Answered step by step

Verified Expert Solution

Question

1 Approved Answer

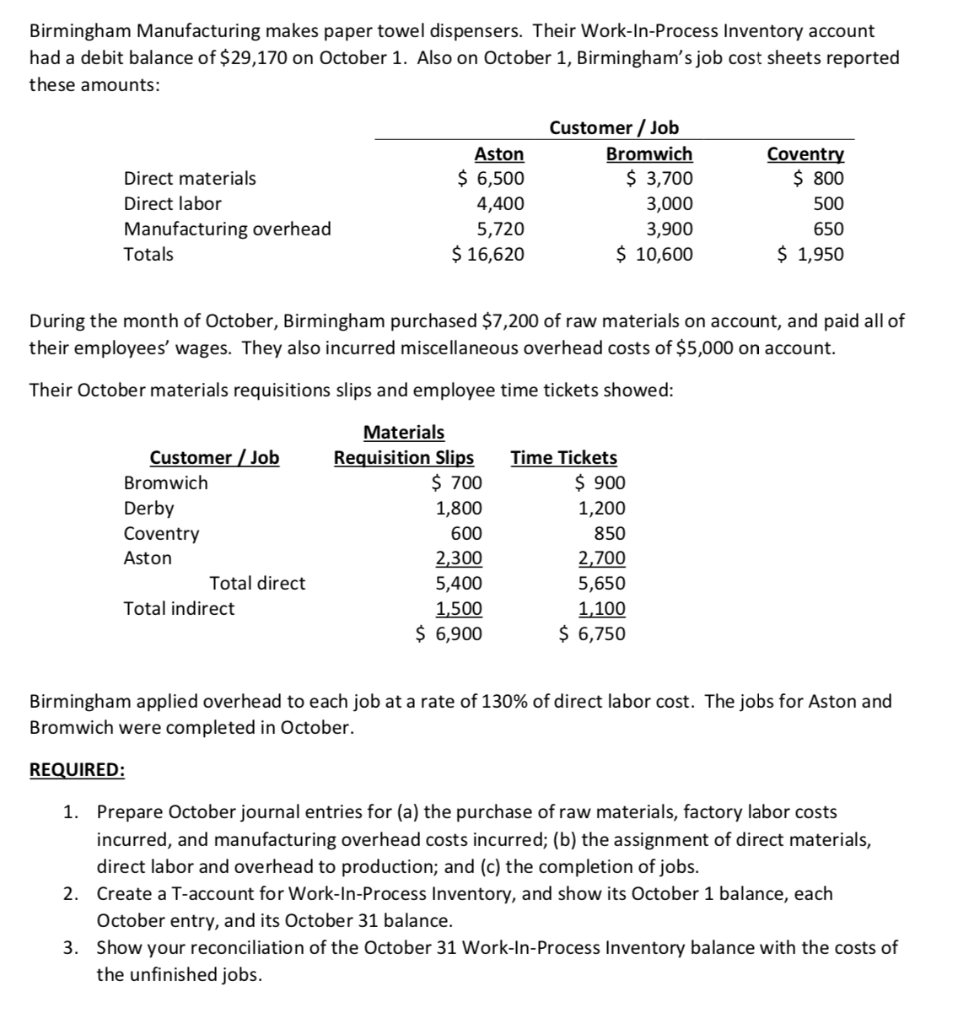

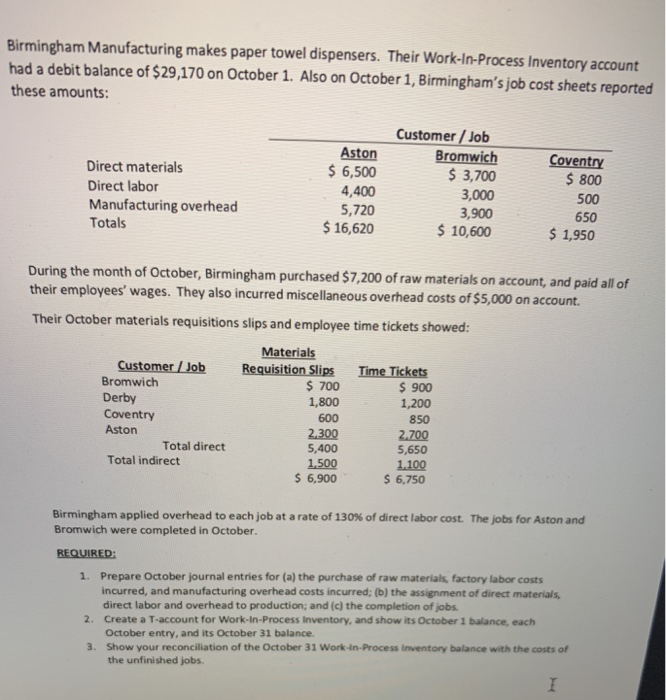

The question is the same in both pictures. Is it visible now? Birmingham Manufacturing makes paper towel dispensers. Their Work-In-Process Inventory account had a debit

The question is the same in both pictures. Is it visible now?

Birmingham Manufacturing makes paper towel dispensers. Their Work-In-Process Inventory account had a debit balance of $29,170 on October 1. Also on October 1, Birmingham's job cost sheets reported these amounts: Direct materials Direct labor Manufacturing overhead Totals Aston $ 6,500 4,400 5,720 $ 16,620 Customer Job Bromwich $ 3,700 3,000 3,900 $ 10,600 Coventry $ 800 500 650 $ 1,950 During the month of October, Birmingham purchased $7,200 of raw materials on account, and paid all of their employees' wages. They also incurred miscellaneous overhead costs of $5,000 on account. Their October materials requisitions slips and employee time tickets showed: Customer / Job Bromwich Derby Coventry Aston Total direct Total indirect Materials Requisition Slips $ 700 1,800 600 2,300 5,400 1,500 $ 6,900 Time Tickets $ 900 1,200 850 2,700 5,650 1,100 $ 6,750 Birmingham applied overhead to each job at a rate of 130% of direct labor cost. The jobs for Aston and Bromwich were completed in October. REQUIRED: 1. Prepare October journal entries for (a) the purchase of raw materials, factory labor costs incurred, and manufacturing overhead costs incurred; (b) the assignment of direct materials, direct labor and overhead to production; and (c) the completion of jobs. 2. Create a T-account for Work-In-Process Inventory, and show its October 1 balance, each October entry, and its October 31 balance. 