The question:

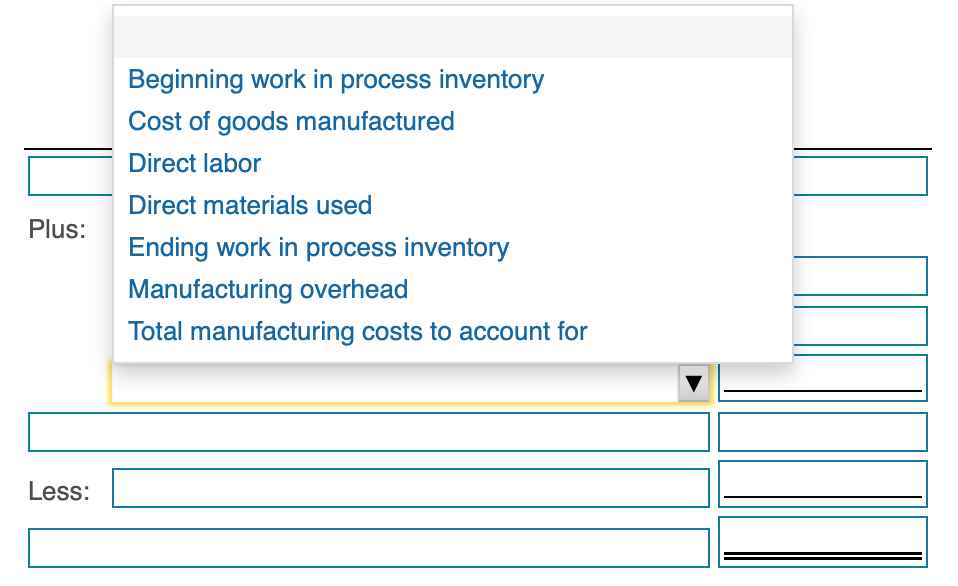

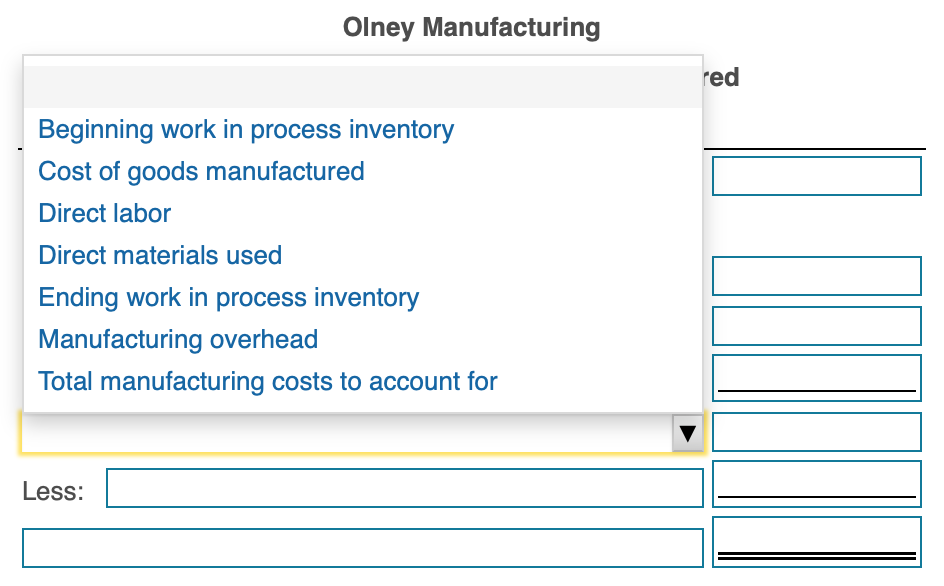

