the question is from inrermediate accounting, what is the additional informaion needed?

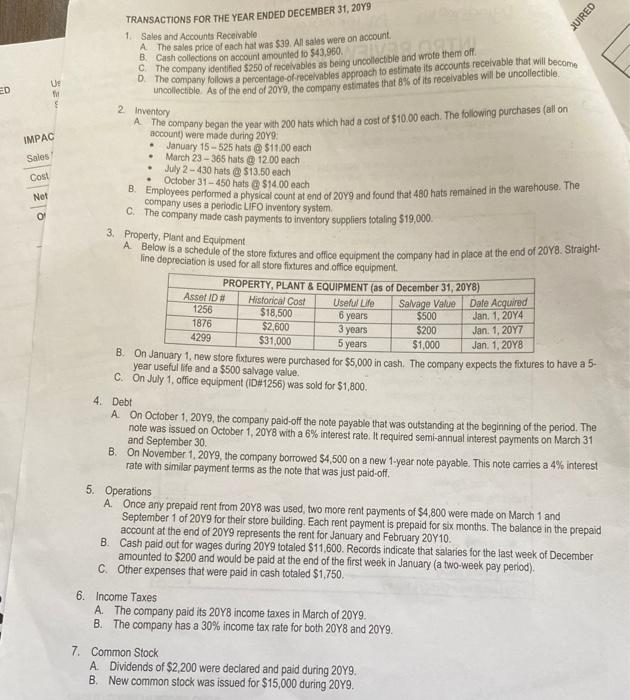

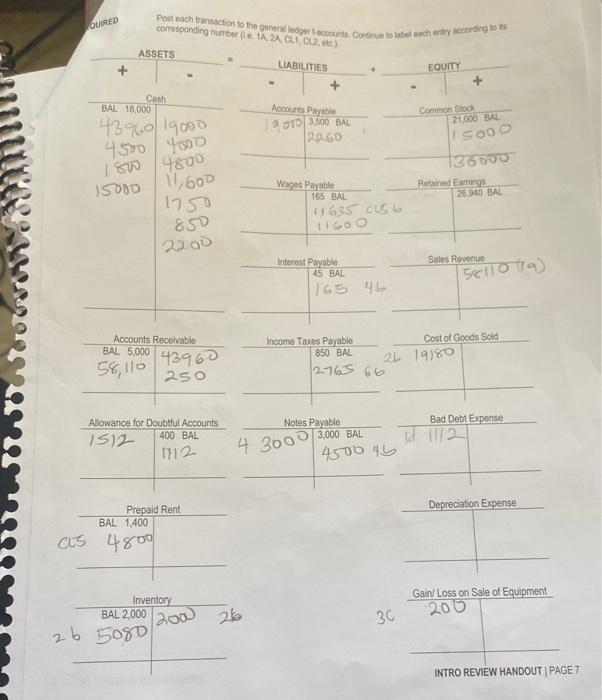

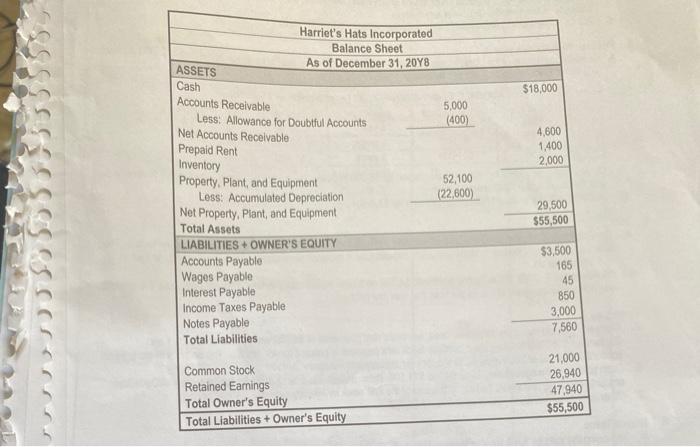

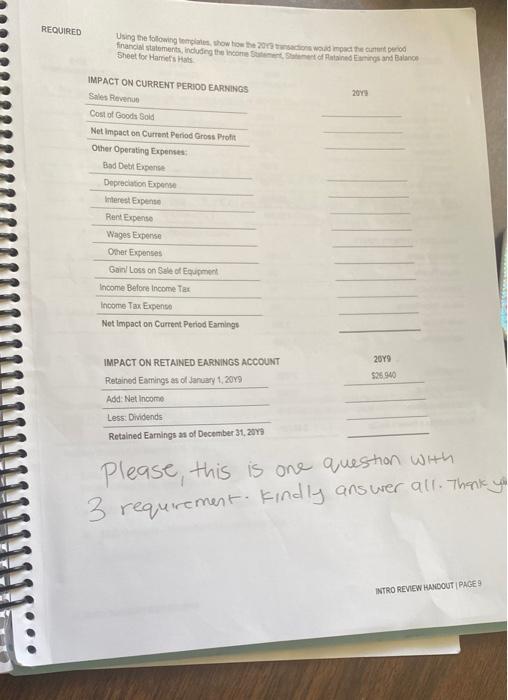

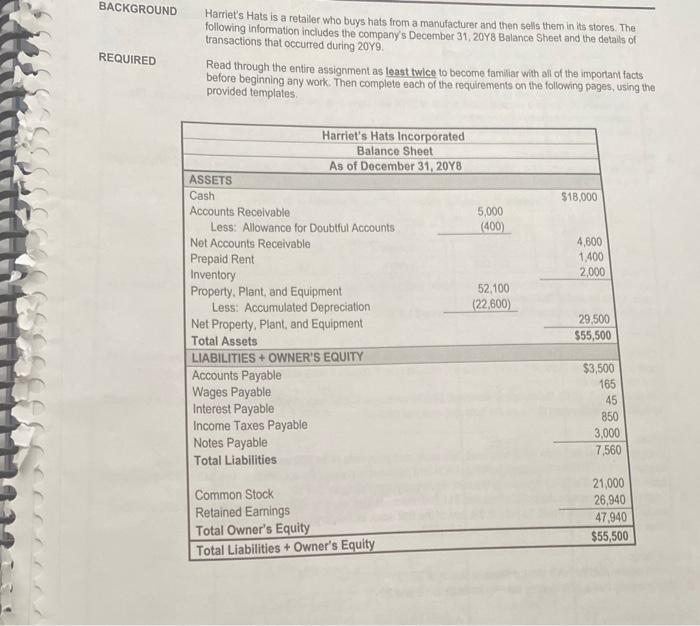

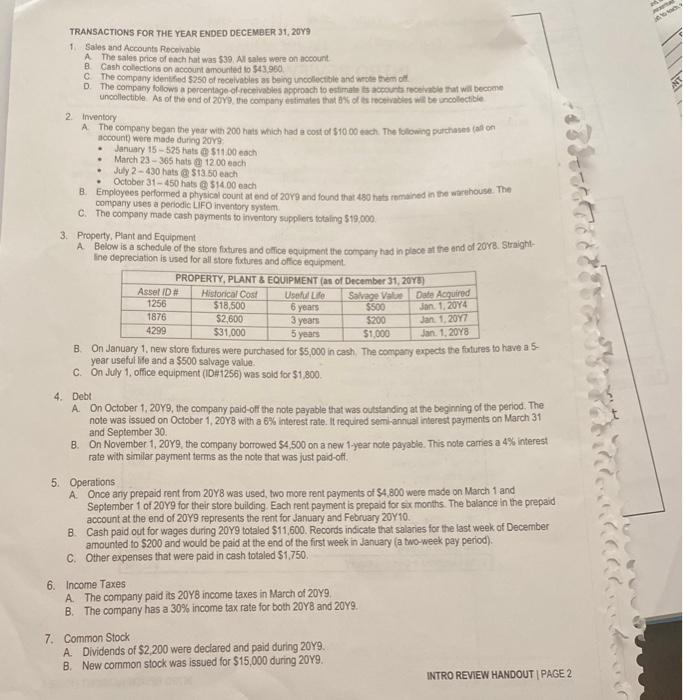

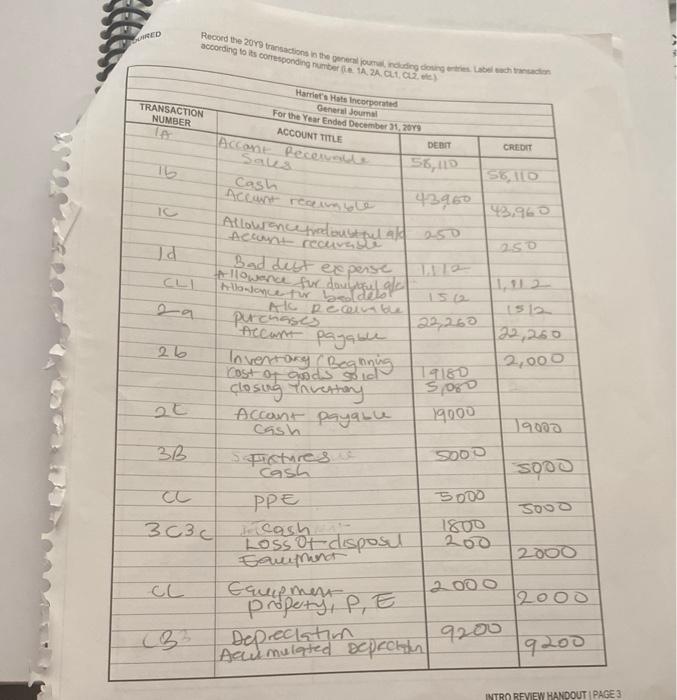

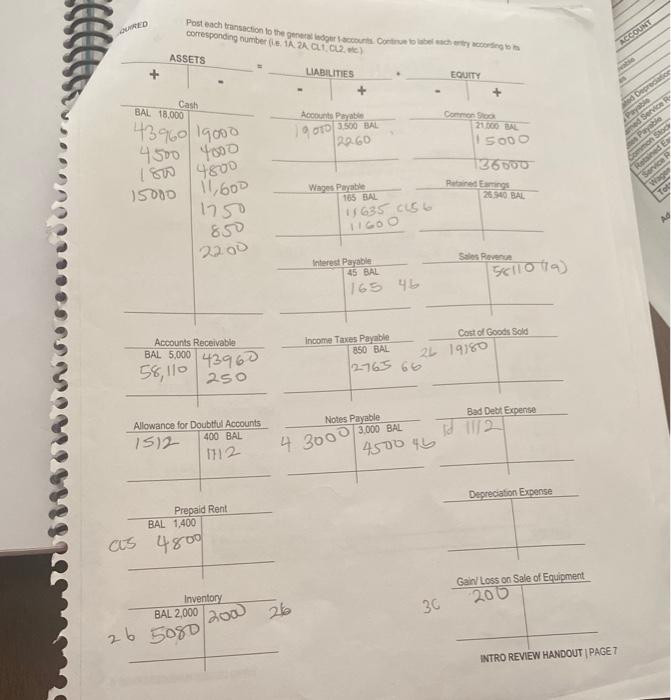

BUIRED TRANSACTIONS FOR THE YEAR ENDED DECEMBER 31, 2049 1 Sales and Accounts Receivable A The sales price of each hat was $39. All sales were on account. The company identified $250 of receivables as being uncollectible and wrote them off 0. The company follows a percentage of recevables approach to estimato its accounts receivable that will become uncollectible. As of the end of 2018, the company estimates that 8% of its receivables will be uncollectible. ED A The company began the year with 200 hats which had a cost of $10.00 each. The following purchases (all on IMPAC Sales Cost Net OP Asset ID# Historical Cost 2 Inventory account) were made during 2049 January 15 - 525 hats @ $11.00 each . March 23-365 hats @ 12.00 each July 2 - 430 hats @ $13.50 each B. Employees performed a physical count at end of 2019 and found that 480 hats remained in the warehouse. The company uses a periodic LIFO inventory system. The company made cash payments to inventory suppliers totaling $19,000. 3. Property, plant and Equipment A Below is a schedule of the store fixtures and ofice equipment the company had in place at the end of 2018. Straight- line depreciation is used for all store foxtures and office equipment PROPERTY, PLANT & EQUIPMENT (as of December 31, 2018) Useful Lile Salvage Value Date Acquired 1256 $18,500 6 years $500 Jan 1, 2014 1876 $2,600 3 years $200 Jan 1, 2017 4299 $31.000 5 years $1,000 Jan 1, 20Y8 B. On January 1, new store fixtures were purchased for $5,000 in cash. The company expects the fixtures to have a 5- year useful life and a $500 salvage value. C. On July 1, office equipment (10#1256) was sold for $1,800. 