Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the questions and required answers are in Excel format. To calculate the missing values You are provided with five possible portfolios to select. The portfolios

the questions and required answers are in Excel format. To calculate the missing values

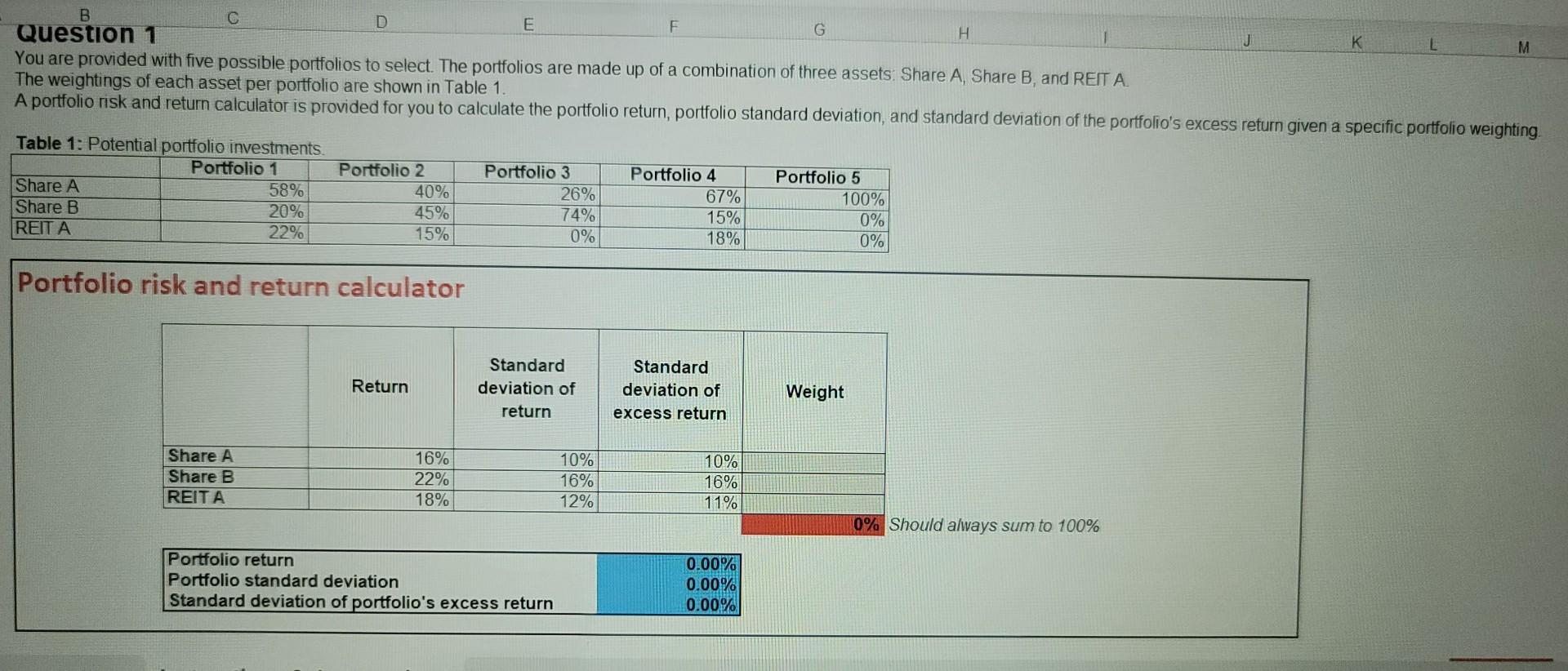

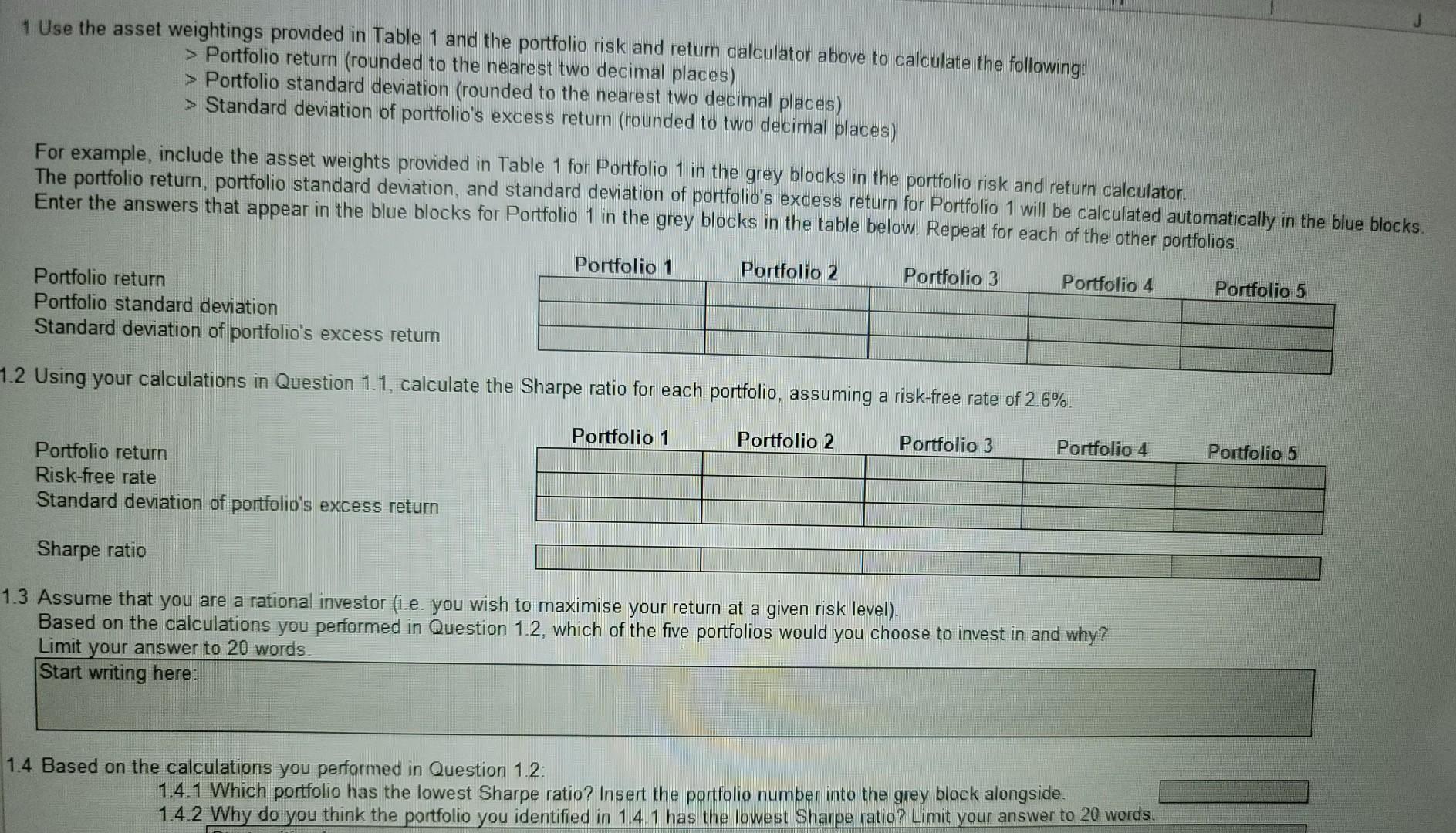

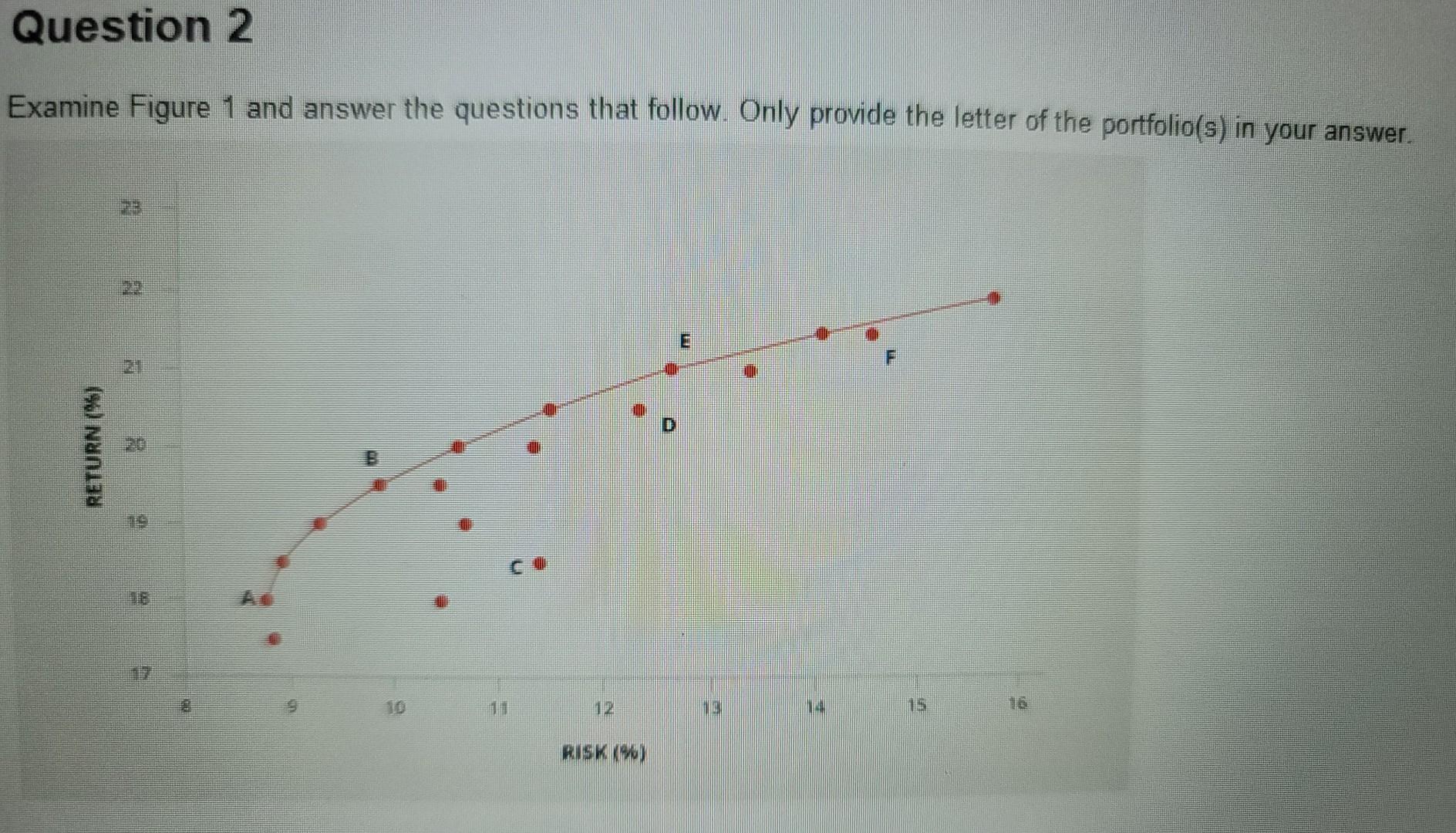

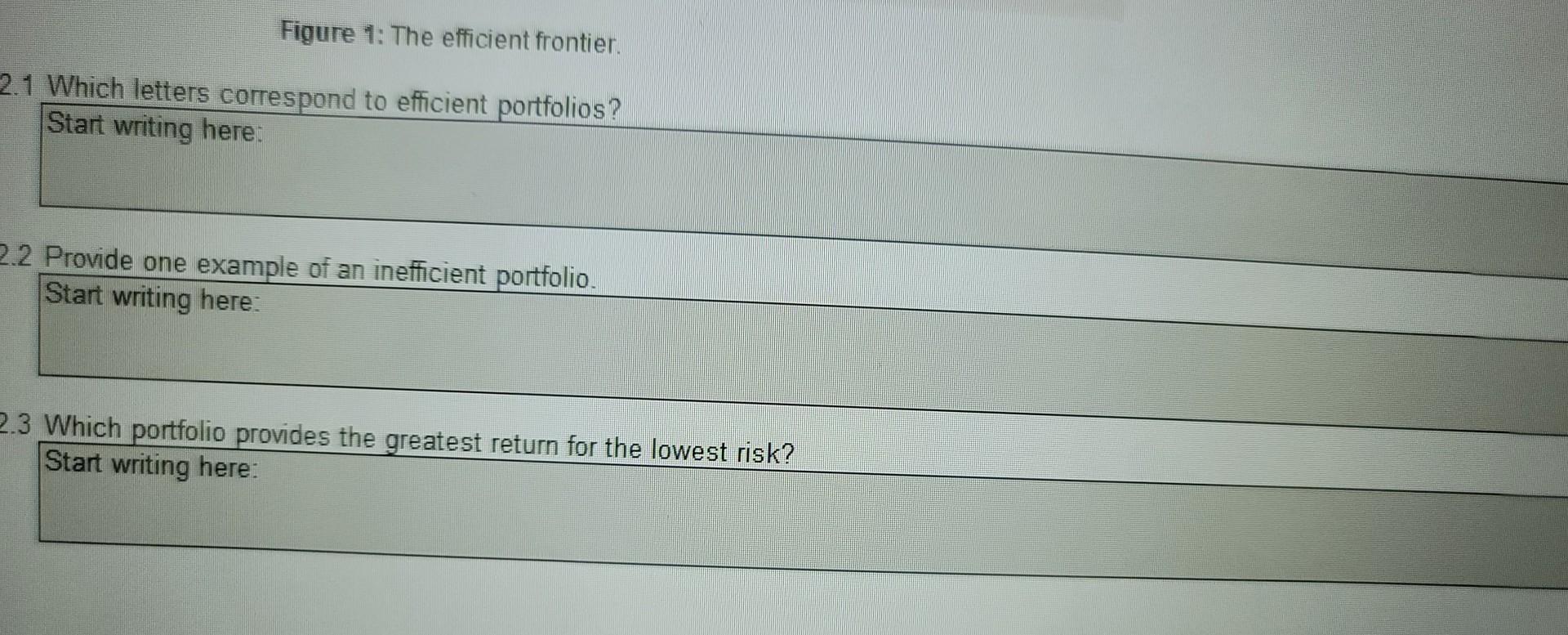

You are provided with five possible portfolios to select. The portfolios are made up of a combination of three assets: Share A, Share B, and REIT A. The weightings of each asset per portfolio are shown in Table 1. A portfolio risk and return calculator is provided for you to calculate the portfolio return, portfolio standard deviation, and standard deviation of the portfolio's excess return given a specific portfolio weighting. Portfolio risk and return calculator 1 Use the asset weightings provided in Table 1 and the portfolio risk and return calculator above to calculate the following: > Portfolio return (rounded to the nearest two decimal places) > Portfolio standard deviation (rounded to the nearest two decimal places) > Standard deviation of portfolio's excess return (rounded to