Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the question is complete :) pleaseee explain the working and the steps for question 3 and 4. thank you. Hobart Company manufactures attach cases and

the question is complete :)

pleaseee explain the working and the steps for question 3 and 4. thank you.

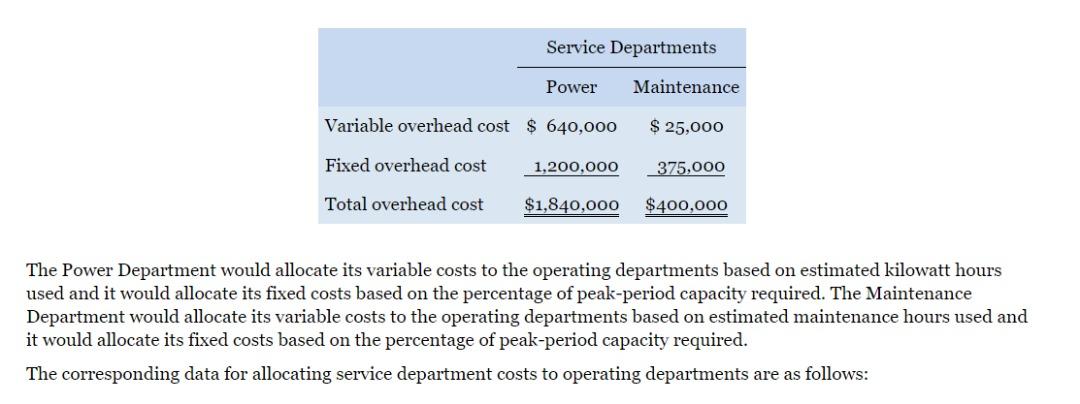

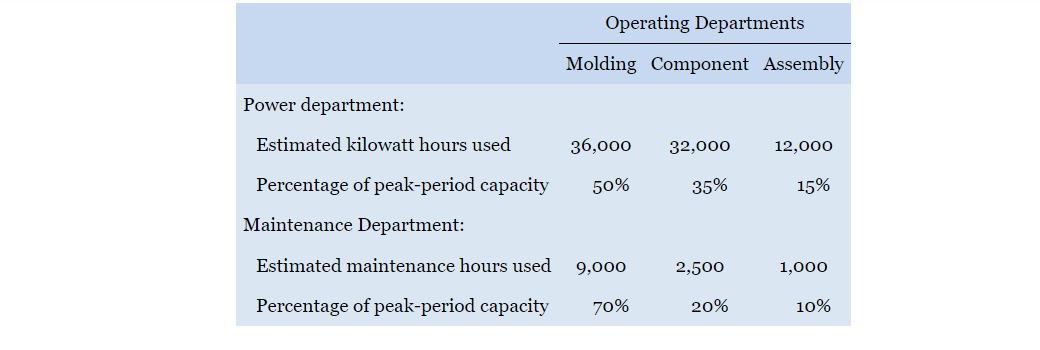

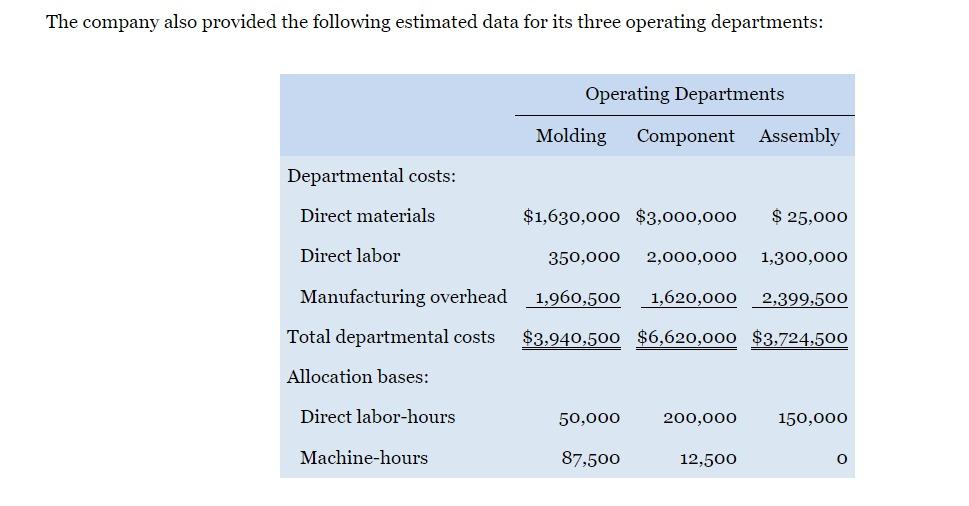

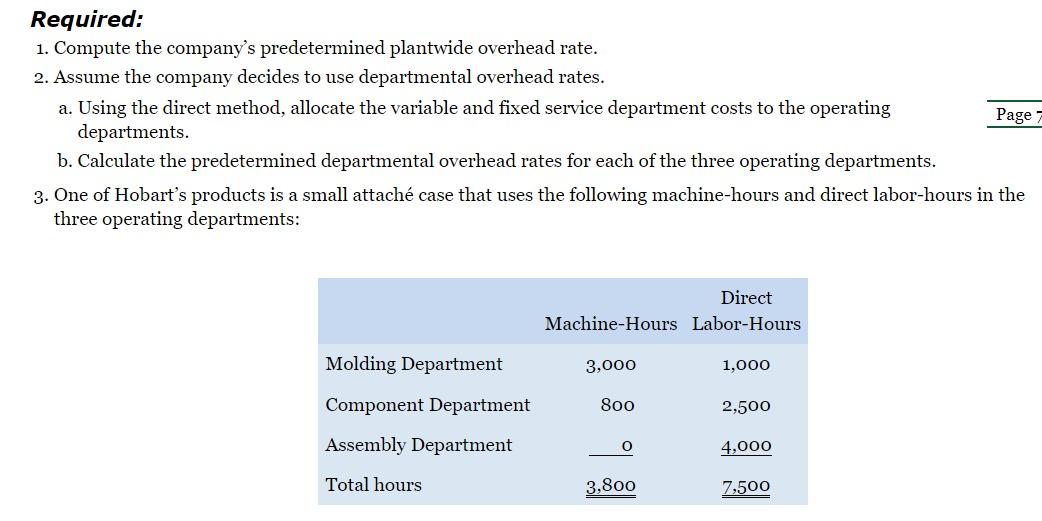

Hobart Company manufactures attach cases and suitcases. It has five manufacturing departments. The Molding, Component, and Assembly departments convert raw materials into finished goods; hence, they are treated as operating departments. The Power and Maintenance departments are treated as service departments because they support the three operating departments. Hobart has always used a plantwide predetermined overhead rate with direct labor-hours as the allocation base Page 783 for product costing purposes. The overhead rate is computed by dividing the company's total estimated overhead cost (across the five manufacturing departments) by the total estimated direct labor-hours to be worked in the three operating departments. The company has been experiencing declining profits; therefore, it is considering switching from plantwide overhead allocation to a departmental approach. Under the departmental approach, the service department costs would be allocated to the three operating departments. Then each operating department would compute its own overhead rate. The overhead rate in Molding would be based on machine-hours and the rates in Component and Assembly would be based on direct labor-hours. The service departments' estimated costs for the coming year are as follows: Service Departments Power Maintenance Variable overhead cost $ 640,000 $ 25,000 Fixed overhead cost 1,200,000 375,000 Total overhead cost $1,840,000 $400,000 The Power Department would allocate its variable costs to the operating departments based on estimated kilowatt hours used and it would allocate its fixed costs based on the percentage of peak-period capacity required. The Maintenance Department would allocate its