Answered step by step

Verified Expert Solution

Question

1 Approved Answer

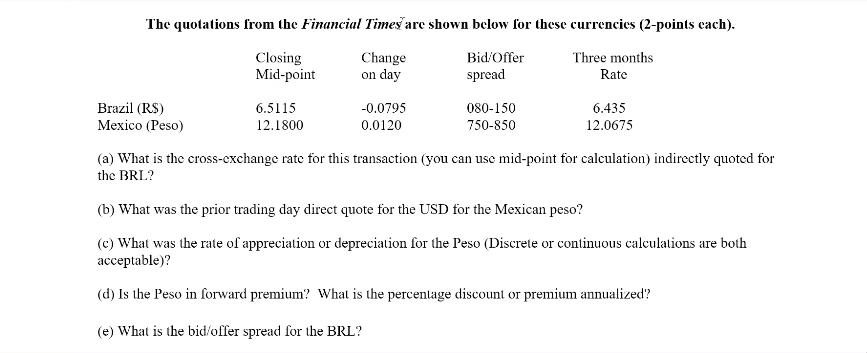

The quotations from the Financial Times are shown below for these currencies (2-points each). Brazil (R$) Mexico (Peso) Closing Mid-point Change on day Bid/Offer

The quotations from the Financial Times are shown below for these currencies (2-points each). Brazil (R$) Mexico (Peso) Closing Mid-point Change on day Bid/Offer spread 6.5115 12.1800 -0.0795 0.0120 080-150 750-850 Three months Rate 6.435 12.0675 (a) What is the cross-exchange rate for this transaction (you can use mid-point for calculation) indirectly quoted for the BRL? (b) What was the prior trading day direct quote for the USD for the Mexican peso? (c) What was the rate of appreciation or depreciation for the Peso (Discrete or continuous calculations are both acceptable)? (d) Is the Peso in forward premium? What is the percentage discount or premium annualized? (e) What is the bid/offer spread for the BRL?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets address each question step by step a To find the crossexchange rate for this transaction indirectly quoted for the BRL Brazilian Real we use the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started