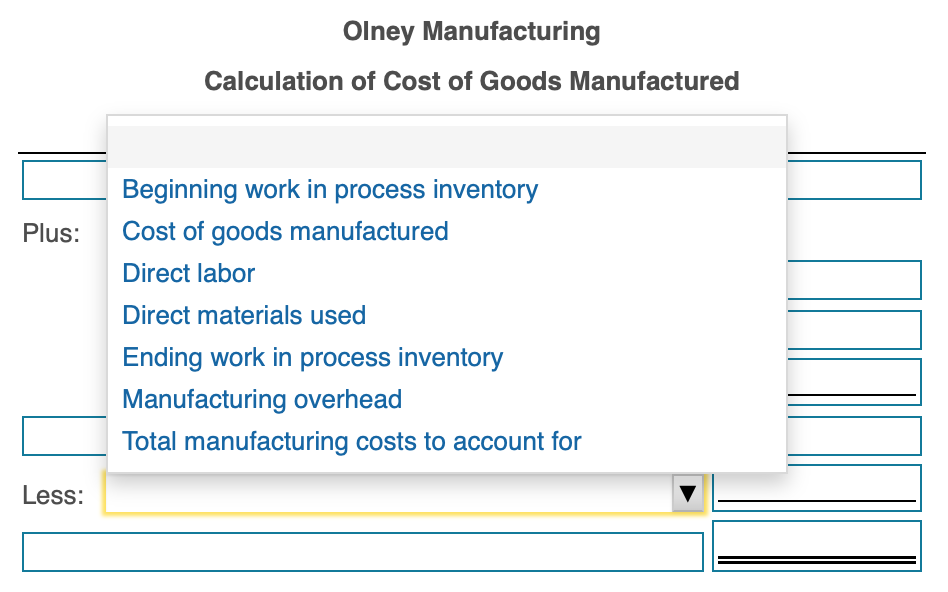

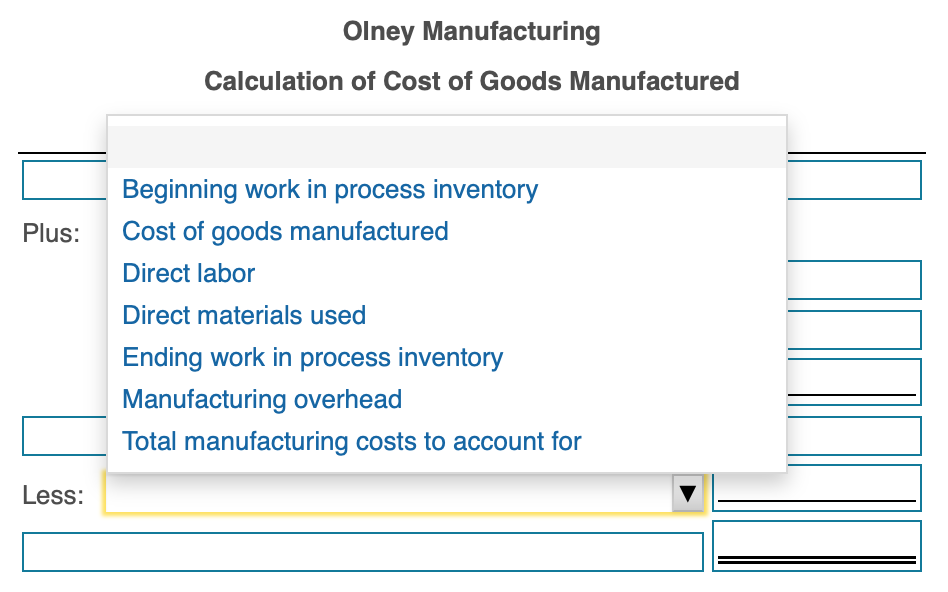