4 Debt A On October 1, 2049, the company paid off the note payable that was outstanding at the beginning of the period. The note was issued on October 1, 20Y8 with a 6% interest rate. It required semi-annual interest payments on March 31 and September 30 B. On November 1, 2099, the company borrowed $4,500 on a new 1-year note payable. This note carries a 4% interest rate with similar payment terms as the note that was just paid-off. 5. Operations A. Once any prepaid rent from 2048 was used, two more rent payments of $4,800 were made on March 1 and September 1 of 2049 for their store building. Each rent payment is prepaid for six months. The balance in the prepaid account at the end of 2049 represents the rent for January and February 20Y10. B. Cash paid out for wages during 2049 totaled $11,600. Records indicate that salaries for the last week of December amounted to $200 and would be paid at the end of the first week in January (a two-week pay period). C. Other expenses that were paid in cash totaled $1,750 6. Income Taxes A. The company paid its 20Y8 income taxes in March of 2049. B. The company has a 30% income tax rate for both 20Y8 and 2049. 7. Common Stock A. Dividends of $2,200 were declared and paid during 2049. B. New common stock was issued for $15,000 during 2049. OURED Post each transconto the generaccount Continue to listel each oty Bording to corresponding number ( 1A 2A CL CL2) ASSETS LIABILITIES EQUITY Cash BAL 18.000 Accounts Payable 19.01D 3500 BAL Common Stock 27.000 BAL 120.60 sooo 136000 4396019000 4500 4000 180 4800 15000 11,600 1750 850 2200 Wages Payable 165 BAL Retained Earnings 26.040 BAL 11635 cist TIGOO Sales Revenue Interest Payable 45 BAL 1165 46 56110 (19) Accounts Receivable BAL5,000 Income Taxes Payable Cost of Goods Sold 850 BAL 2L 19180 2765 66 143960 250 58,110 Notes Payable Bad Debt Expense Allowance for Doubtful Accounts 1512 400 BAL 4 300 3.000 BAL 4500 45 Depreciation Expense Prepaid Rent BAL 1,400 as 4800 Gain/Loss on Sale of Equipment Inventory BAL 2,000 26 200 30 205 2b 5080 INTRO REVIEW HANDOUT | PAGE 7 $18,000 4,600 1,400 2,000 Harriet's Hats Incorporated Balance Sheet As of December 31, 20Y8 ASSETS Cash Accounts Receivable 5,000 Less: Allowance for Doubtful Accounts (400) Net Accounts Receivable Prepaid Rent Inventory Property. Plant, and Equipment 52,100 Less: Accumulated Depreciation (22.600) Net Property Plant, and Equipment Total Assets LIABILITIES + OWNER'S EQUITY Accounts Payable Wages Payable Interest Payable Income Taxes Payable Notes Payable Total Liabilities 29,500 $55,500 $3,500 165 45 850 3,000 7,560 Common Stock Retained Earnings Total Owner's Equity Total Liabilities + Owner's Equity 21,000 26,940 47,940 $55,500 REQUIRED Using the following how to the 2011 octor francia aliments de comedians and B Sheet for Hans Hals 2013 IMPACT ON CURRENT PERIOD EARNINGS Sales Revenge Cost of Goods Sold Net Impact on Current Period Gross Profit Other Operating Expenses Bad Debit pense Depreciation Expense Interest Expense Rent Expense Wages Expense Other Expenses Gain Loss on Sale of Eument Income Before Income Tax Income Tax Expense Net Impact on Current Period Earnings 2099 52940 IMPACT ON RETAINED EARNINGS ACCOUNT Retained Earnings as of January 1, 2019 Add: Net Income Less: Dividends Retained Earnings as of December 31, 2049 Please, this is one question with 3 requirement. Kindly answer all. Thank you INTRO REVIEW HANDOUT PAGE 9 BACKGROUND REQUIRED Harriet's Hats is a retailer who buys hats from a manufacturer and then sells them in its stores. The following information includes the company's December 31, 20Y8 Balance Sheet and the details of transactions that occurred during 2049 Read through the entire assignment as least twice to become familiar with all of the important facts before beginning any work. Then complete each of the requirements on the following pages, using the provided templates $18,000 5,000 (400) 4,600 1.400 2,000 Harriet's Hats Incorporated Balance Sheet As of December 31, 2048 ASSETS Cash Accounts Receivable Less: Allowance for Doubtful Accounts Net Accounts Receivable Prepaid Rent Inventory Property. Plant, and Equipment Less: Accumulated Depreciation Net Property. Plant, and Equipment Total Assets LIABILITIES + OWNER'S EQUITY Accounts Payable Wages Payable Interest Payable Income Taxes Payable Notes Payable Total Liabilities 52,100 (22,600) 29,500 $55,500 $3,500 165 45 850 3,000 7,560 Common Stock Retained Earnings Total Owner's Equity Total Liabilities + Owner's Equity 21,000 26,940 47,940 $55,500 . TRANSACTIONS FOR THE YEAR ENDED DECEMBER 31, 2019 1 