysis, a. Create two separate five-year tables for cash outflows, one for the old system and one for the new system. (Hint: initial purchases should be in year 0.) b. Calculate a Breakeven analysis using discounted cash flows. c. Calculate the payback period for the new system (without discounting). What assumptions has Tina made? Were they legitimate assumptions? How would you have assumed differently? How would your assumptions have changed your answers to the cost- benefit analysis you just prepared? 3. What comparison factors could not be introduced into the dollar-oriented cost-benefit methodology? How would you use the qualitative factors? 4. Complete the following benefits grid for the new system. Benefits Grid Increases Profits Decreases Costs Tangible Intangible System Development Life Cycle 5. Tina selected the direct (often called crash) method of cutover from the current to the new inventory system. Was she correct or incorrect in doing so? Why or why not? How would her analysis have changed had she selected a parallel cutover approach? 6. What criteria might Carey Manufacturing Company executives use to decide whether or not to outsource development of the new inventory system? 7. Should Tina be so concerned about her cost-benefit analysis proving to be incorrect two or three years from now? Why or why not? IT Valuation 8. Assume that Tin's proposal is accepted and the system is implemented with resulting costs within 20% of Tina's estimates. How should Carey treat these system costs in relation to: The balance sheet (i.c., what portion of project costs can be capitalized what period of time)? b. The income statement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts