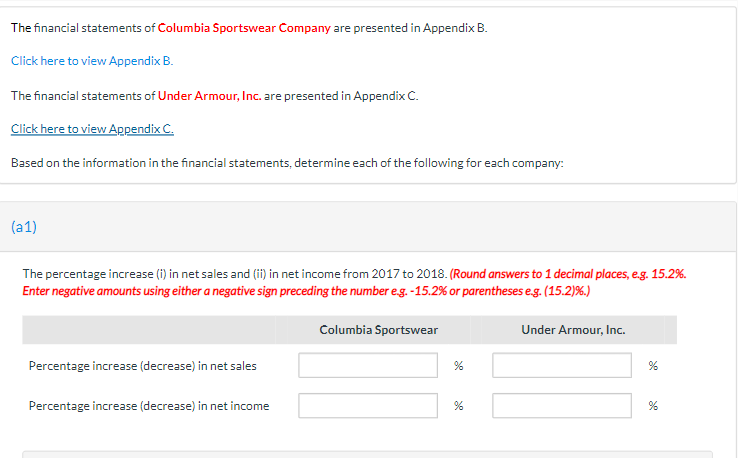

THE QUESTION :

SUPPORTING INFORMATION TO ANSWER THE QUESTION:

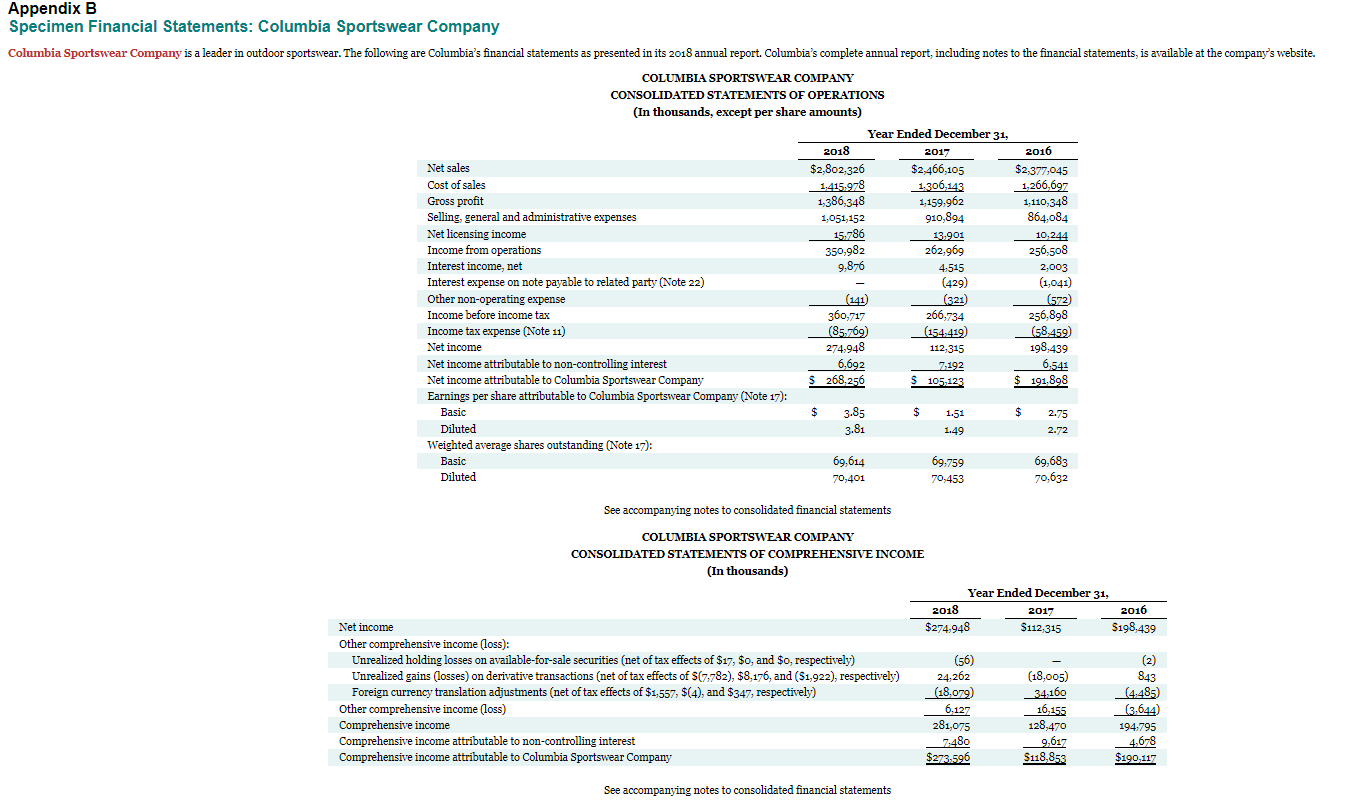

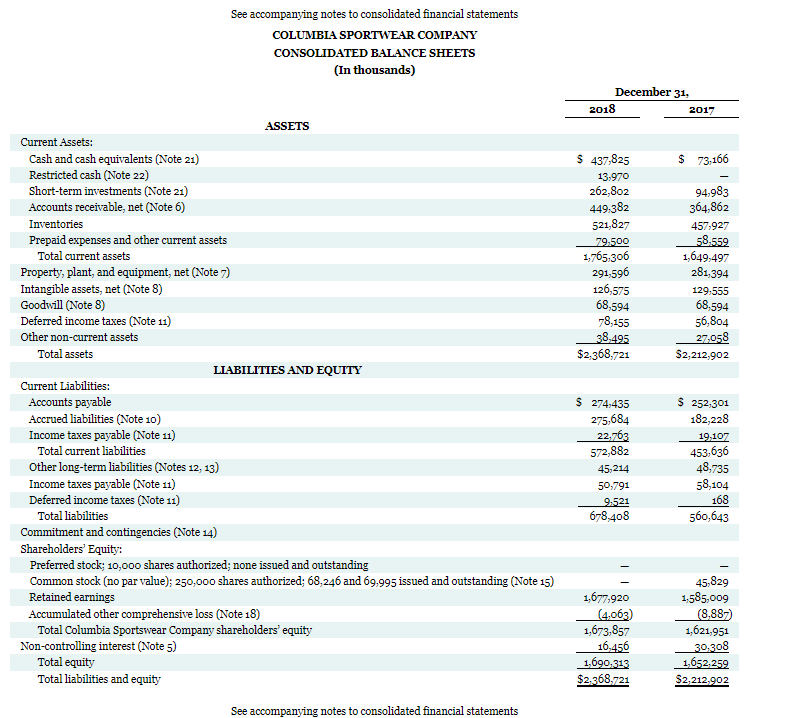

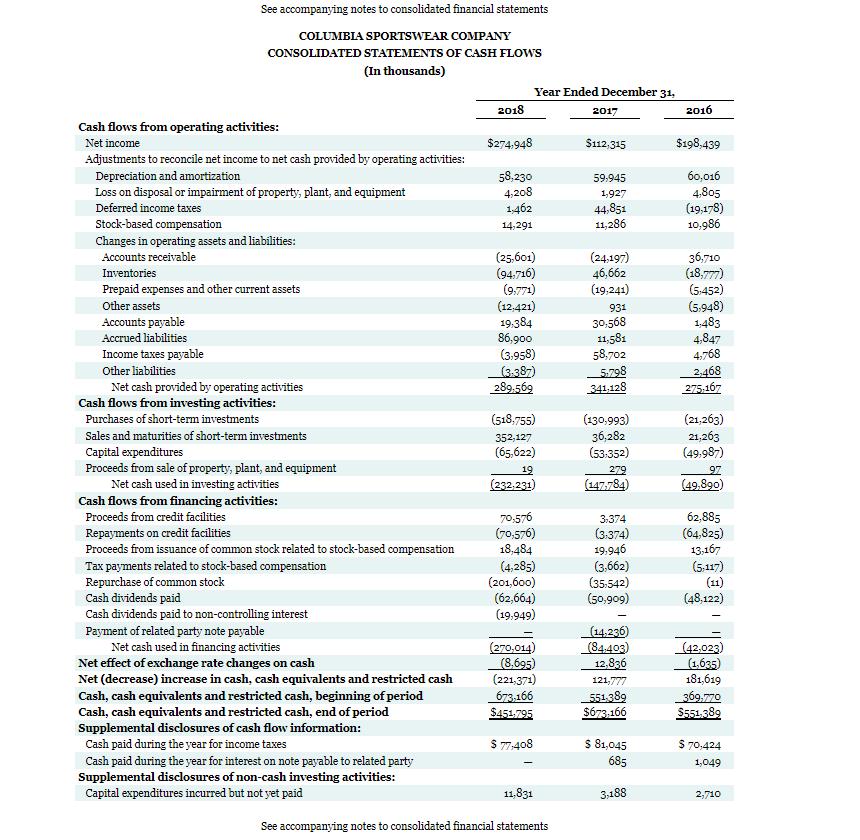

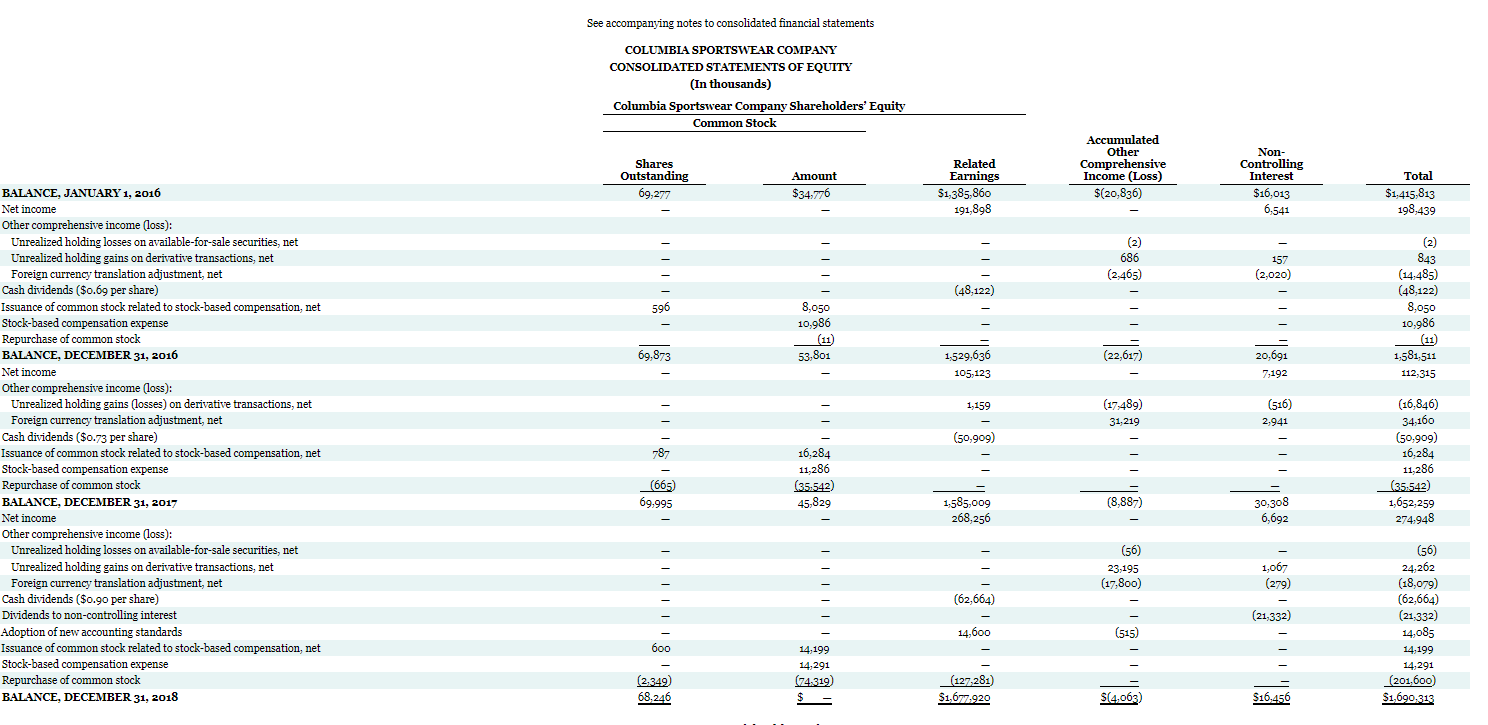

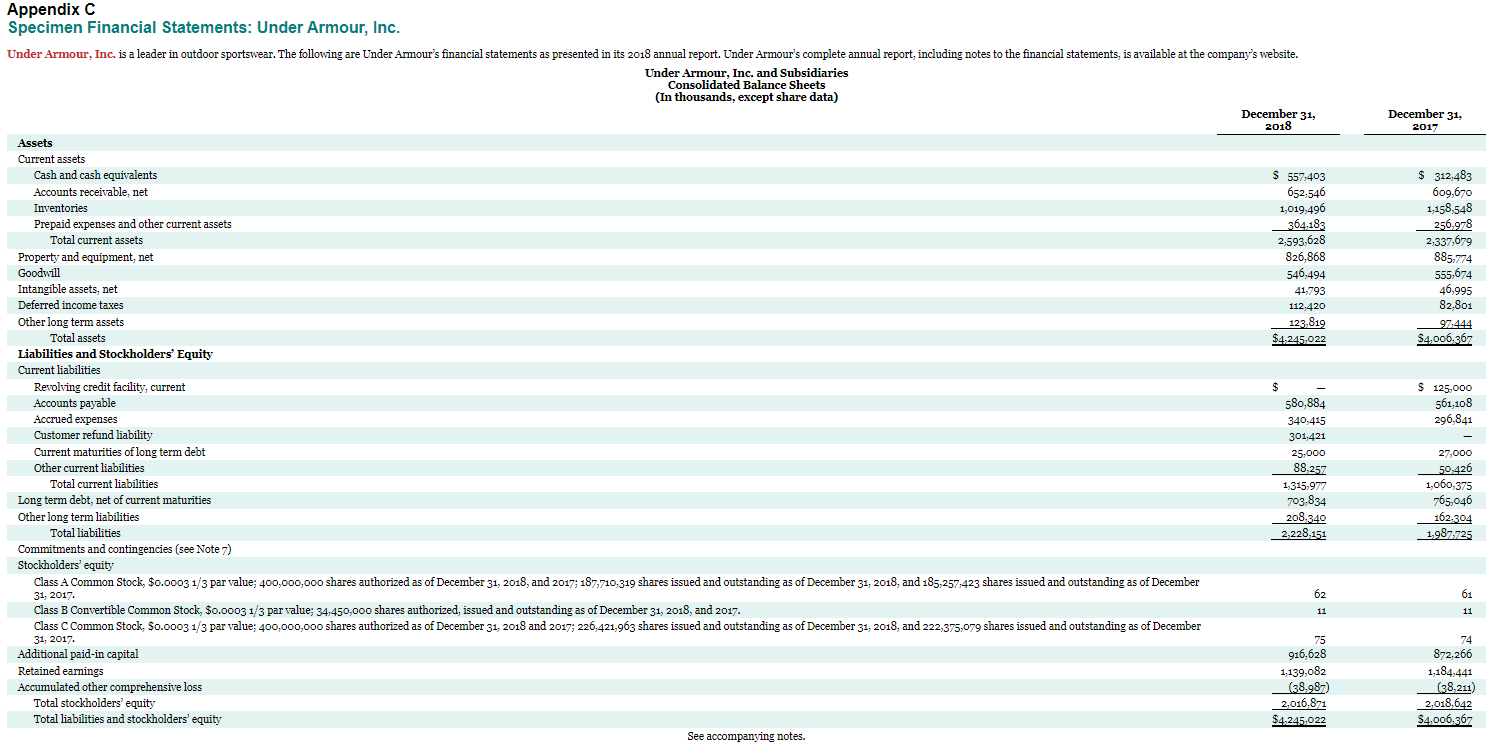

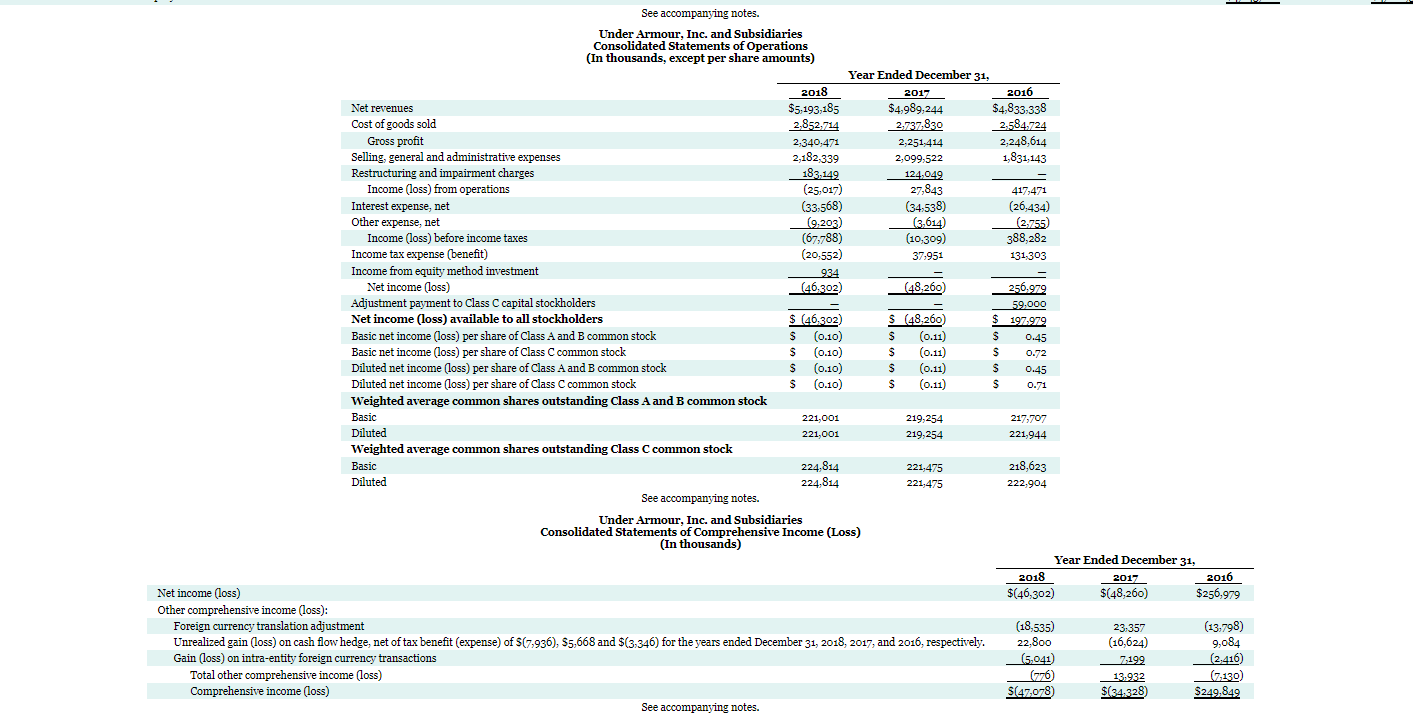

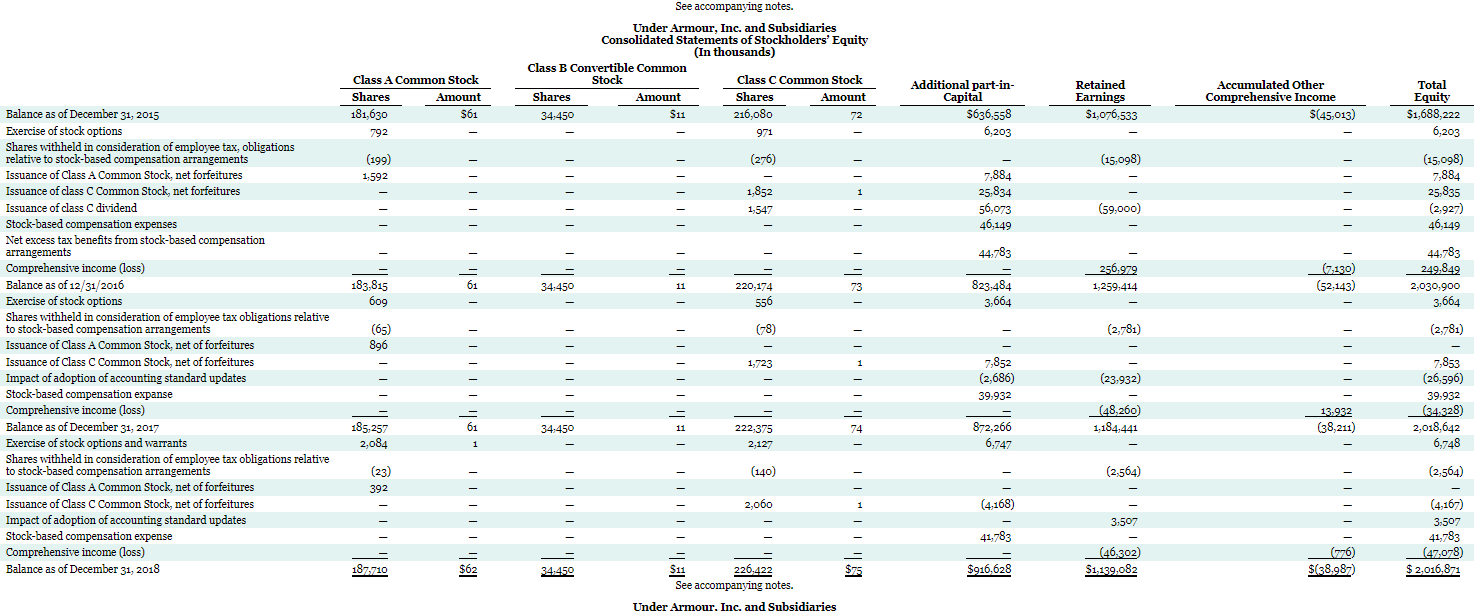

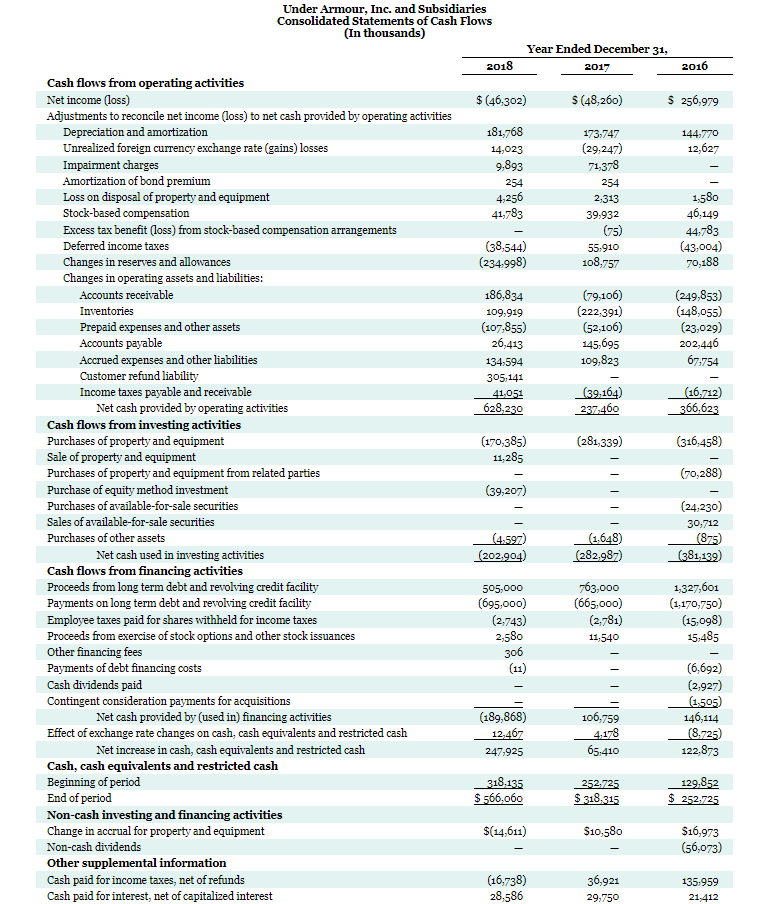

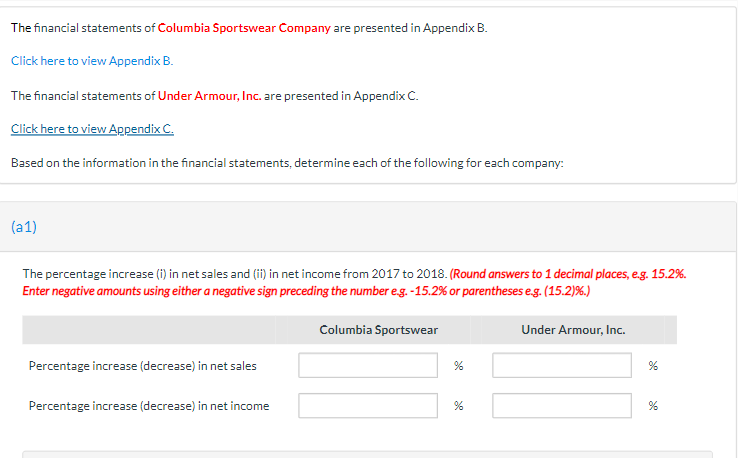

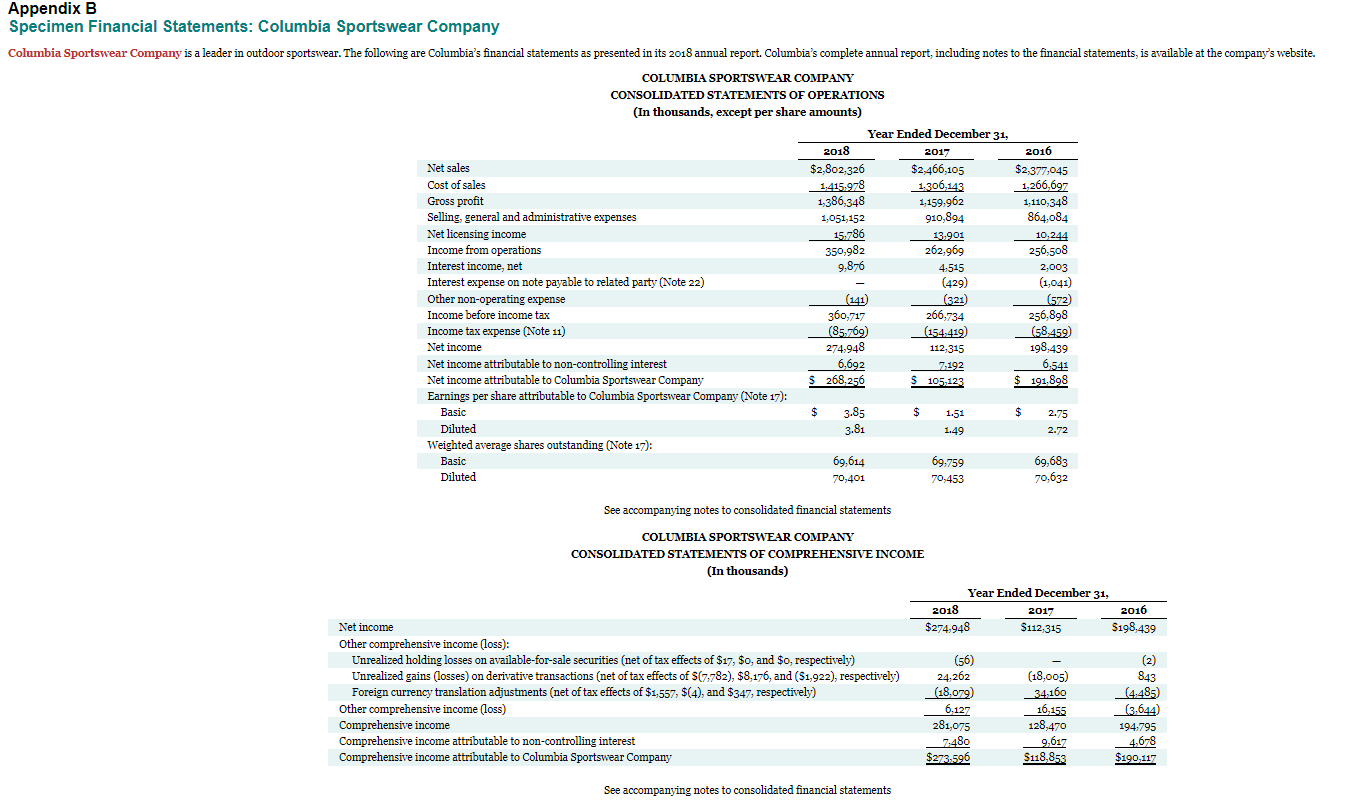

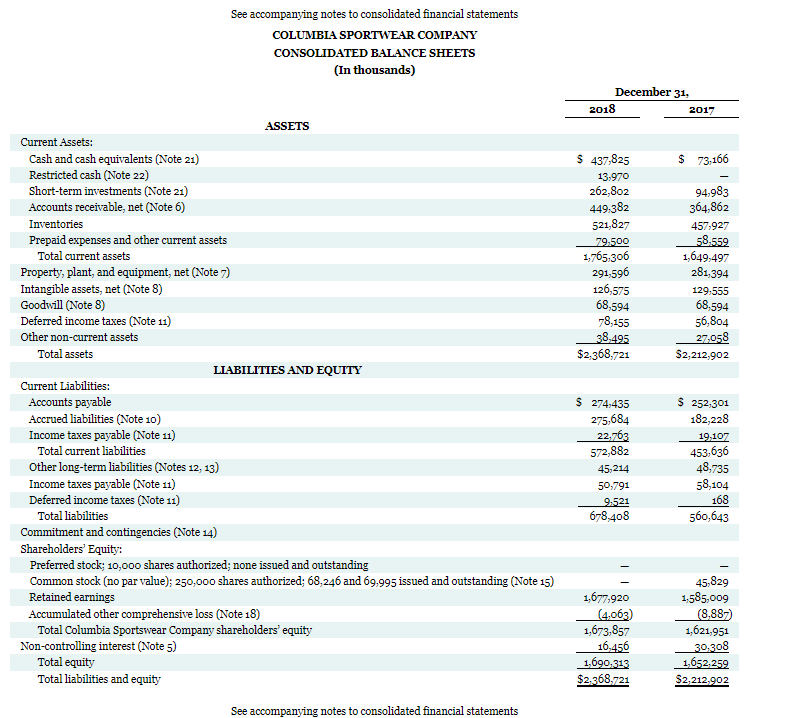

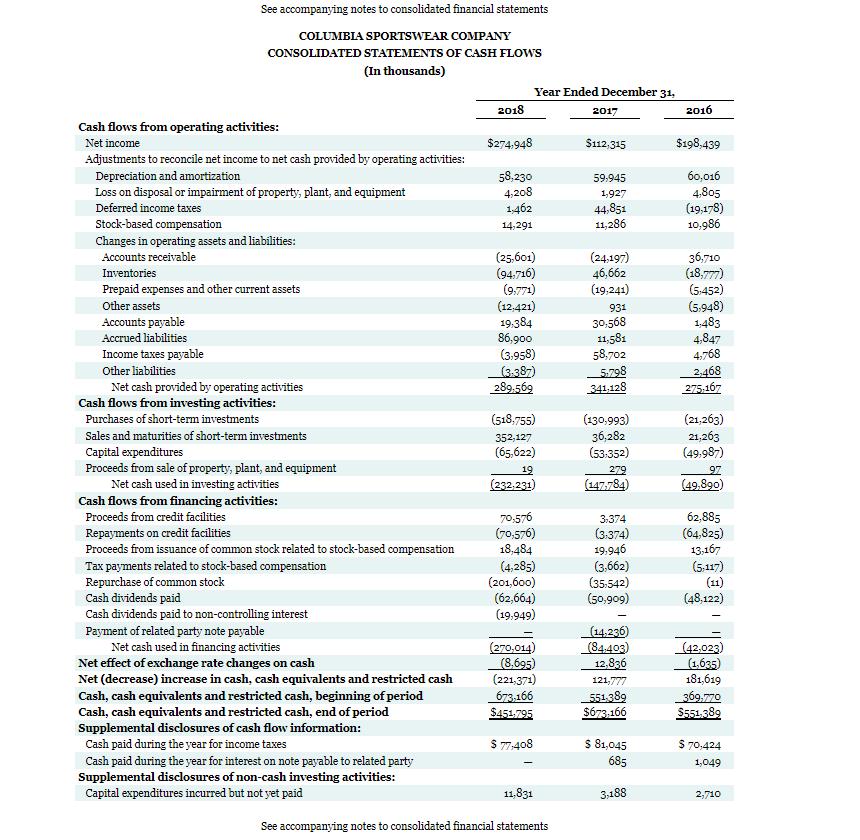

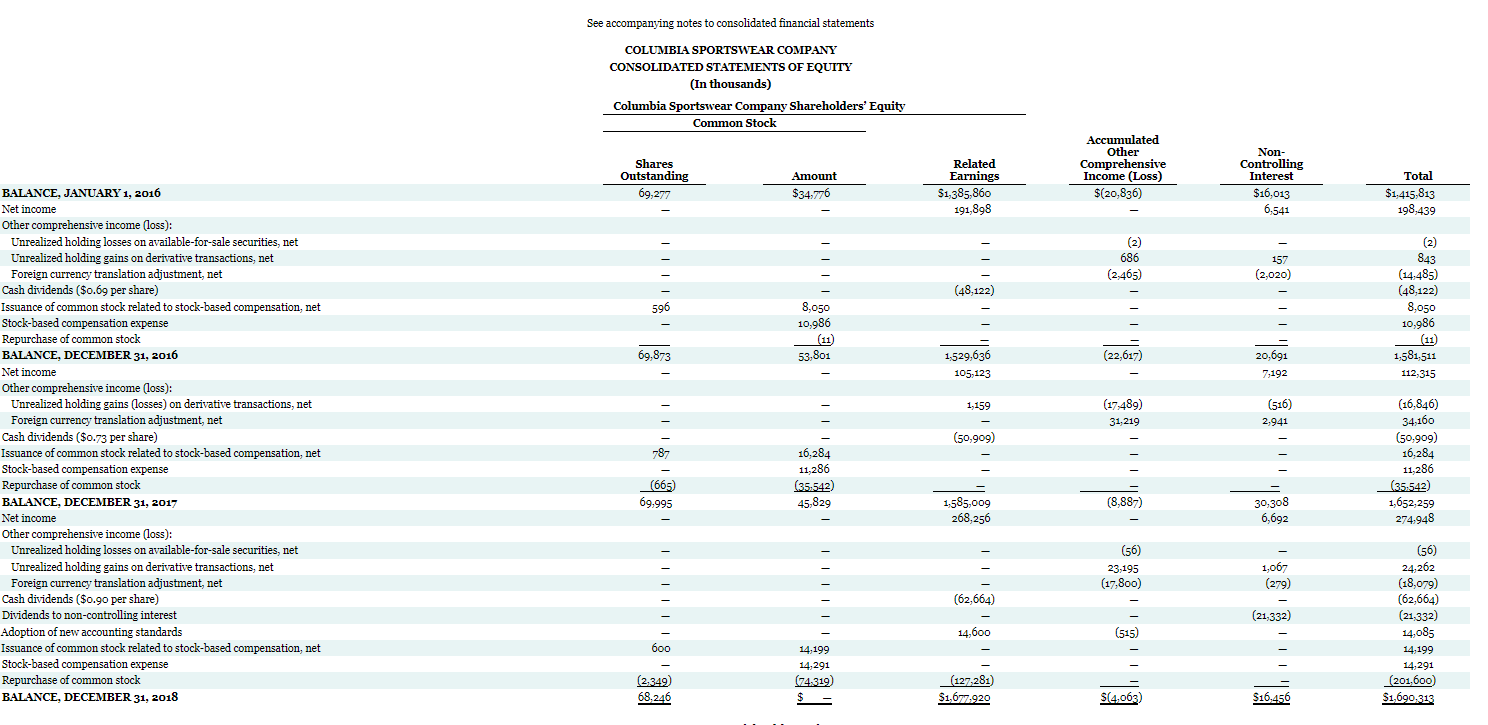

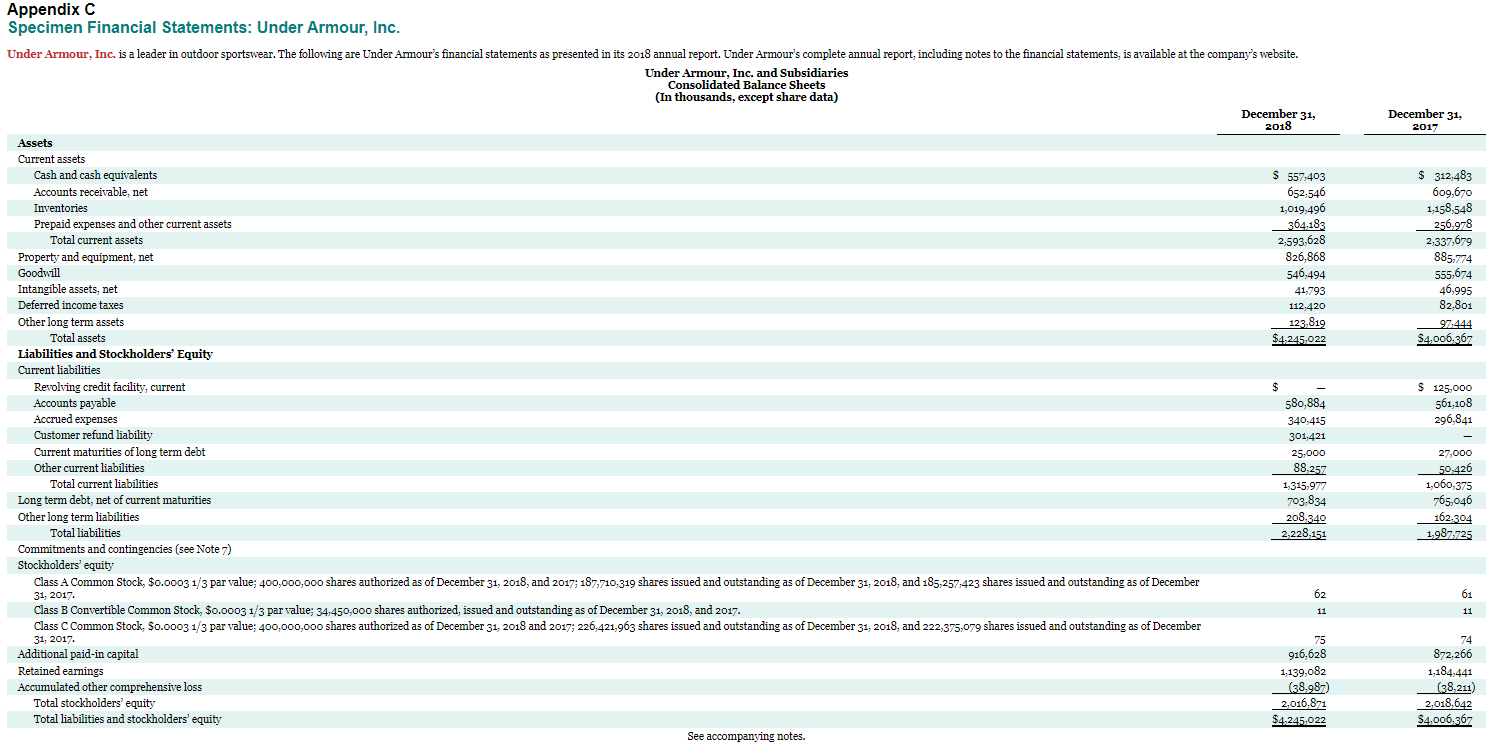

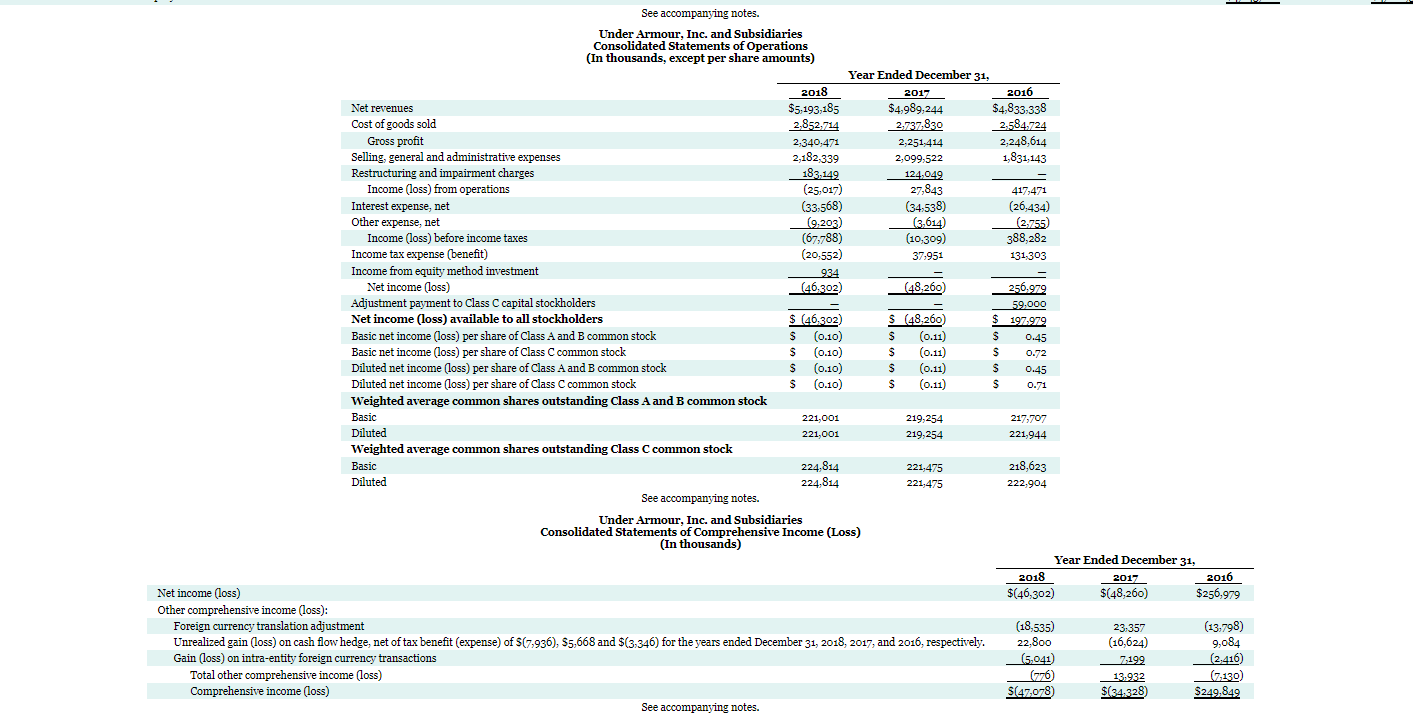

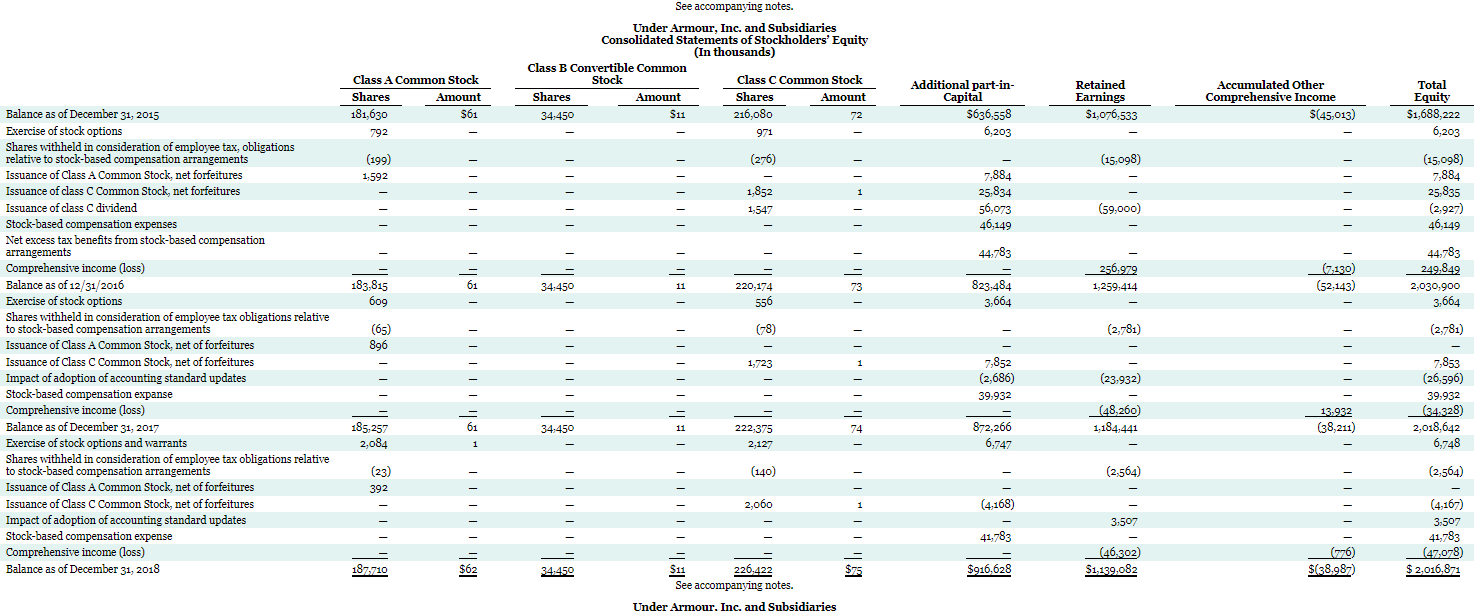

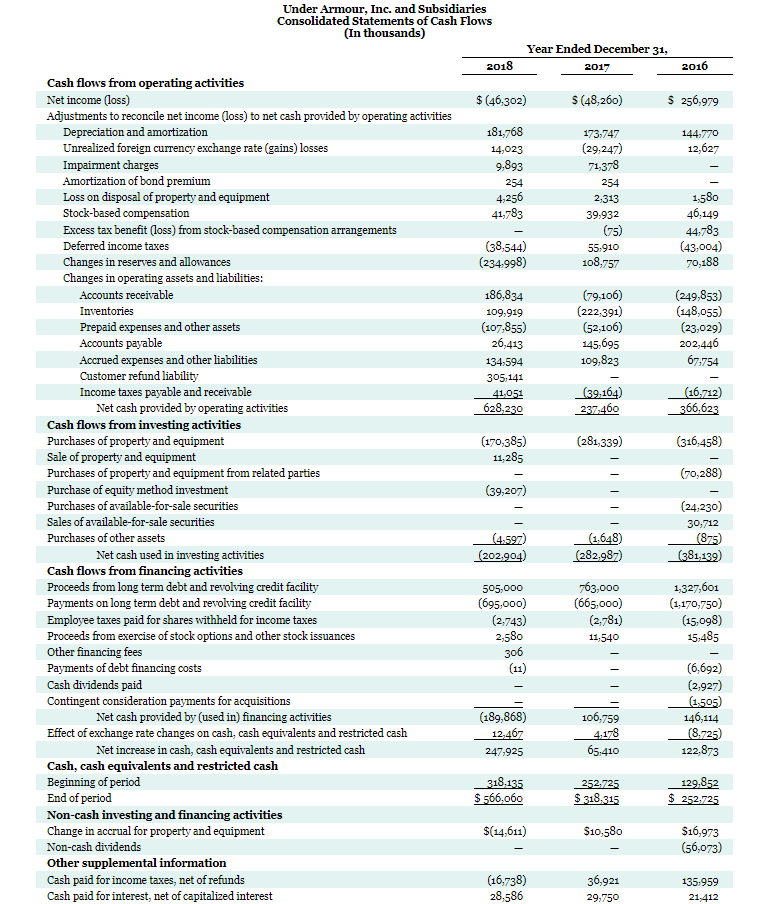

The financial statements of Columbia Sportswear Company are presented in Appendix B. Click here to view Appendix B. The financial statements of Under Armour, Inc. are presented in Appendix C. Click here to view Appendix C. Based on the information in the financial statements, determine each of the following for each company: (21) The percentage increase (i) in net sales and (ii) in net income from 2017 to 2018. (Round answers to 1 decimal places, eg. 15.2%. Enter negative amounts using either a negative sign preceding the number e.g.-15.2% or parentheses eg. (15.2)%.) Columbia Sportswear Under Armour, Inc. Percentage increase (decrease) in net sales % % Percentage increase (decrease) in net income % % Appendix B Specimen Financial Statements: Columbia Sportswear Company Columbia Sportswear Company is a leader in outdoor sportswear. The following are Columbia's financial statements as presented in its 2018 annual report. Columbia's complete annual report, including notes to the financial statements, is available at the company's website. COLUMBIA SPORTSWEAR COMPANY CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands, except per share amounts) Year Ended December 31, 2018 2017 2016 Net sales $2,802,326 $2,466,105 $2,377,045 Cost of sales 1,415,978 1,306,143 1,266,697 Gross profit 1,386,348 1,159,962 1,110,348 Selling, general and administrative expenses 1,051, 152 910,894 864.084 Net licensing income 13.901 10,244 Income from operations 262,969 het 256,508 Interest income, net 4,515 2,003 Interest expense on note payable to related party (Note 22) (429) (1,041) ca Other non-operating expense (321) (572) Income before income tax 266,734 256,898 Income tax expense (Note 11) (154,419) (58.459 Net income 112,315 198,439 .. Net income attributable to non-controlling interest 7,192 6,541 Net income attributable to Columbia Sportswear Company S 105,123 $ 191.898 Earnings per share attributable to Columbia Sportswear Company (Note 17): Basic $ $ 1.51 $ 2.75 Diluted 1.49 2.72 Weighted average shares outstanding (Note 17): Basic 69,759 69,683 Diluted 70,453 70,632 32797899492999441 See accompanying notes to consolidated financial statements $112.315 COLUMBIA SPORTSWEAR COMPANY CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In thousands) Year Ended December 31, 2018 2017 2016 Net income $274,948 $198.439 Other comprehensive income (loss): Unrealized holding losses on available-for-sale securities (net of tax effects of $17, $o, and $o, respectively) (56) (2) Unrealized gains (losses) on derivative transactions (net of tax effects of $(7,782), $8,176, and ($1,922), respectively) 24,262 (18,005) 843 Foreign currency translation adjustments (net of tax effects of $1,557, $(4), and $347, respectively) (18,079) 34,160 (4.485) Other comprehensive income (loss) 6.127 16.155 (3,644) Comprehensive income 281,075 128,470 194,795 Comprehensive income attributable to non-controlling interest 7.480 9,617 4.678 Comprehensive income attributable to Columbia Sportswear Company $273,596 S118,853 $190,117 See accompanying notes to consolidated financial statements See accompanying notes to consolidated financial statements COLUMBIA SPORTWEAR COMPANY CONSOLIDATED BALANCE SHEETS (In thousands) December 31, 2018 2017 $ 73,166 $ 437,825 13,970 262,802 449,382 521,827 79.500 1,765,306 291,596 126,575 68,594 78.155 38.495 $2,368,721 94,983 364,862 457,927 58.559 1,649,497 281,394 129,555 68,594 56,804 27.058 $2,212,902 ASSETS Current Assets: Cash and cash equivalents (Note 21) Restricted cash (Note 22) Short-term investments (Note 21) Accounts receivable, net (Note 6) Inventories Prepaid expenses and other current assets Total current assets Property, plant, and equipment, net (Note 7) Intangible assets, net (Note 8) Goodwill (Note 8) Deferred income taxes (Note 11) Other non-current assets Total assets LIABILITIES AND EQUITY Current Liabilities: Accounts payable Accrued liabilities (Note 10) Income taxes payable (Note 11) Total current liabilities Other long-term liabilities (Notes 12, 13) Income taxes payable (Note 11) Deferred income taxes (Note 11) Total liabilities Commitment and contingencies (Note 14) Shareholders' Equity: Preferred stock: 10,000 shares authorized: none issued and outstanding Common stock (no par value); 250,000 shares authorized; 68,246 