Sales and Accounts Receivable A The sales price of each hat was $39. Al sales were on account 8 Cash collections on account amounted to 543.900 The company identified $250 of receivables as being uncollectible and wrote them at D. The company follows a percentage of receivables approach to estimates accounts receivable that will become uncollectible As of the end of 2079, the company estimates that % of its roches will be collectible 2 Inventory A The company began the year with 200 hats which had a cost of $10.00 each. The following purchases tall on account) were made during 2049 January 15-525 hats @ $11.00 each March 23 - 365 hats 1200 each July 2 - 430 hats @ $13.50 each October 31 - 450 hats 514.00 each B. Employees performed a physical count at end of 2019 and found that 480 hats comained in the warehouse. The company uses a periodic LIFO inventory system C. The company made cash payments to inventory suppliers totaling 519.000 3. Property. Plant and Equipment A Below is a schedule of the store fixtures and office equipment the company had in place at the end of 2078. Straight line depreciation is used for all store foxtures and office equipment PROPERTY, PLANT & EQUIPMENT (as of December 31, 2045) Asset ID# Historical Cost Useful Lille Savage Value Date Acquired 1256 $18,500 6 years $500 1876 $2,600 3 years $200 4299 $31.000 5 years $1.000 Jan 1, 2048 B. on January 1. new store fixtures were purchased for $5,000 in cash. The company expeds the futures to have a 5 c. On July 1, office equipment (ID#1255) was sold for 51 800 Jan 1, 2014 Jan 1, 2017 4. Debt A On October 1, 2079, the company paid off the note payable that was outstanding at the beginning of the period. The note was issued on October 1, 2018 with a 8% interest rate. It required semi-annual interest payments on March 31 and September 30 B. On November 1, 2019, the company borrowed 54,500 on a new 1-year nota payable. This note cames a 4% interest rate with similar payment terms as the note that was just paid off 5. Operations A Once any prepaid rent from 2078 was used, two more rent payments of 54,800 were made on March 1 and September 1 of 20y9 for their store building. Each rent payment is prepaid for sx months. The