3. Show your reconciliation of the October 31 Work-In-Process Inventory balance with the costs of the unfinished jobs. Birmingham Manufacturing makes paper towel dispensers. Their Work-In-Process Inventory account had a debit balance of $29,170 on October 1. Also on October 1, Birmingham's job cost sheets reported these amounts: Direct materials Direct labor Manufacturing overhead Totals Aston $ 6,500 4,400 5,720 $ 16,620 Customer / Job Bromwich $ 3,700 3,000 3,900 $ 10,600 Coventry $ 800 500 650 $ 1,950 During the month of October, Birmingham purchased $7,200 of raw materials on account, and paid all of their employees' wages. They also incurred miscellaneous overhead costs of $5,000 on account. Their October materials requisitions slips and employee time tickets showed: Customer Job Bromwich Derby Coventry Aston Total direct Total indirect Materials Requisition Slips $ 700 1,800 600 2.300 5,400 1,500 $ 6,900 Time Tickets $ 900 1,200 850 2.700 5,650 1.100 $ 6,750 Birmingham applied overhead to each job at a rate of 130% of direct labor cost. The jobs for Aston and Bromwich were completed in October. REQUIRED: 1. Prepare October journal entries for (a) the purchase of raw materials factory labor costs incurred, and manufacturing overhead costs incurred; (b) the assignment of direct materials direct labor and overhead to production; and (c) the completion of jobs. 2. Create a T-account for Work-In-Process Inventory, and show its October 1 balance, each October entry, and its October 31 balance. 3. Show your reconciliation of the October 31 Work In Process Inventory balance with the costs of the unfinished jobsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started