and 69,995 issued and outstanding (Note 15) Retained earnings Accumulated other comprehensive loss (Note 18) Total Columbia Sportswear Company shareholders' equity Non-controlling interest (Note 5) Total equity Total liabilities and equity $ 274,435 275,684 22.763 572,882 45,214 50,791 9.521 678,408 $ 252,301 182,228 19,107 453,636 48,735 58,104 168 560,643 1,677,920 (4,063) 1,673,857 16,456 1,690,313 $2.368.721 45,829 1,585,009 (8,887) 1,621,951 30-308 1,652.259 $2,212,902 See accompanying notes to consolidated financial statements See accompanying notes to consolidated financial statements 4,208 1,462 44.851 11,286 11,581 4,768 5.798 COLUMBIA SPORTSWEAR COMPANY CONSOLIDATED STATEMENTS OF CASH FLOWS (In thousands) Year Ended December 31, 2018 2017 2016 Cash flows from operating activities: Net income $274,948 $112,315 $198,439 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization 58,230 59,945 60,016 Loss on disposal or impairment of property, plant, and equipment 1,927 4,805 Deferred income taxes (19,178) Stock-based compensation 14,291 10,986 Changes in operating assets and liabilities: Accounts receivable (25,601) (24,197) 36,710 Inventories (94,716) 46,662 (18,777) Prepaid expenses and other current assets (9,771) (19,241) (5-452) Other assets (12,421) 931 (5.948) Accounts payable 19,384 30,568 1,483 Accrued liabilities 86,900 4,847 Income taxes payable (3,958) 58.702 Other liabilities (3:387) 2,468 Net cash provided by operating activities 289.569 341-128 275,167 Cash flows from investing activities: Purchases of short-term investments (518,755) (130,993) (21,263) Sales and maturities of short-term investments 352,127 36,282 21,263 Capital expenditures (65,622) (53:352) (49,987) Proceeds from sale of property, plant, and equipment 19 97 Net cash used in investing activities (232.231) (147.784) (49,890) Cash flows from financing activities: Proceeds from credit facilities 70,576 3,374 62,885 Repayments on credit facilities 60,576) (3374) (64,825) Proceeds from issuance of common stock related to stock-based compensation 18,484 19,946 13,167 Tax payments related to stock-based compensation (4,285) (3,662) (5.117) Repurchase of common stock (201,600) (35.542) (11) Cash dividends paid (62,664) (50,909) (48,122) Cash dividends paid to non-controlling interest (19,949) Payment of related party note payable (14,236 Net cash used in financing activities (270,014) (84,403) (42,023) Net effect of exchange rate changes on cash (8,695) 12,836 (1.635) Net (decrease) increase in cash, cash equivalents and restricted cash (221,371) 121,777 181,619 Cash, cash equivalents and restricted cash, beginning of period 673,166 551389 369,770 Cash, cash equivalents and restricted cash, end of period $451,795 $673 166 $551389 Supplemental disclosures of cash flow information: Cash paid during the year for income taxes $ 77,408 $ 81,045 $ 70,424 Cash paid during the year for interest on note payable to related party 685 1,049 Supplemental disclosures of non-cash investing activities: Capital expenditures incurred but not yet paid 11,831 2,710 279 3,188 See accompanying notes to consolidated financial statements See accompanying notes to consolidated financial statements COLUMBIA SPORTSWEAR COMPANY CONSOLIDATED STATEMENTS OF EQUITY (In thousands) Columbia Sportswear Company Shareholders' Equity Common Stock Shares Outstanding 69,277 Accumulated Other Comprehensive Income (Loss) $(20,836) Related Earnings $1,385,860 191,898 Amount $34,776 Non Controlling Interest $16,013 6,541 Total $1,415,813 198,439 686 (2,465) 157 (2,020) (48,122) 596 8,050 10,986 (11) 53,801 (2) 843 (14,485) (48,122) 8,050 10,986 (11) 1,581,511 112,315 69,873 (22,617) 1,529,636 105,123 20,691 7,192 1,159 (17,489) 31,219 (516) 2,941 (50-909) BALANCE, JANUARY 1, 2016 Net income Other comprehensive income (loss): Unrealized holding losses on available-for-sale securities, net Unrealized holding gains on derivative transactions, net Foreign currency translation adjustment, net Cash dividends ($0.69 per share) Issuance of common stock related to stock-based compensation, net Stock-based compensation expense stola hond chase of Repurchase of common stock avec BALANCE, DECEMBER 31, 2016 Net income Other comprehensive income (loss): Unrealized holding gains (losses) on derivative transactions, net Foreign currency translation adjustment, net Cash dividends ($0.73 per share) Issuance of common stock related to stock-based compensation, net Stock-based compensation expense Repurchase of common stock BALANCE, DECEMBER 31, 2017 Net income Other Other comprehensive income (loss): Unrealized holding losses on available-for-sale securities, net Unrealized holding gains on derivative transactions, net Foreign currency translation adjustment, net Cash dividends ($0.90 per share) Dividends to non-controlling interest Adoption of new accounting standards Issuance of common stock related to stock-based compensation, net Stock-based compensation expense Repurchase of common stock BALANCE, DECEMBER 31, 2018 787 16,284 11,286 (35.542) 45,829 (16,846) 34,160 (50,909) 16,284 11,286 (35.542) 1,652.259 274.948 LINE (665) 69,995 (8,887) 1,585,009 268,256 30,308 6,692 (56) 23,195 (17,800) 1,067 (279) (62,664) (21,332) (56) 24,262 (18,079) (62,664) (21,332) 14,085 14,199 14,291 (201,600 $1,690,313 14,600 (515) 600 14,199 14,291 (74,319) $ - (2.349) 68.246 (127,281) $1,677.920 S(4,063) $16,456 December 31, 2017 $ 312,483 609,670 1,158,548 256,978 2,337,679 885.774 555,674 46,995 82,801 97444 $4.006.367 Appendix C Specimen Financial Statements: Under Armour, Inc. Under Armour, Inc. is a leader in outdoor sportswear. The following are Under Armour's financial statements as presented in its 2018 annual report. Under Armour's complete annual report, including notes to the financial statements, is available at the company's website. Under Armour, Inc. and Subsidiaries Consolidated Balance Sheets (In thousands, except share data) December 31, 2018 Assets Current assets Cash and cash equivalents $ 557-403 Accounts receivable, net 652,546 Inventories 1,019,496 Prepaid expenses and other current assets _364,183 Total current assets 2,593,628 Property and equipment, net 826,868 Goodwill 546,494 Intangible assets, net 41,793 Deferred income taxes 112,420 Other long term assets 123,819 Total assets $4,245.022 Liabilities and Stockholders' Equity Current liabilities Revolving credit facility, current $ Accounts payable 580,884 Accrued expenses 340,415 Customer refund liability 301,421 Current maturities of long term debt 25,000 Other current liabilities Total current liabilities 1,315,977 Long term debt, net of current maturities 703,834 Other long term liabilities 208.340 Total liabilities 2,228,151 Commitments and contingencies (see Note 7) Stockholders' equity Class A Common Stock $0.0003 1/3 par value; 400,000,000 shares authorized as of December 31, 2018, and 2017; 187,710,319 shares issued and outstanding as of December 31, 2018, and 185,257,423 shares issued and outstanding as of December 31, 2017 62 Class B Convertible Common Stock, $0.0003 1/3 par value; 34.450,000 shares authorized, issued and outstanding as of December 31, 2018, and 2017. 11 Class C Common Stock, S0.0003 1/3 par value; 400,000,000 shares authorized as of December 31, 2018 and 2017; 226,421,963 shares issued and outstanding as of December 31, 2018, and 222,375,079 shares issued and outstanding as of December , 31, 2017. 