Answered step by step

Verified Expert Solution

Question

1 Approved Answer

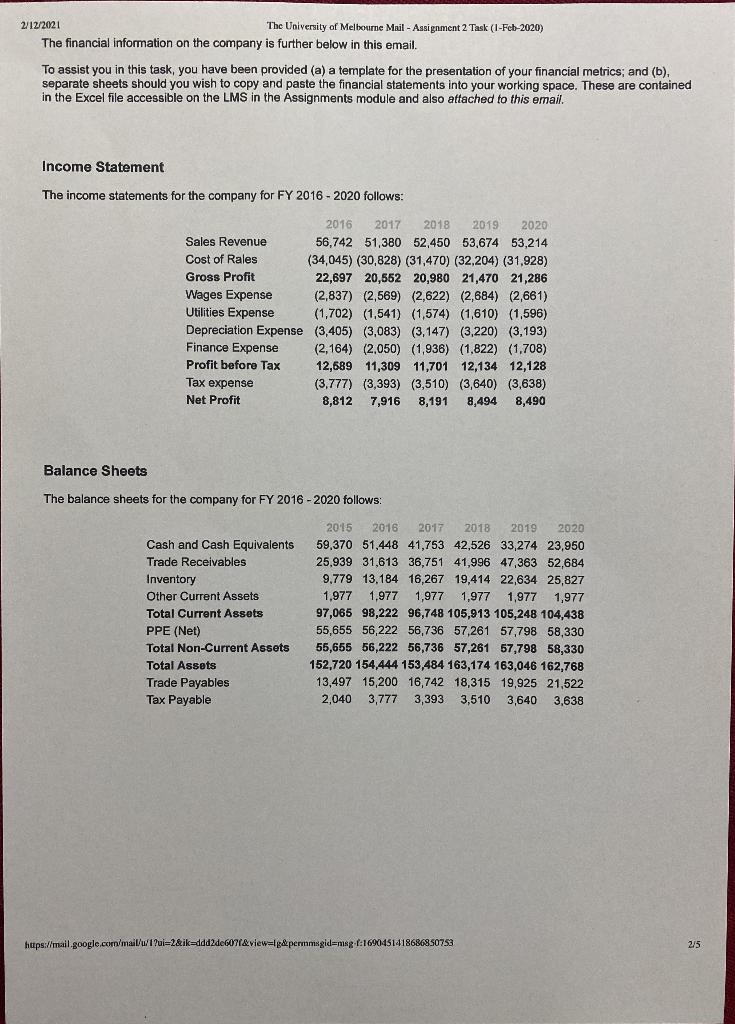

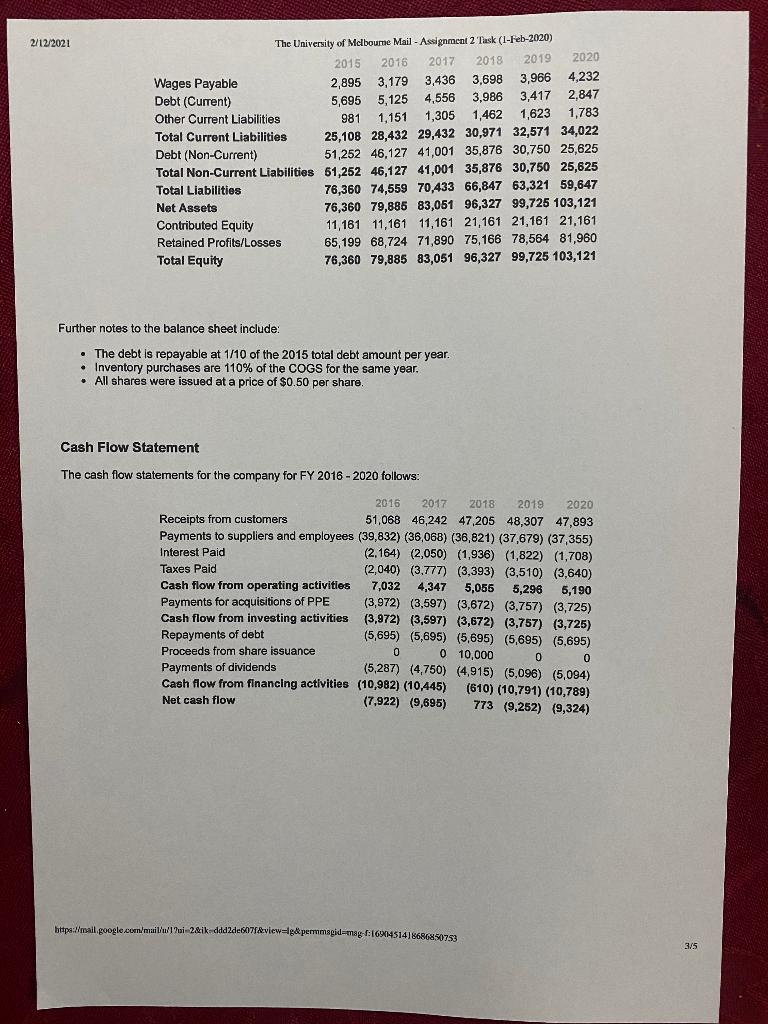

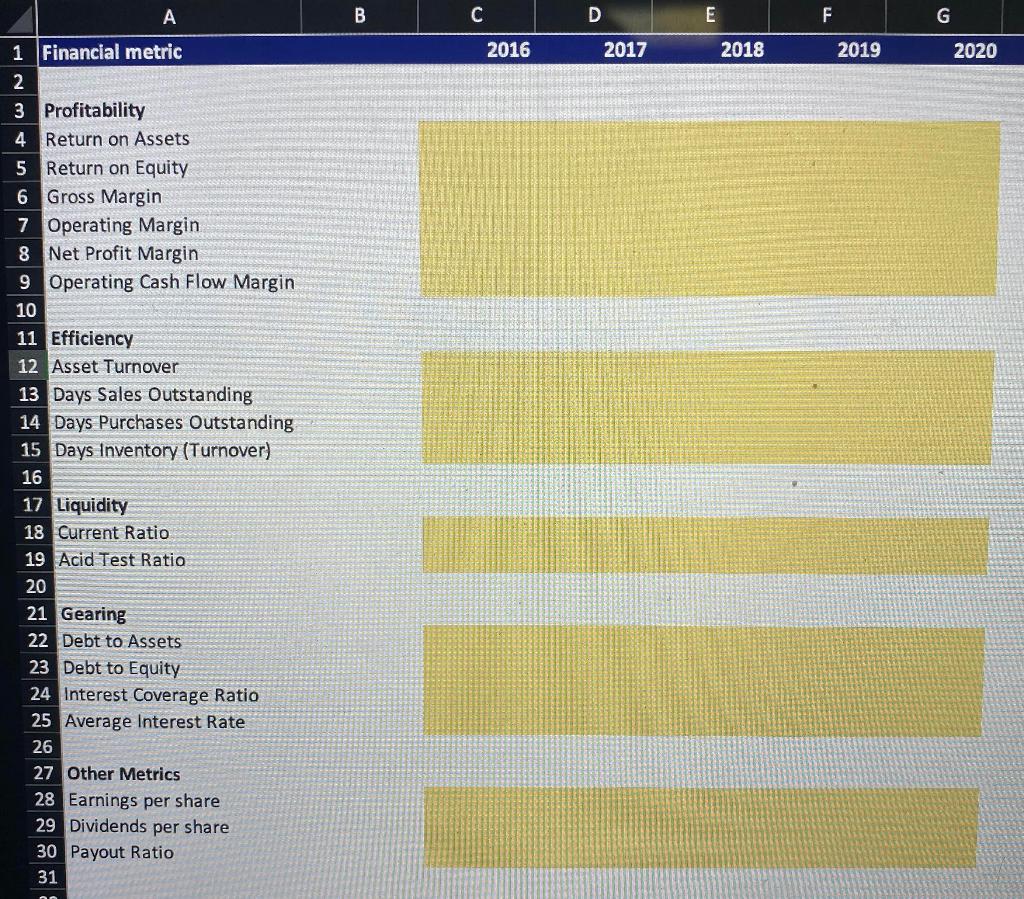

The ratios to be written down on the third image table. THANKS. 212/2021 The University of Melboume Mail - Assignment 2 Task (1-Feb-2020) The financial

The ratios to be written down on the third image table. THANKS.

