Question

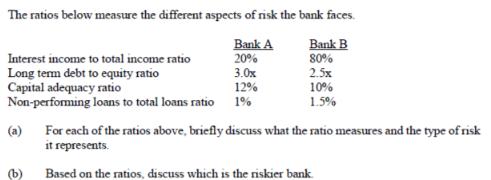

The ratios below measure the different aspects of risk the bank faces. Bank A Bank B 20% 80% Interest income to total income ratio

The ratios below measure the different aspects of risk the bank faces. Bank A Bank B 20% 80% Interest income to total income ratio Long term debt to equity ratio Capital adequacy ratio Non-performing (b) loans to total loans ratio 3.0x 12% 1% 2.5x 10% 1.5% For each of the ratios above, briefly discuss what the ratio measures and the type of risk it represents. Based on the ratios, discuss which is the riskier bank.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Interest income to total income ratio This ratio measures the proportion of a banks income generated from interest compared to its total income A high...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting

Authors: Charles T. Horngren, Walter T. Harrison Jr., Jo Ann L. Johnston, Carol A. Meissner, Peter R. Norwood

9th Canadian Edition volume 2

013269008X, 978-0133122855, 133122859, 978-0132690089

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App