balance in the prepaid account at the end of 2049 represents the rent for January and February 2010 B. Cash paid out for wages during 2049 totaled $11,600. Records indicate that salaries for the last week of December amounted to $200 and would be paid at the end of the first week in January (a two-week pay period). C. Other expenses that were paid in cash totaled $1,750, 6. Income Taxes A. The company paid its 20Y8 income taxes in March of 2049, B. The company has a 30% income tax rate for both 20Y8 and 2049. 7. Common Stock A Dividends of $2,200 were declared and paid during 2049. B. New common stock was issued for $15,000 during 2049. INTRO REVIEW HANDOUT | PAGE 2 Record the 2019 transactions in the groundingdong bachadon SURVED according to its contesponding number A 2A 1 ) TRANSACTION NUMBER TA Harriet's Hats incorporated General Journal For the Year Ended December 31, 2018 ACCOUNT TITLE Accant recevable Sales Cash Accant recamble DEDIT CREDIT IC 250 CLL 56,00 SAD 43960 43,960 Allowanceprodoustful and 250 Account recuvalle Baddest experse Allowance for boadelor Iso Al Decorable 151 purchases Accant payable 22,260 Inventang Begnning cost of goods sold closing invettory Accant payable 19000 Cash 26 2,000 19180 5080 19000 3B 3636 cash disposul Spictures SODO cash S000 pe 5 000 Jooo 1800 200 Samtina 2000 Capment 2000 property, P, E 12000 Deprecktim 9200 Acumulated Depechan 19200 INTRO REVIEW HANDOUT PAGE 3 URED Posteach transaction to the general ledger is to be achterstry actions corresponding number 1 2012) ASSETS EQUITY LABILITIES ACCOUNT + Cash BAL 18.000 Accounts Payable 4396019000 19 OTO 3500 BAL 20.60 100 Deprecat Paya med Service Pay Commons 21.00 BAL I 5000 126000 Peaming 26.940 BAL 4500 4000 18 4800 1500 11,600 157) Wages Payable 165 BAL 1635 CSE GOO AD 850 2200 Revenge Interest Payable 45 BAL sollola) 165 46 Cost of Goods Sold Accounts Receivable BAL 5,000 43960 250 Income Taxes Payable 850 BAL 12765 66 2L 19180 56,110 Allowance for Doubtful Accounts 400 BAL 1512 Bad Debt Expense Tid 1/2 Notes Payable 3.000 BAL 4500 45 1712 4 3000 Depreciation Expense Prepaid Rent BAL 1,400 as 4800 Gain Loss on Sale of Equipment 200 Inventory BAL 2,000 30 200 26 26 5080 INTRO REVIEW HANDOUT PAGE 7