75 Additional paid-in capital 916,628 Retained earnings 1139,082 Accumulated other comprehensive loss (38,987) Total stockholders' equity 2.016.821 Total liabilities and stockholders' equity $4,245,022 See accompanying notes. $ 125.000 561,108 296,841 27,000 88,257 _50,426 1,060,375 765,046 162,304 1987.725 61 11 74 872,266 1,184,441 (38,211) 2,018,642 $4,006,367 2,340,471 0.45 See accompanying notes Under Armour, Inc. and Subsidiaries Consolidated Statements of Operations (In thousands, except per share amounts) Year Ended December 31, 2018 2017 2016 Net revenues $5,193,185 $4,989,244 $4,833,338 Cost of goods sold 2.852.714 2.737.830 2.584.724 Gross profit 2,251,414 2,248,614 Selling, general and administrative expenses 2,182,339 2,099,522 1,831,143 Restructuring and impairment charges 183,149 124,049 Income (loss) from operations (25,017) 27,843 417,471 Interest expense, net (33,568) (34,538) (26,434) Other expense, net (9,203) (3,614) (2.755) Income (loss) before income taxes (67788) (10,309) 388,282 Income tax expense (benefit) (20,552) 37,951 131,303 Income from equity method investment 934 Net income (loss) (46.302) (48,260) 256.979 Adjustment payment to Class C capital stockholders 59,000 Net income (loss) available to all stockholders $ (46.302) S (48,260) $ 197.979 Basic net income (loss) per share of Class A and B common stock S (0.10) S (0.11) S Basic net income (loss) per share of Class C common stock S (0.10) S S (0.11) $ 0.72 Diluted net income (loss) per share of Class A and B common stock S $ (0.10) S (0.11) S S 0.45 Diluted net income (loss) per share of Class common stock $ (0.10) S S (0.11) $ 0.71 Weighted average common shares outstanding Class A and B common stock Basic 221,001 219,254 217,707 Diluted 221,001 219,254 221,944 Weighted average common shares outstanding Class C common stock Basic 224,814 221,475 218,623 Diluted 224,814 221,475 222,904 See accompanying notes. Under Armour, Inc. and Subsidiaries Consolidated Statements of Comprehensive Income (Loss) (In thousands) Year Ended December 31, 2018 2017 2016 Net income (loss) $(46,302) $(48,260) $256,979 Other comprehensive income (loss): Foreign currency translation adjustment (18,535) 23,357 (13.798) Unrealized gain (loss) on cash flow hedge, net of tax benefit (expense) of $(7,936), 55,668 and $(3:346) for the years ended December 31, 2018, 2017, and 2016, respectively. 22,800 (16,624) 9,084 Gain (loss) on intra-entity foreign currency transactions (5,041) 7,199 (2.416) Total other comprehensive income (loss) (776) 13,932 (7130) Comprehensive income (loss) S(47078) $(34,328) $249,849 See accompanying notes. See accompanying notes. Under Armour, Inc. and Subsidiaries Consolidated Statements of Stockholders' Equity (In thousands) Class B Convertible Common Stock Class C Common Stock Shares Amount Shares