two decimal places) For example, include the asset weights provided in Table 1 for Portfolio 1 in the grey blocks in the portfolio risk and return calculator. The portfolio return, portfolio standard deviation, and standard deviation of portfolio's excess return for Portfolio 1 will be calculated automatically in the blue blocks Enter the answers that appear in the blue blocks for Portfolio 1 in the grey blocks in the table below. Repeat for each of the other portfolios. Portfolio return Portfolio standard deviation Standard deviation of portfolio's excess return 2 Using your calculations in Question 1.1, calculate the Sharpe ratio for each portfolio, assuming a risk-free rate of 2.6%. 1.3 Assume that you are a rational investor (i.e. you wish to maximise your return at a given risk level). Based on the calculations you performed in Question 1.2, which of the five portfolios would you choose to invest in and why? Limit your answer to 20 words. Start writing here: 1.4 Based on the calculations you performed in Question 1.2: 1.4.1 Which portfolio has the lowest Sharpe ratio? Insert the portfolio number into the grey block alongside. 1.4.2 Why do you think the portfolio you identified in 1.4 .1 has the lowest Sharpe ratio? Limit your answer to 20 words. Examine Figure 1 and answer the questions that follow. Only provide the letter of the portfolio(s) in your answer. 3 Which portfolio provides the greatest return for the lowest risk? Start writing here: You are provided with five possible portfolios to select. The portfolios are made up of a combination of three assets: Share A, Share B, and REIT A. The weightings of each asset per portfolio are shown in Table 1. A portfolio risk and return calculator is provided for you to calculate the portfolio return, portfolio standard deviation, and standard deviation of the portfolio's excess return given a specific portfolio weighting. Portfolio risk and return calculator 1 Use the asset weightings provided in Table 1 and the portfolio risk and return calculator above to calculate the following: > Portfolio return (rounded to the nearest two decimal places) > Portfolio standard deviation (rounded to the nearest two decimal places) > Standard deviation of portfolio's excess return (rounded to two decimal places) For example, include the asset weights provided in Table 1 for Portfolio 1 in the grey blocks in the portfolio risk and return calculator. The portfolio return, portfolio standard deviation, and standard deviation of portfolio's excess return for Portfolio 1 will be calculated automatically in the blue blocks Enter the answers that appear in the blue blocks for Portfolio 1 in the grey blocks in the table below. Repeat for each of the other portfolios. Portfolio return Portfolio standard deviation Standard deviation of portfolio's excess return 2 Using your calculations in Question 1.1, calculate the Sharpe ratio for each portfolio, assuming a risk-free rate of 2.6%. 1.3 Assume that you are a rational investor (i.e. you wish to maximise your return at a given risk level). Based on the calculations you performed in Question 1.2, which of the five portfolios would you choose to invest in and why? Limit your answer to 20 words. Start writing here: 1.4 Based on the calculations you performed in Question 1.2: 1.4.1 Which portfolio has the lowest Sharpe ratio? Insert the portfolio number into the grey block alongside. 1.4.2 Why do you think the portfolio you identified in 1.4 .1 has the lowest Sharpe ratio? Limit your answer to 20 words. Examine Figure 1 and answer the questions that follow. Only provide the letter of the portfolio(s) in your answer. 3 Which portfolio provides the greatest return for the lowest risk? Start writing hereStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started