Answered step by step

Verified Expert Solution

Question

1 Approved Answer

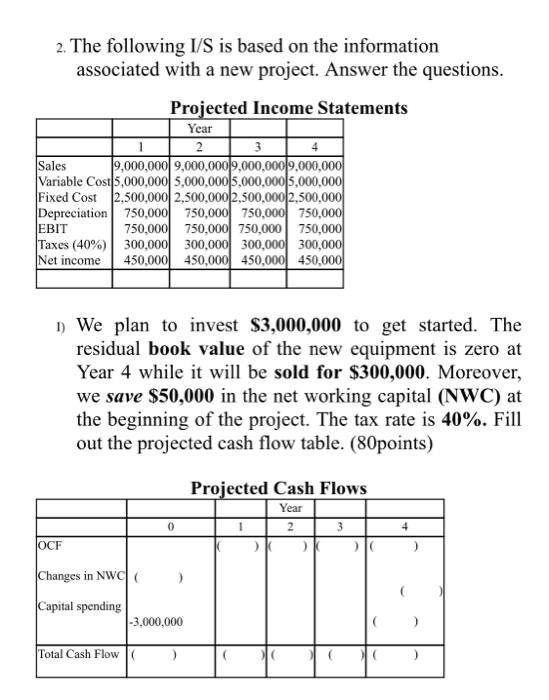

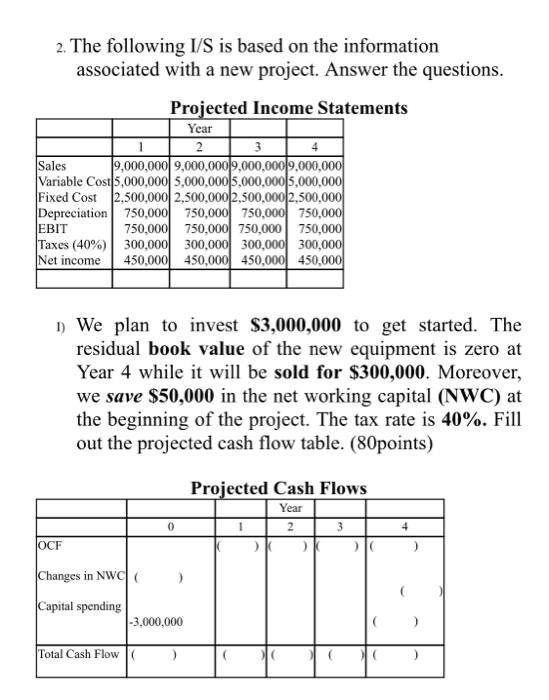

The questions are continued in the next picture 2. The following I/S is based on the information associated with a new project. Answer the questions.

The questions are continued in the next picture

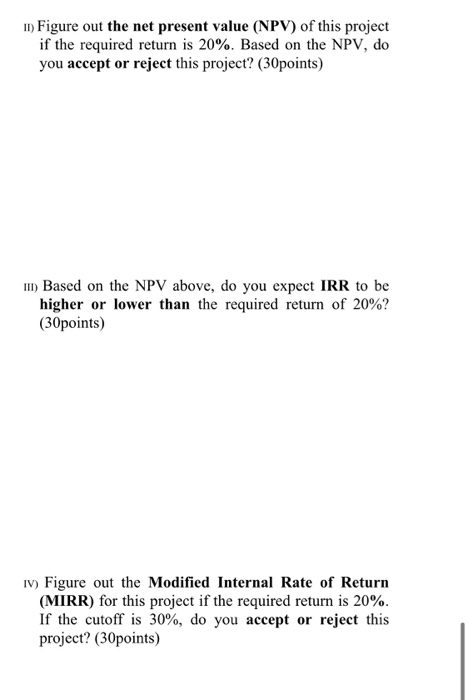

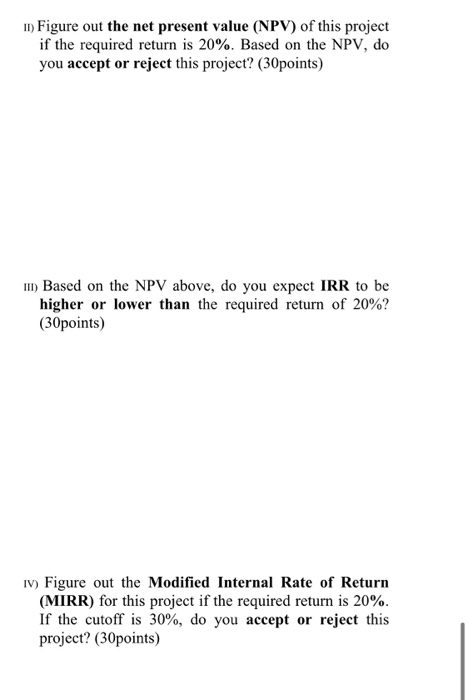

2. The following I/S is based on the information associated with a new project. Answer the questions. Projected Income Statements Year 2 3 Sales 19,000,000 9,000,000|9,000,000|9,000,000 Variable Cost 5,000,000 5,000,000 5,000,000 5,000,000 Fixed Cost 12,500,000 2,500,00012,500,000 2,500,000 Depreciation 750,000 750,000 750.000 750,000 EBIT 750,000 750.000 750.000 750,000 Taxes (40%) 300,000 300,000 300,000 300,000 Net income 450,000 450,000 450,000 450,000 1) We plan to invest $3,000,000 to get started. The residual book value of the new equipment is zero at Year 4 while it will be sold for $300,000. Moreover, we save $50,000 in the net working capital (NWC) at the beginning of the project. The tax rate is 40%. Fill out the projected cash flow table. (80points) Projected Cash Flows 1 Year 1 2 3 0 4 OCF Changes in NW ) Capital spending -3,000,000 Total Cash Flow | 11) Figure out the net present value (NPV) of this project if the required return is 20%. Based on the NPV, do you accept or reject this project? (30points) III) Based on the NPV above, do you expect IRR to be higher or lower than the required return of 20%? (30points) Iv) Figure out the Modified Internal Rate of Return (MIRR) for this project if the required return is 20%. If the cutoff is 30%, do you accept or reject this project? (30points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started