Amount 34,450 S11 216,080 971 Class A Common Stock A Shares Amount 181,630 $61 792 Additional part-in- Capital $636,558 6,203 Retained Earnings $1,076,533 Accumulated Other Comprehensive Income $(45,013) Total Equity $1,688,222 6,203 72 (199) (276) (15,098) TI 1.592 - 1 1,852 1,547 7,884 25.834 56,073 (15,098) 7,884 25,835 (2,927) 46,149 (59,000) 46,249 44,783 - 73 256,979 1,259,414 (7.130) (52,143) 44,783 249.849 2,030,900 3,664 61 34,450 183,815 609 220,174 556 823,484 3,664 yer- (78) Balance as of December 31, 2015 Exercise of stock options Shares withheld in consideration of employee tax, obligations relative to stock-based compensation arrangements Issuance of Class A Common Stock, net forfeitures Issuance of class C Common Stock, net forfeitures Issuance of class C dividend Stock-based compensation expenses Net excess tax benefits from stock-based compensation arrangements Comprehensive income (loss) Balance as of 12/31/2016 Exercise of stock options Shares withheld in consideration of employee tax obligations relative to stock-based compensation arrangements Issuance of Class A Common Stock, net of forfeitures Issuance of Class C Common Stock, net of forfeitures Impact of adoption of accounting standard updates Stock-based compensation expanse Comprehensive income (loss) Balance as of December 31, 2017 Exercise of stock options and warrants Shares withheld in consideration of employee tax obligations relative to stock-based compensation arrangements Issuance of Class A Common Stock, net of forfeitures Issuance of Class C Common Stock, net of forfeitures Impact of adoption of accounting standard updates Stock-based compensation expense Comprehensive income (loss) Balance as of December 31, 2018 (2,781) (2,781) (65) ( 896 1,723 7,852 (2,686) 39,932 (23,932) AI IIII!!!!!!! 7,853 (26,596) 39,932 (34-328) 2,018,642 6,748 (48,260 1.184,441 13,932 (38,211) 34:450 185,257 2,084 222,375 2,127 872,266 6,747 (140) (2,564) (2,564) (23) 392 115 11!!! !!!"!! 2,000 (4,168) 3.507 41,783 (4,167) 3.507 41,783 (47.078) $2,016,871 (46.302) $1,139,082 (76) $(28.987) 187.710 34.450 $916.628 226.422 See accompanying notes. Under Armour, Inc. and Subsidiaries Under Armour, Inc. and Subsidiaries Consolidated Statements of Cash Flows (In thousands) Year Ended December 31, 2017 2018 2016 $(46,302) $(48,260) $ 256,979 144,770 12,627 181,768 14,023 9,893 254 4,256 41,783 173,747 (29,247) 71,378 254 2,313 39,932 (5) 55,910 108,757 1,580 46,149 44,783 (43,004) 70,188 (38,544) (234,998) 186,834 109,919 (107,855) 26,413 134,594 305,141 41,051 628.230 