Question

The Rapid Feast has two restaurants that are open 24 hours a day. Fixed costs for the two restaurants together total $509,000 per year.

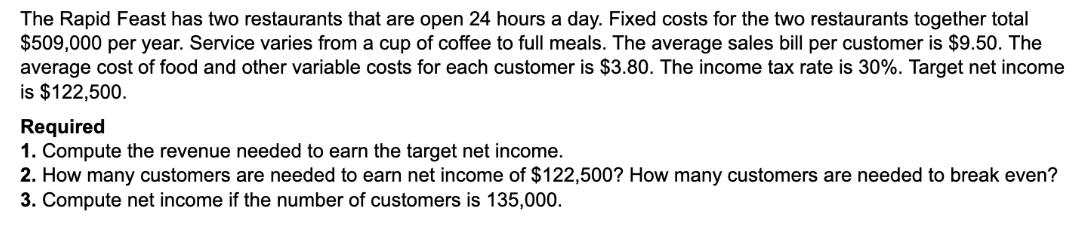

The Rapid Feast has two restaurants that are open 24 hours a day. Fixed costs for the two restaurants together total $509,000 per year. Service varies from a cup of coffee to full meals. The average sales bill per customer is $9.50. The average cost of food and other variable costs for each customer is $3.80. The income tax rate is 30%. Target net income is $122,500. Required 1. Compute the revenue needed to earn the target net income. 2. How many customers are needed to earn net income of $122,500? How many customers are needed to break even? 3. Compute net income if the number of customers is 135,000.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To solve these questions well use some basic accounting and financial analysis Lets break down each part step by step 1 Compute the revenue needed to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cost Accounting A Managerial Emphasis

Authors: Srikant M. Datar, Madhav V. Rajan, Charles T. Horngren, Louis Beaubien, Chris Graham

7th Canadian Edition

133138445, 978-0133926330, 133926338, 978-0133138443

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App