Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the questions are on the picture, its needs an excel file to be completed 1) Prepare cash flows to each investor 2) determine the amount

the questions are on the picture, its needs an excel file to be completed

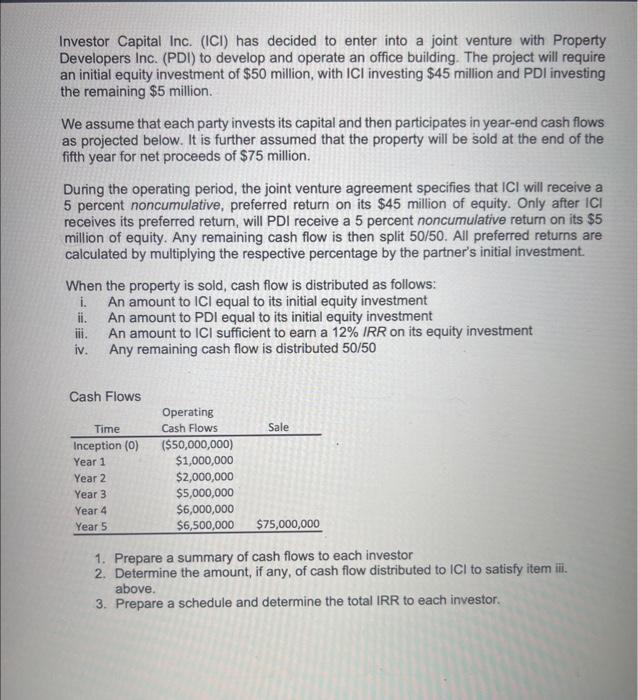

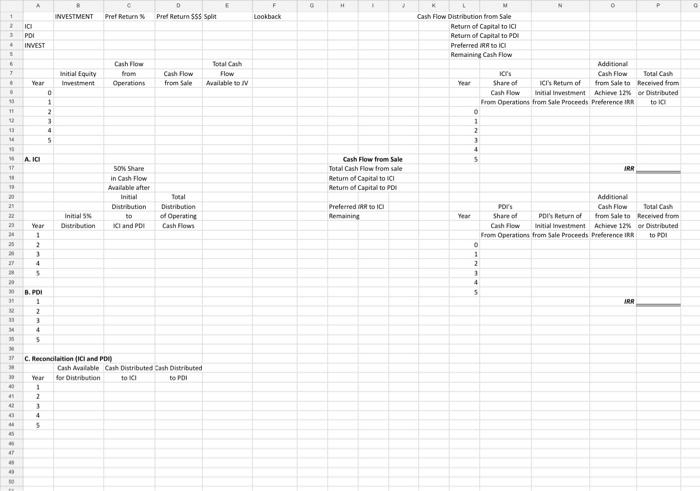

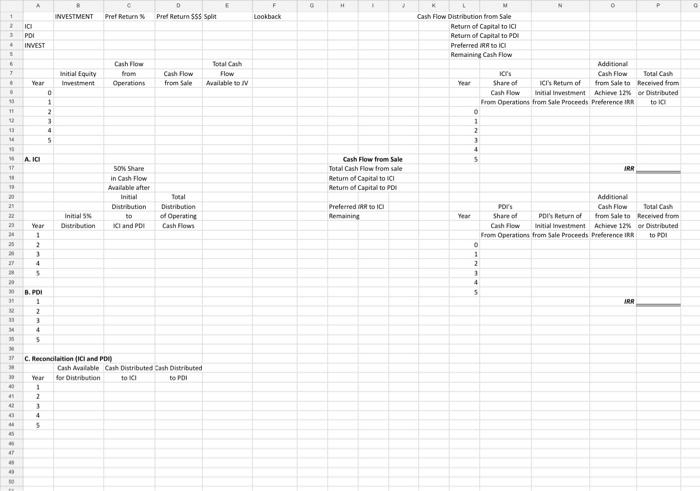

1) Prepare cash flows to each investor

Investor Capital Inc. (ICl) has decided to enter into a joint venture with Property Developers Inc. (PDI) to develop and operate an office building. The project will require an initial equity investment of $50 million, with ICl investing $45 million and PDI investing the remaining $5 million. We assume that each party invests its capital and then participates in year-end cash flows as projected below. It is further assumed that the property will be sold at the end of the fifth year for net proceeds of $75 million. During the operating period, the joint venture agreement specifies that ICI will receive a 5 percent noncumulative, preferred return on its $45 million of equity. Only after ICI receives its preferred return, will PDI receive a 5 percent noncumulative return on its $5 million of equity. Any remaining cash flow is then split 50/50. All preferred returns are calculated by multiplying the respective percentage by the partner's initial investment. When the property is sold, cash flow is distributed as follows: i. An amount to ICl equal to its initial equity investment ii. An amount to PDI equal to its initial equity investment iii. An amount to ICl sufficient to earn a 12% IRR on its equity investment. iv. Any remaining cash flow is distributed 50/50 1. Prepare a summary of cash flows to each investor 2. Determine the amount, if any, of cash flow distributed to Cl to satisfy item iii. above. 3. Prepare a schedule and determine the total IRR to each investor. Investor Capital Inc. (ICl) has decided to enter into a joint venture with Property Developers Inc. (PDI) to develop and operate an office building. The project will require an initial equity investment of $50 million, with ICl investing $45 million and PDI investing the remaining $5 million. We assume that each party invests its capital and then participates in year-end cash flows as projected below. It is further assumed that the property will be sold at the end of the fifth year for net proceeds of $75 million. During the operating period, the joint venture agreement specifies that ICI will receive a 5 percent noncumulative, preferred return on its $45 million of equity. Only after ICI receives its preferred return, will PDI receive a 5 percent noncumulative return on its $5 million of equity. Any remaining cash flow is then split 50/50. All preferred returns are calculated by multiplying the respective percentage by the partner's initial investment. When the property is sold, cash flow is distributed as follows: i. An amount to ICl equal to its initial equity investment ii. An amount to PDI equal to its initial equity investment iii. An amount to ICl sufficient to earn a 12% IRR on its equity investment. iv. Any remaining cash flow is distributed 50/50 1. Prepare a summary of cash flows to each investor 2. Determine the amount, if any, of cash flow distributed to Cl to satisfy item iii. above. 3. Prepare a schedule and determine the total IRR to each investor 2) determine the amount if any of cash flow distributed to ICI to satisfy them iii above

3) Prepare a schedule and determine the total irr to each investor

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started