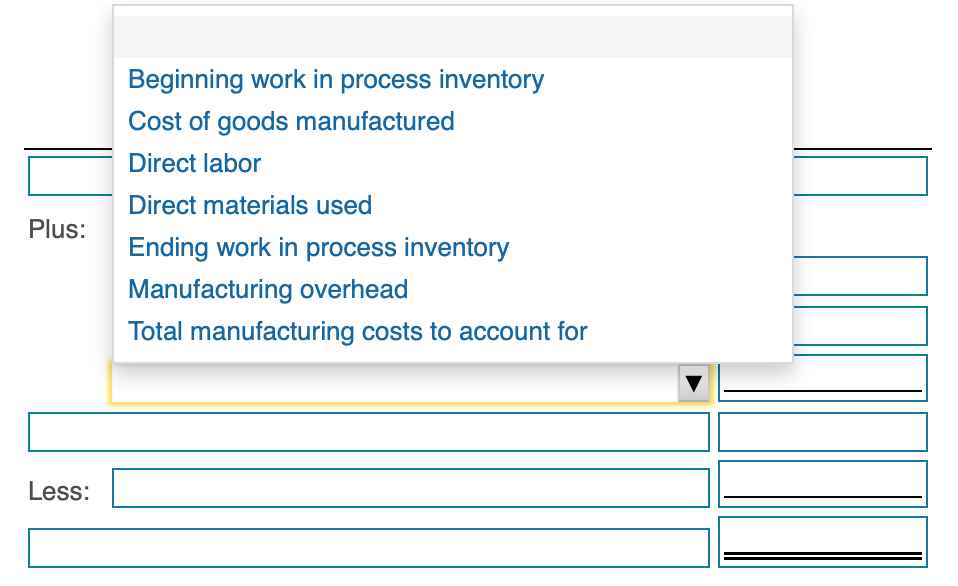

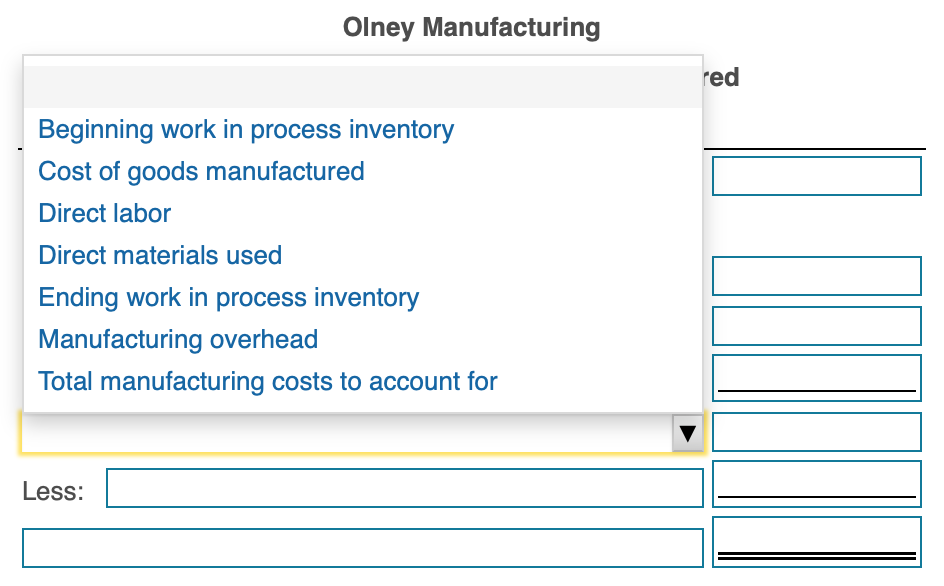

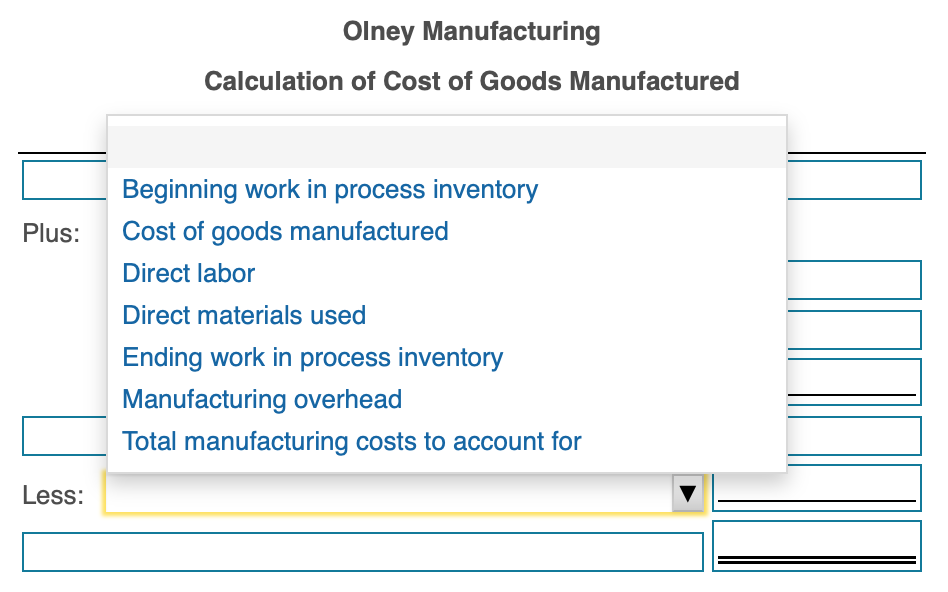

