Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The ratios in the table below are calculated using the information from CiM's financial statements presented in the case. Complete the last column of the

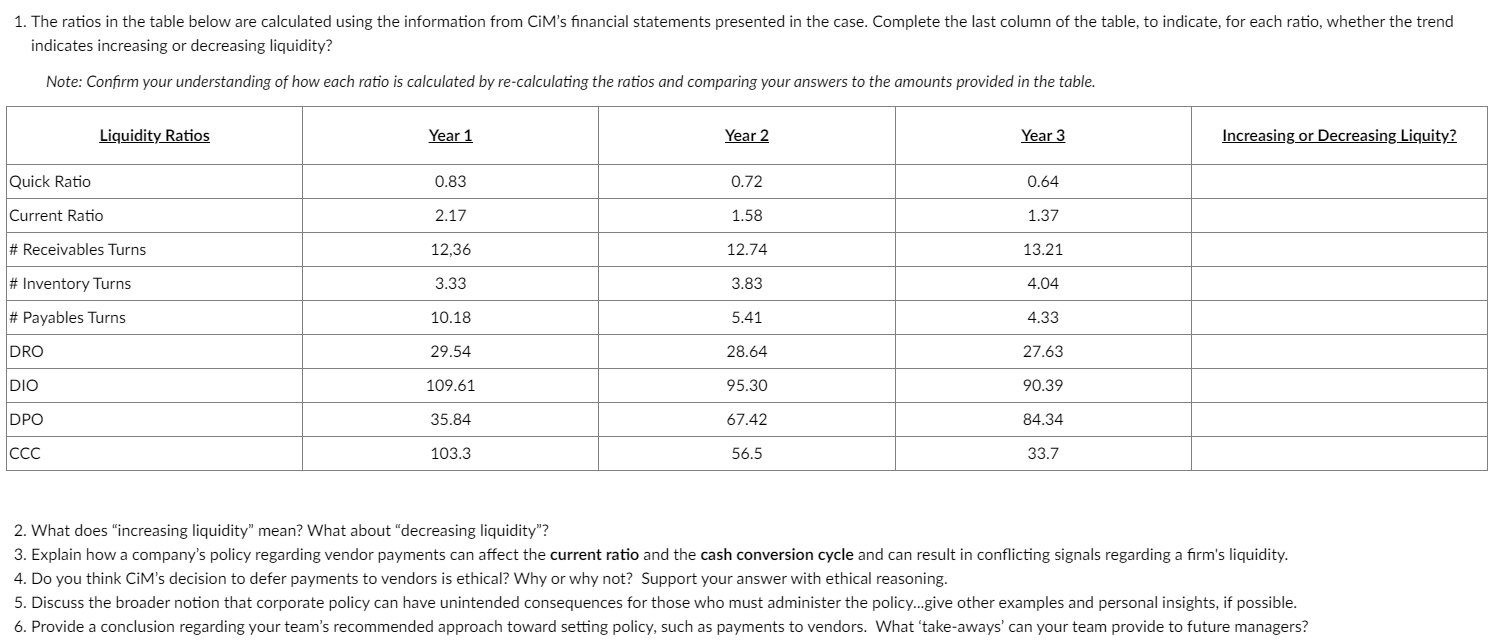

The ratios in the table below are calculated using the information from CiM's financial statements presented in the case. Complete the last column of the table, to indicate, for each ratio, whether the trend

indicates increasing or decreasing liquidity?

Note: Confirm your understanding of how each ratio is calculated by recalculating the ratios and comparing your answers to the amounts provided in the table.

What does "increasing liquidity" mean? What about "decreasing liquidity"?

Explain how a company's policy regarding vendor payments can affect the current ratio and the cash conversion cycle and can result in conflicting signals regarding a firm's liquidity.

Do you think CiM's decision to defer payments to vendors is ethical? Why or why not? Support your answer with ethical reasoning.

Discuss the broader notion that corporate policy can have unintended consequences for those who must administer the policy....give other examples and personal insights, if possible.

Provide a conclusion regarding your team's recommended approach toward setting policy, such as payments to vendors. What 'takeaways' can your team provide to future managers?The ratios in the table below are calculated using the information from CiMs financial statements presented in the case. Complete the last column of the table, to indicate, for each ratio, whether the trend indicates increasing or decreasing liquidity?

Note: Confirm your understanding of how each ratio is calculated by recalculating the ratios and comparing your answers to the amounts provided in the table.

Liquidity Ratios Year Year Year Increasing or Decreasing Liquity?

Quick Ratio

Current Ratio

# Receivables Turns

# Inventory Turns

# Payables Turns

DRO

DIO

DPO

CCC

What does increasing liquidity mean? What about decreasing liquidity

Explain how a companys policy regarding vendor payments can affect the current ratio and the cash conversion cycle and can result in conflicting signals regarding a firm's liquidity.

Do you think CiMs decision to defer payments to vendors is ethical? Why or why not? Support your answer with ethical reasoning.

Discuss the broader notion that corporate policy can have unintended consequences for those who must administer the policy...give other examples and personal insights, if possible.

Provide a conclusion regarding your teams recommended approach toward setting policy, such as payments to vendors. What takeaways can your team provide to future managers?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started