Answered step by step

Verified Expert Solution

Question

1 Approved Answer

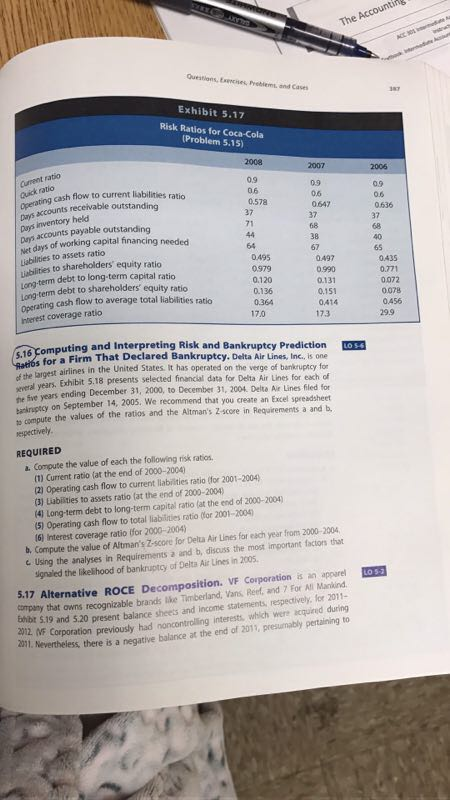

the question is from 5.16 part A,B and C Questions, Exhibit 5.17 Risk Ratios for Coca-Cola (Problem 5.15 06 cash flow to current liabilities ratio

the question is from 5.16 part A,B and C

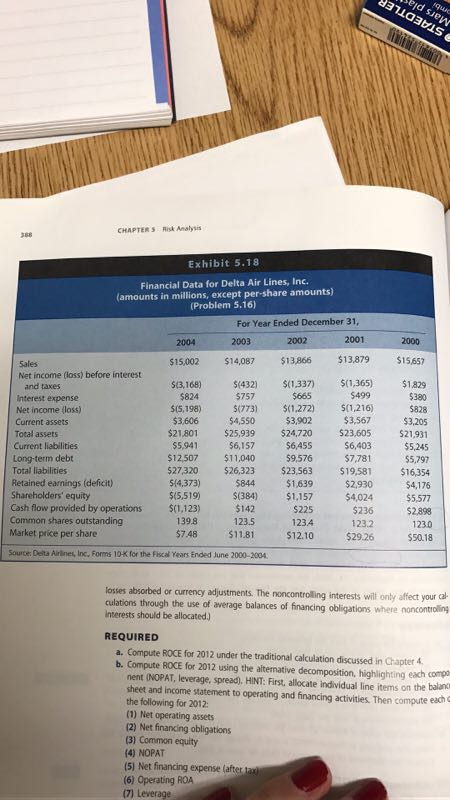

Questions, Exhibit 5.17 Risk Ratios for Coca-Cola (Problem 5.15 06 cash flow to current liabilities ratio operating receivable outstanding 0.57a 0647 Dans inventory held outstanding needed Days payable financing accounts capital working Liabilities to assets ratio equity ratio to shareholders ong-term debt to long-term capital ratio 0.131 term debt to shareholders' equity ratio 0.136 0,151 ating cashflow to average total ratio 0414 nterest coverage ratio 170 173 mputing and Interpreting Risk and Bankruptcy Prediction 5,16 for a Firm That Declared Bankruptcy. Delta Air Lines, Inc is one of the largest airlines in the United States. It has operated on the verge of bankruptcy for Exhibit 5.18 presents selected financial data for Delta Air Lines for fled for each of nt se years ending December 31, 2000, to December 31, 2004 Ar Lines on September 14, 2005. We recommend that you create an Excel a and b. tocompute the values of the ratios and the Altman's Zscore in Requirements REQUIRED a. Compute the value of each the following risk ratios. Current ratio (at the end of 2000-20041 ratio (for 2001-2004) operating cash flow to current liabiities Liabilities to assets (at the end of 2000-2004) 2004) Long-term debt to long-term capital ratio (at the end of 2000 (5) operating cash flow to total liabilities ratio (or 2001-2004 16l Interest coverage ratio (for 2000 2004) each year from 2000 2004, Compute the value of Altman's Z-score lor Dela Air Lines for factors that Using the analyses in a and b, discuss the most important signaled the likelihood of bankruptcy of Delta Air Lines in 2005. 5.17 Alternative ROCE Decomposition. VF Corporation is an apparel copany that owns recognizable brands vans Reef, For Afi lor 2011- 19 and 5.20 present balance sheets and income statements, respectively. during 2012 MF Corporation had interests acquired to Nevertheless there is a negative balance at the end of 2011, presumably pertaining 0.271 0072Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started