variable costs to the operating departments based on estimated maintenance hours used and it would allocate its fixed costs based on the percentage of peak-period capacity required. The corresponding data for allocating service department costs to operating departments are as follows: Operating Departments Molding Component Assembly Power department: Estimated kilowatt hours used 36,000 32,000 12,000 Percentage of peak-period capacity 50% 35% 15% Maintenance Department: Estimated maintenance hours used 9,000 2,500 1,000 Percentage of peak-period capacity 70% 20% 10% The company also provided the following estimated data for its three operating departments: Operating Departments Molding Component Assembly Departmental costs: Direct materials $1,630,000 $3,000,000 $ 25,000 Direct labor 350,000 2,000,000 1,300,000 1,960,500 1,620,000 2,399,500 Manufacturing overhead Total departmental costs $3,940,500 $6,620,000 $3,724,500 Allocation bases: Direct labor-hours 50,000 200,000 150,000 Machine-hours 87,500 12,500 O Required: 1. Compute the company's predetermined plantwide overhead rate. 2. Assume the company decides to use departmental overhead rates. a. Using the direct method, allocate the variable and fixed service department costs to the operating departments. b. Calculate the predetermined departmental overhead rates for each of the three operating departments. 3. One of Hobart's products is a small attach case that uses the following machine-hours and direct labor-hours in the three operating departments: Page 1 Direct Machine-Hours Labor-Hours Molding Department 3,000 1,000 Component Department 800 2,500 Assembly Department O 4,000 Total hours 3,800 7.500 a. Calculate the amount of overhead that would be applied to this attach case using the plantwide approach. b. Calculate the amount of overhead that would be applied to this attach case using the departmental approach. 4. Is the plantwide approach overcosting or undercosting the attach case compared to the departmental approach? If the company uses cost-plus pricing, how would plantwide overhead allocation affect its price setting decisionsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started