212/2021 The University of Melboume Mail - Assignment 2 Task (1-Feb-2020) The financial information on the company is further below in this email. To assist you in this task, you have been provided (a) a template for the presentation of your financial metrics; and (b). separate sheets should you wish to copy and paste the financial statements into your working space. These are contained in the Excel file accessible on the LMS in the Assignments module and also attached to this email. Income Statement 2018 The income statements for the company for FY 2016 - 2020 follows: 2016 2017 2019 2020 Sales Revenue 56,742 51,380 52,450 53,674 53,214 Cost of Rales (34,045) (30,828) (31,470) (32,204) (31.928) Gross Profit 22,697 20,552 20,980 21,470 21,286 Wages Expense (2,837) (2,569) (2,622) (2,684) (2,661) Utilities Expense (1,702) (1,541) (1,574) (1,610) (1,596) Depreciation Expense (3,405) (3,083) (3,147) (3,220) (3,193) Finance Expense (2,164) (2.050) (1.936) (1.822) (1.708) Profit before Tax 12,689 11,309 11,701 12,134 12,128 Tax expense (3,777) (3,393) (3,510) (3,640) (3,638) Net Profit 8,812 8,191 8,494 7,916 8,490 Balance Sheets The balance sheets for the company for FY 2016 - 2020 follows: 1,977 Cash and Cash Equivalents Trade Receivables Inventory Other Current Assets Total Current Assets PPE (Net) Total Non-Current Assets Total Assets Trade Payables Tax Payable 2015 2016 2017 2018 2015 2020 59,370 51,448 41,753 42,526 33,274 23,950 25,939 31,613 36,751 41,996 47,363 52,684 9,779 13,184 16,267 19,414 22,634 25,827 1,977 1,977 1,977 1,977 1,977 97,065 98,222 96,748 105,913 105,248 104,438 55,655 56,222 56,736 57,261 57,798 58,330 55,655 56,222 56,736 57,261 57,798 58,330 152,720 154,444 153,484 163,174 163,046 162,768 13,497 15,200 16,742 18,315 19,925 21,522 2,040 3,777 3,393 3,510 3,640 3,638 hups://mail.google.com/mail/u/?i=2&k=ddd2d6071&view=lg&permmsgid=msgt:1690451418686850753 2/5 2/12/2021 2020 The University of Melbourne Mail - Assignment 2 Task (1-Feb-2020) 2015 2016 2017 2018 2019 Wages Payable 2,895 3,179 3,436 3,698 3,966 4,232 Debt (Current) 5,695 5,125 4.556 3,986 3,417 2,847 Other Current Liabilities 981 1,151 1.305 1,462 1,623 1,783 Total Current Liabilities 25,108 28,432 29,432 30,971 32,571 34,022 Debt (Non-Current) 51,252 46,127 41,001 35.876 30.750 25,625 Total Non-Current Liabilities 61,252 46,127 41,001 35,876 30,750 25,625 Total Liabilities 76,360 74,559 70,433 66,847 63,321 59,647 Net Assets 76,360 79,886 83,051 96,327 99,725 103,121 Contributed Equity 11,161 11,161 11,161 21,161 21,161 21,161 Retained Profits/Losses 65,199 68,724 71,890 75,166 78,564 81,960 Total Equity 76,360 79,885 83,051 96,327 99,725 103,121 Further notes to the balance sheet include: The debt is repayable at 1/10 of the 2015 total debt amount per year. Inventory purchases are 110% of the COGS for the same year. . All shares were issued at a price of $0.50 per share. Cash Flow Statement The cash flow statements for the company for FY 2016 - 2020 follows: 2016 2017 2018 2019 2020 Receipts from customers 51,068 46,242 47,205 48,307 47,893 Payments to suppliers and employees (39,832) (36,068) (36,821) (37,679) (37,355) Interest Paid (2.164) (2,050) (1,936) (1,822) (1,708) Taxes Paid (2,040) (3.777) (3,393) (3,510) (3,640) Cash flow from operating activities 7,032 4,347 5,055 5,296 5,190 Payments for acquisitions of PPE (3,972) (3,597) (3,672) (3.757) (3,725) Cash flow from investing activities (3,972) (3,597) (3,672) (3,757) (3,725) Repayments of debt (5,695) (5,695) (5,695) (5,695) (5,695) Proceeds from share issuance 0 0 10,000 0 0 Payments of dividends (5,287) (4,750) (4,915) (5,096) (5,094) Cash flow from financing activities (10,982) (10,445) (610) (10,791) (10,789) Net cash flow (7,922) (9,695) 773 (9,252) (9,324) https://mail.google.com/mail/u/?ui 2&ik ddd2de6071&view=lg&permmagid=mag :16911451418686250753 3/5 A B C D E F G 2016 2017 2018 2019 2020 1 Financial metric 2 3 Profitability 4 Return on Assets 5 Return on Equity 6 Gross Margin 7 Operating Margin 8 Net Profit Margin 9 Operating Cash Flow Margin 10 11 Efficiency 12 Asset Turnover 13 Days Sales Outstanding 14 Days Purchases Outstanding 15 Days Inventory (Turnover) 16 17 Liquidity 18 Current Ratio 19 Acid Test Ratio 20 21 Gearing 22 Debt to Assets 23 Debt to Equity 24 Interest Coverage Ratio 25 Average Interest Rate 26 27 Other Metrics 28 Earnings per share 29 Dividends per share 30 Payout Ratio 31Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started