69,106) (222,391) (52,106) 145,695 109,823 (249,853) (148,055) (23,029) 202,446 67.754 (39,164) 237,460 (16.712) 366,623 (281,339) (316,458) (170,385) 11,285 (0,288) Cash flows from operating activities Net income (los) Adjustments to reconcile net income (loss) to net cash provided by operating activities Depreciation and amortization Unrealized foreign currency exchange rate (gains) losses Impairment charges Amortization of bond premium Loss on disposal of property and equipment Stock-based compensation Excess tax benefit (loss) from stock-based compensation arrangements Deferred income taxes Changes in reserves and allowances Changes in operating assets and liabilities: Accounts receivable Inventories Prepaid expenses and other assets Accounts payable Accrued expenses and other liabilities Customer refund liability Income taxes payable and receivable Net cash provided by operating activities Cash flows from investing activities Purchases of property and equipment Sale of property and equipment Purchases of property and equipment from related parties Purchase of equity method investment Purchases of available-for-sale securities Sales of available-for-sale securities Purchases of other assets Net cash used in investing activities Cash flows from financing activities Proceeds from long term debt and revolving credit facility Payments on long term debt and revolving credit facility Employee taxes paid for shares withheld for income taxes Proceeds from exercise of stock options and other stock issuances Other financing fees Payments of debt financing costs Cash dividends paid Contingent consideration payments for acquisitions Net cash provided by (used in) financing activities Effect of exchange rate changes on cash, cash equivalents and restricted cash Net increase in cash, cash equivalents and restricted cash Cash, cash equivalents and restricted cash Beginning of period End of period Non-cash investing and financing activities Change in accrual for property and equipment Non-cash dividends Other supplemental information Cash paid for income taxes, net of refunds Cash paid for interest, net of capitalized interest (39,207) (4,597) (202,904) (1,648) (282,987) (24,230) 30,712 (875) (381,139) 505,000 (695,000) (2,743) 2,580 306 (11) 763,000 (665,000) (2.781) 11,540 1,327,601 (1,170,750) (15.098) 15,485 (189,868) 12.467 247,925 (6,692) (2.927) (1:505) 146,114 (8.725) 122,873 106,759 4,178 65,410 318,135 $ 566,000 252.725 $ 318,315 129,852 $ 252.725 $(14,611) $10,580 $16,973 (56,073) (16,738) 28,586 36,921 29,750 135,959 21,412