Answered step by step

Verified Expert Solution

Question

1 Approved Answer

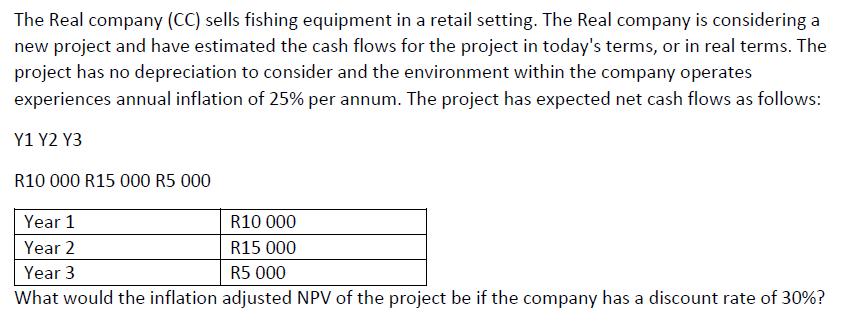

The Real company (CC) sells fishing equipment in a retail setting. The Real company is considering a new project and have estimated the cash

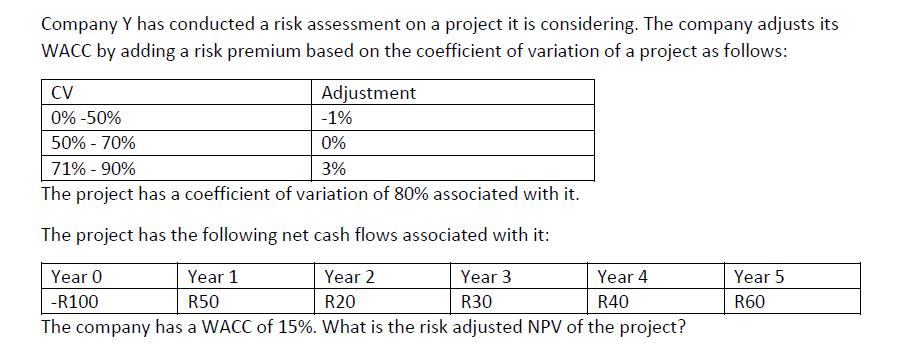

The Real company (CC) sells fishing equipment in a retail setting. The Real company is considering a new project and have estimated the cash flows for the project in today's terms, or in real terms. The project has no depreciation to consider and the environment within the company operates experiences annual inflation of 25% per annum. The project has expected net cash flows as follows: Y1 Y2 Y3 R10 000 R15 000 R5 000 Year 1 Year 2 Year 3 What would the inflation adjusted NPV of the project be if the company has a discount rate of 30%? R10 000 R15 000 R5 000 Company Y has conducted a risk assessment on a project it is considering. The company adjusts its WACC by adding a risk premium based on the coefficient of variation of a project as follows: Adjustment -1% 0% CV 0% -50% 50% - 70% 71% - 90% 3% The project has a coefficient of variation of 80% associated with it. The project has the following net cash flows associated with it: Year 0 Year 1 R50 Year 2 R20 Year 3 R30 -R100 The company has a WACC of 15%. What is the risk adjusted NPV of the project? Year 4 R40 Year 5 R60

Step by Step Solution

★★★★★

3.56 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the inflationadjusted NPV for the first project we need to adjust the cash flows for in...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started