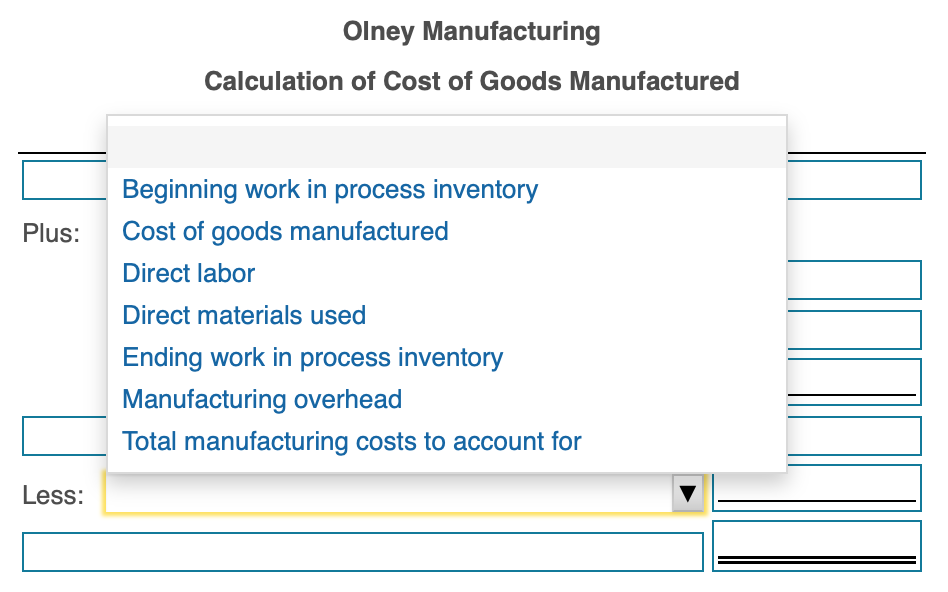

The options for each drop down:

