Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The question is from Corporate finance. solve both the steps in detail step by step solution required. A. There are two bonds: a 20-year bond

The question is from Corporate finance. solve both the steps in detail

step by step solution required.

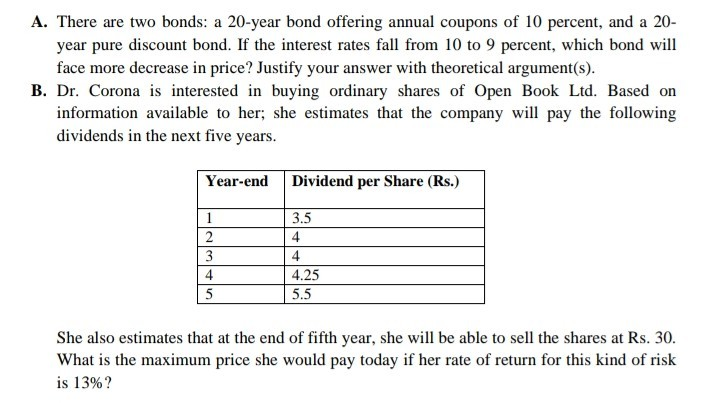

A. There are two bonds: a 20-year bond offering annual coupons of 10 percent, and a 20- year pure discount bond. If the interest rates fall from 10 to 9 percent, which bond will face more decrease in price? Justify your answer with theoretical argument(s). B. Dr. Corona is interested in buying ordinary shares of Open Book Ltd. Based on information available to her, she estimates that the company will pay the following dividends in the next five years. Year-end Dividend per Share (Rs.) 1 2 3 4 5 3.5 4 4 4.25 5.5 She also estimates that at the end of fifth year, she will be able to sell the shares at Rs. 30. What is the maximum price she would pay today if her rate of return for this kind of risk is 13%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started