Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Really Big Corporation (the Company) is a Canadian controlled private corporation throughout the year that operates a small but capital-intensive business that is

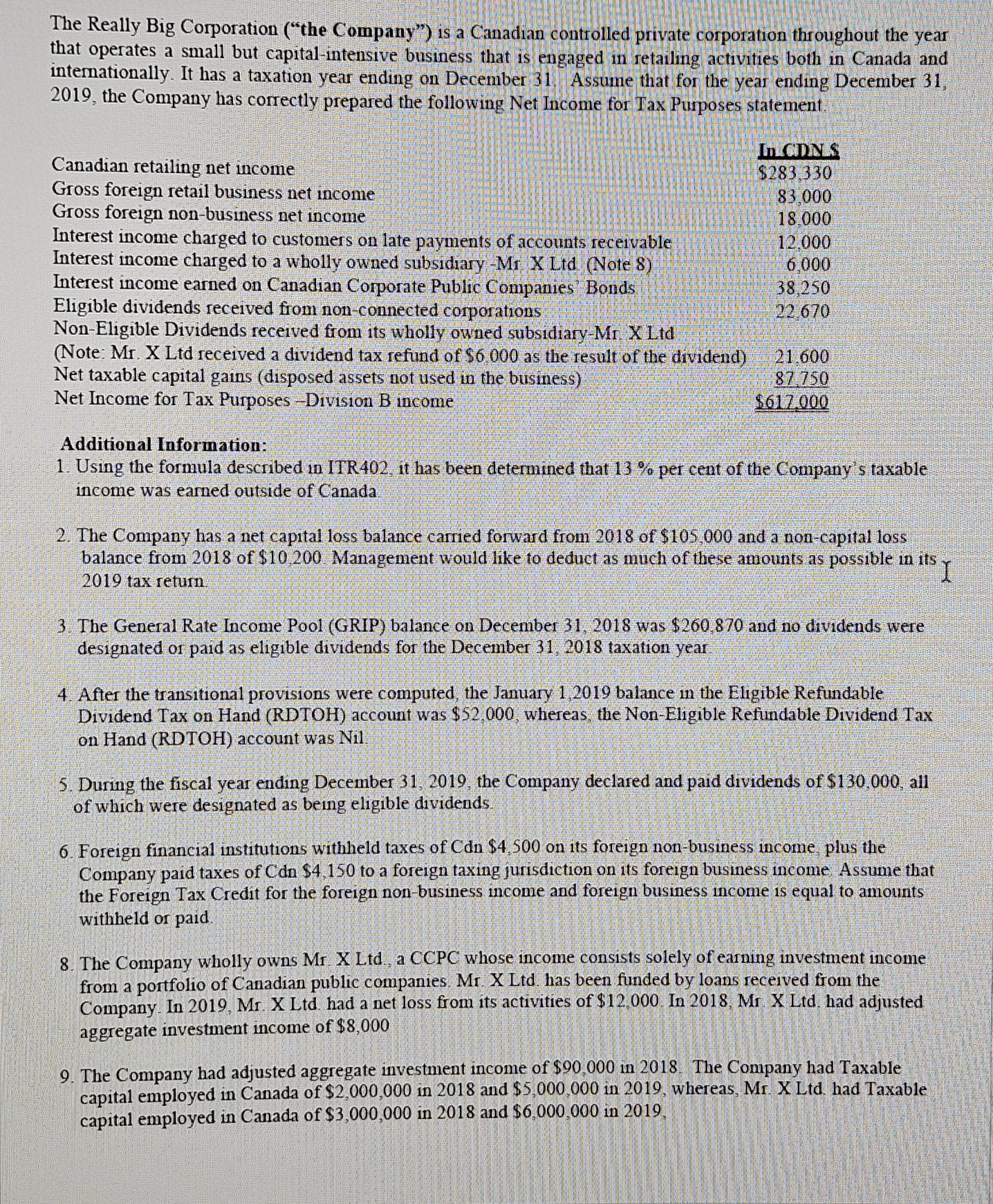

The Really Big Corporation ("the Company") is a Canadian controlled private corporation throughout the year that operates a small but capital-intensive business that is engaged in retailing activities both in Canada and internationally. It has a taxation year ending on December 31 Assume that for the year ending December 31, 2019, the Company has correctly prepared the following Net Income for Tax Purposes statement. Canadian retailing net income Gross foreign retail business net income Gross foreign non-business net income Interest income charged to customers on late payments of accounts receivable Interest income charged to a wholly owned subsidiary -Mr X Ltd (Note 8) In CONS $283.330 83.000 18.000 12,000 6.000 Interest income earned on Canadian Corporate Public Companies Bonds Eligible dividends received from non-connected corporations 38.250 22.670 Non-Eligible Dividends received from its wholly owned subsidiary-Mr. X Ltd (Note: Mr. X Ltd received a dividend tax refund of $6,000 as the result of the dividend) Net taxable capital gains (disposed assets not used in the business) Net Income for Tax Purposes-Division B income 21.600 87.750 $617.000 Additional Information: 1. Using the formula described in ITR402, it has been determined that 13% per cent of the Company's taxable income was earned outside of Canada 2. The Company has a net capital loss balance carried forward from 2018 of $105,000 and a non-capital loss balance from 2018 of $10,200 Management would like to deduct as much of these amounts as possible in its 2019 tax return. 3. The General Rate Income Pool (GRIP) balance on December 31, 2018 was $260,870 and no dividends were designated or paid as eligible dividends for the December 31, 2018 taxation year its I 4. After the transitional provisions were computed, the January 1,2019 balance in the Eligible Refundable Dividend Tax on Hand (RDTOH) account was $52,000, whereas, the Non-Eligible Refundable Dividend Tax on Hand (RDTOH) account was Nil 5. During the fiscal year ending December 31, 2019, the Company declared and paid dividends of $130,000, all of which were designated as being eligible dividends. 6. Foreign financial institutions withheld taxes of Cdn $4,500 on its foreign non-business income, plus the Company paid taxes of Cdn $4,150 to a foreign taxing jurisdiction on its foreign business income. Assume that the Foreign Tax Credit for the foreign non-business income and foreign business income is equal to amounts withheld or paid 8. The Company wholly owns Mr. X Ltd., a CCPC whose income consists solely of earning investment income from a portfolio of Canadian public companies. Mr. X Ltd. has been funded by loans received from the Company. In 2019, Mr. X Ltd. had a net loss from its activities of $12,000. In 2018, Mr. X Ltd. had adjusted aggregate investment income of $8,000 9. The Company had adjusted aggregate investment income of $90,000 in 2018. The Company had Taxable capital employed in Canada of $2,000,000 in 2018 and $5,000,000 in 2019, whereas, Mr. X Ltd. had Taxable capital employed in Canada of $3,000,000 in 2018 and $6,000,000 in 2019,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To calculate the Canadian tax payable for The Really Big Corporation the Company for the year ending December 31 2019 we need to consider vario...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started