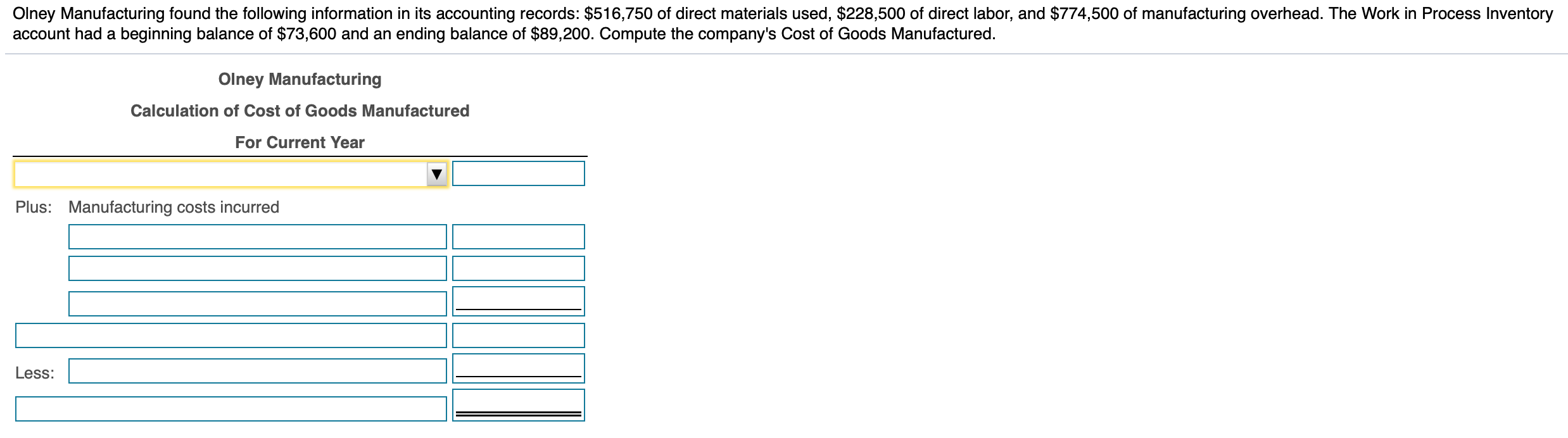

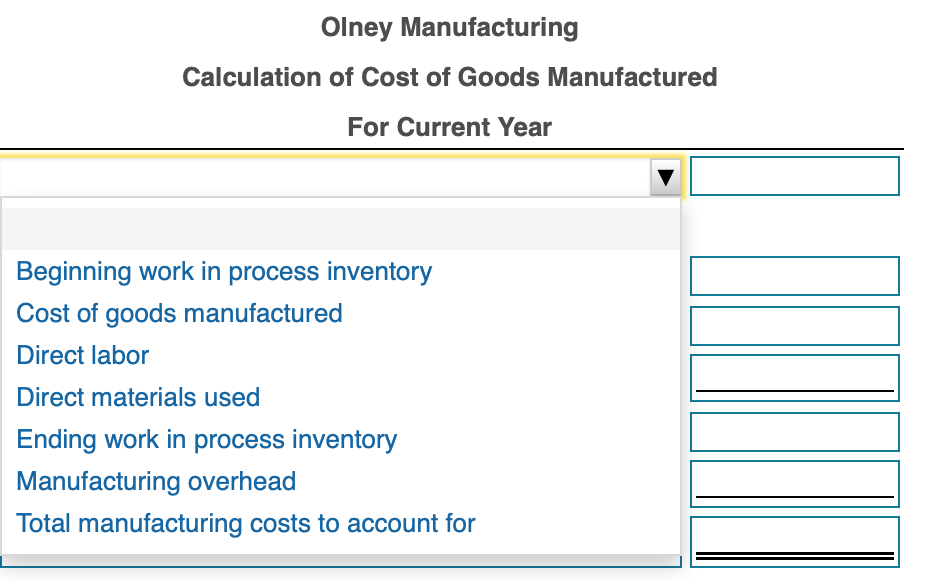

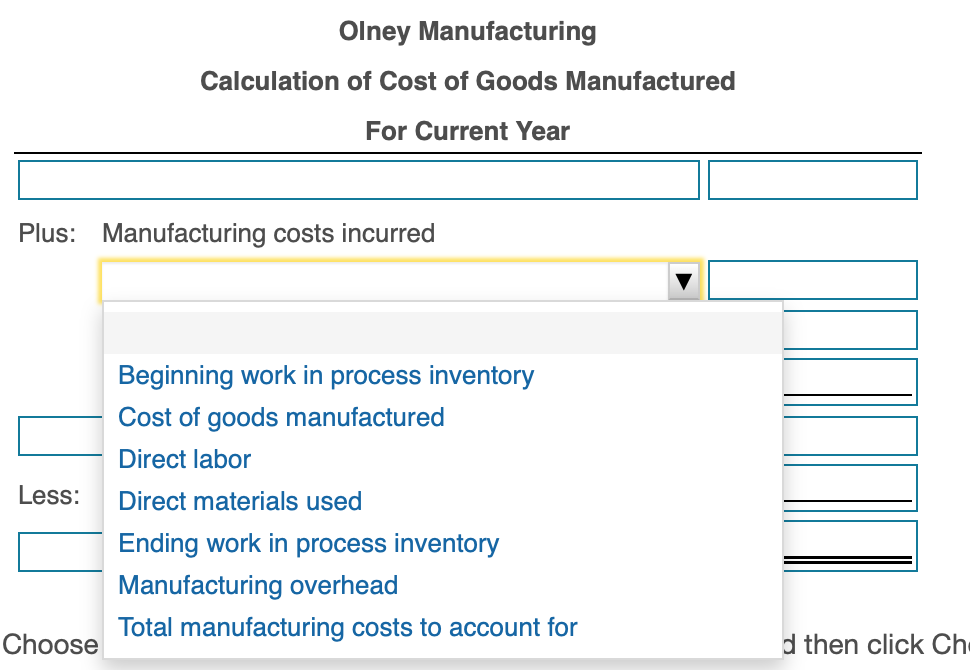

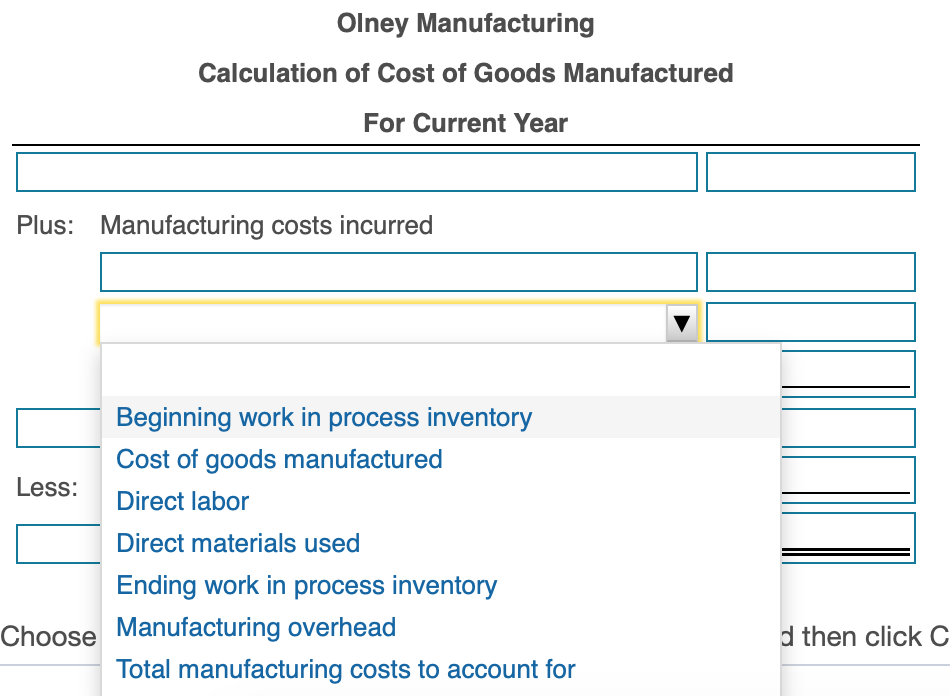

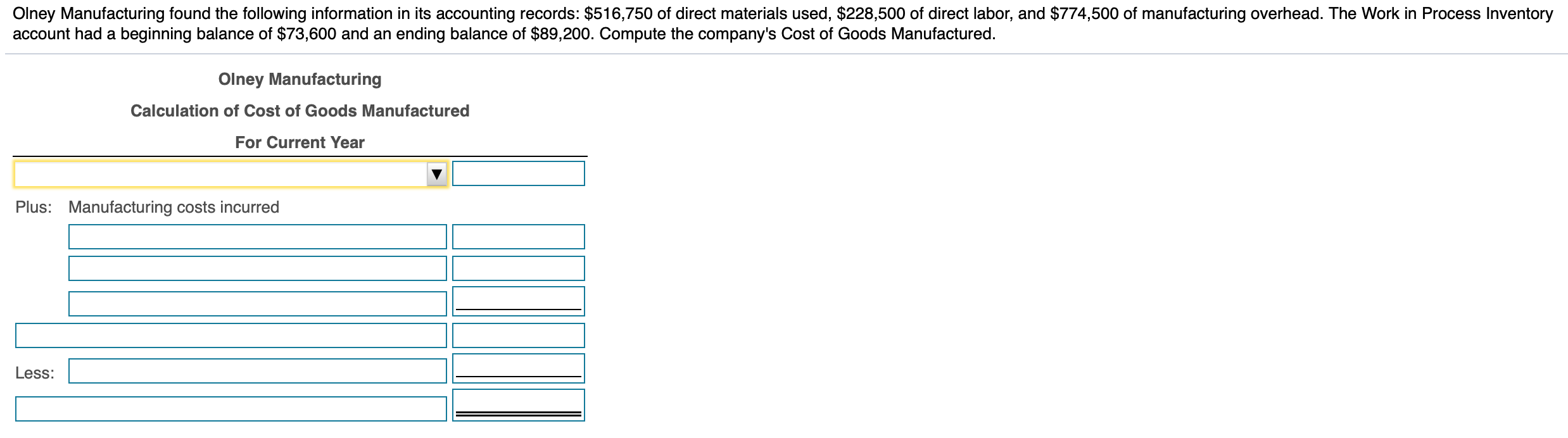

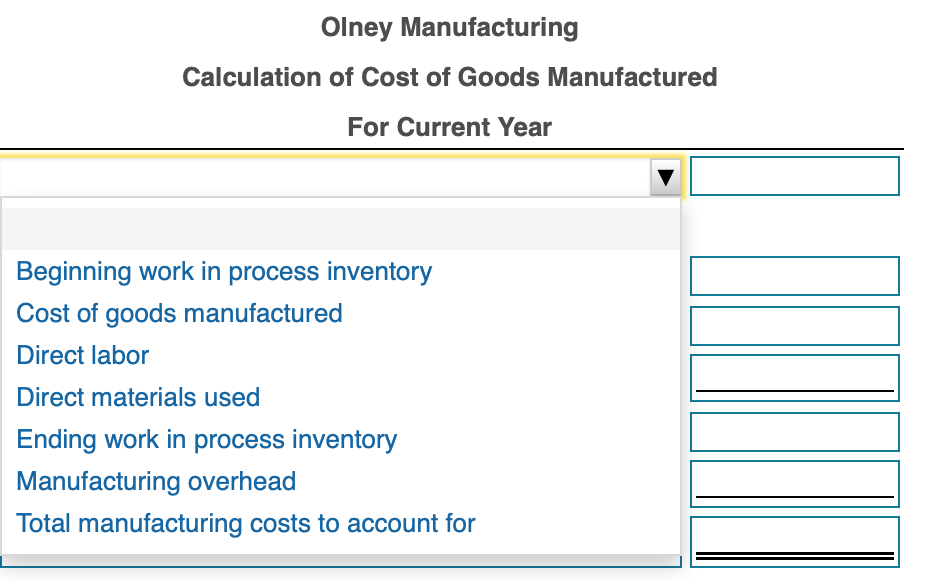

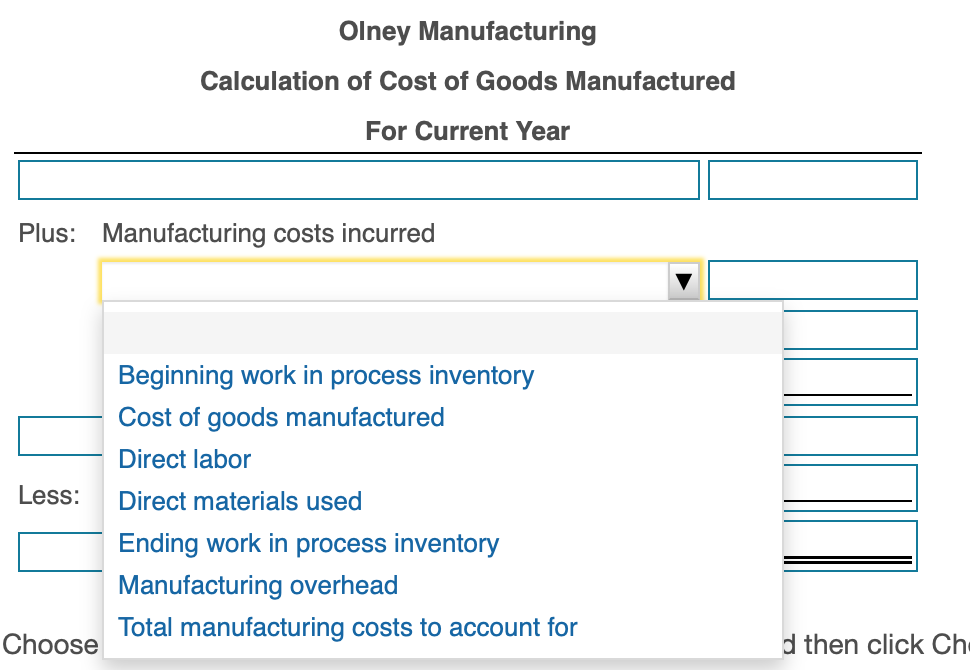

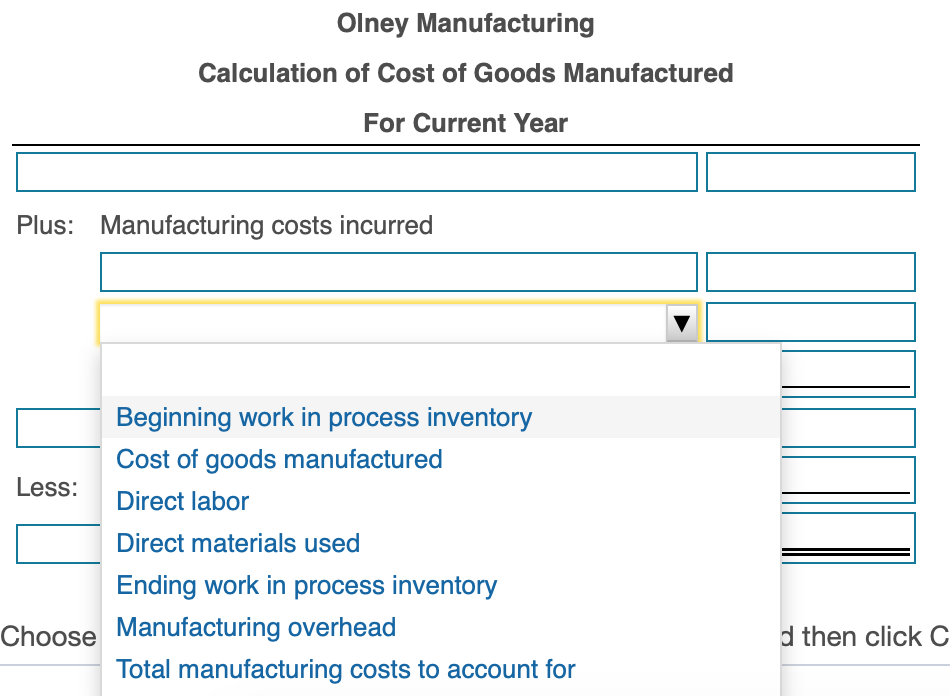

Olney Manufacturing found the following information in its accounting records: $516,750 of direct materials used, $228,500 of direct labor, and $774,500 of manufacturing overhead. The Work in Process Inventory account had a beginning balance of $73,600 and an ending balance of $89,200. Compute the company's Cost of Goods Manufactured. Olney Manufacturing Calculation of Cost of Goods Manufactured For Current Year Plus: Manufacturing costs incurred Less: Olney Manufacturing Calculation of Cost of Goods Manufactured For Current Year Beginning work in process inventory Cost of goods manufactured Direct labor Direct materials used Ending work in process inventory Manufacturing overhead Total manufacturing costs to account for Olney Manufacturing Calculation of Cost of Goods Manufactured For Current Year Plus: Manufacturing costs incurred Less: Beginning work in process inventory Cost of goods manufactured Direct labor Direct materials used Ending work in process inventory Manufacturing overhead Total manufacturing costs to account for Choose d then click Ch Olney Manufacturing Calculation of Cost of Goods Manufactured For Current Year Plus: Manufacturing costs incurred Beginning work in process inventory Cost of goods manufactured Less: Direct labor Direct materials used Ending work in process inventory Choose Manufacturing overhead Total manufacturing costs to account for d then click C Beginning work in process inventory Cost of goods manufactured Direct labor Direct materials used Ending work in process inventory Manufacturing overhead Total manufacturing costs to account for Plus: Less: Olney Manufacturing red Beginning work in process inventory Cost of goods manufactured Direct labor Direct materials used Ending work in process inventory Manufacturing overhead Total manufacturing costs to account for Less: Olney Manufacturing Calculation of Cost of Goods Manufactured Plus: Beginning work in process inventory Cost of goods manufactured Direct labor Direct materials used Ending work in process inventory Manufacturing overhead Total manufacturing costs to account for Less: Olney Manufacturing Calculation of Cost of Goods Manufactured Plus: Beginning work in process inventory Cost of goods manufactured Direct labor Direct materials used Ending work in process inventory Manufacturing overhead Total manufacturing costs to account for Less