Answered step by step

Verified Expert Solution

Question

1 Approved Answer

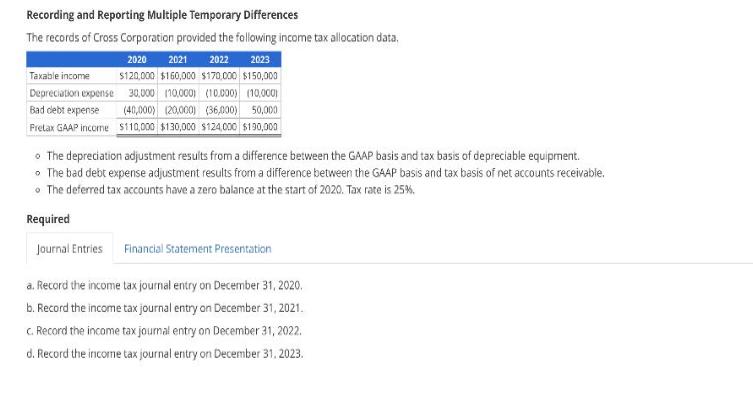

Recording and Reporting Multiple Temporary Differences The records of Cross Corporation provided the following income tax allocation data. Taxable income Depreciation expense 2020 2021

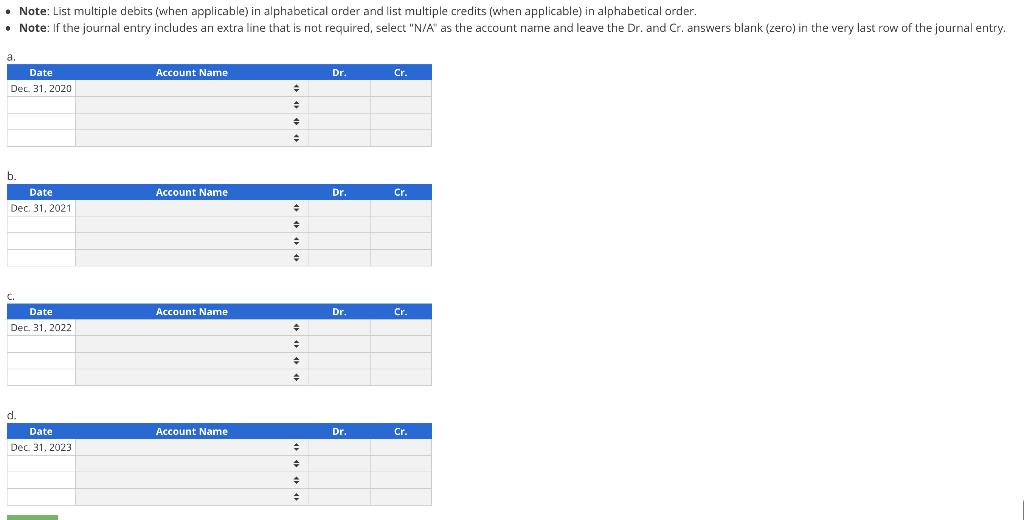

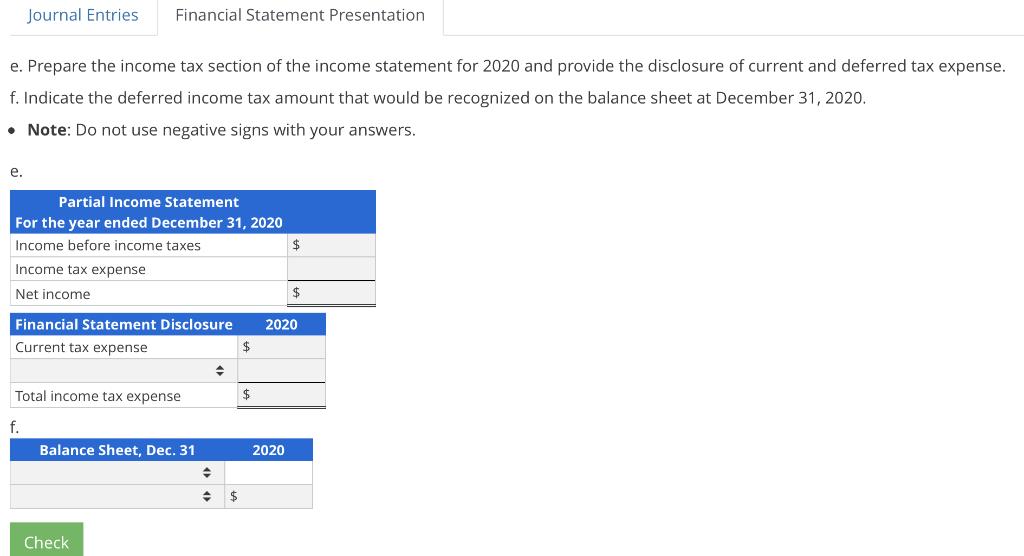

Recording and Reporting Multiple Temporary Differences The records of Cross Corporation provided the following income tax allocation data. Taxable income Depreciation expense 2020 2021 2022 2023 $120,000 $160,000 $170,000 $150,000 30,000 (10,000) (10.000) (10,000) Bad clebt expense (40,000) (20,000) (36,000) 50,000 Pretax GAAP income $110,000 $130,000 $124,000 $190,000 The depreciation adjustment results from a difference between the GAAP basis and tax basis of depreciable equipment. The bad debt expense adjustment results from a difference between the GAAP basis and tax basis of net accounts receivable. The deferred tax accounts have a zero balance at the start of 2020. Tax rate is 25%. Required Journal Entries Financial Statement Presentation a. Record the income tax journal entry on December 31, 2020. b. Record the income tax journal entry on December 31, 2021. c. Record the income tax journal entry on December 31, 2022. d. Record the income tax journal entry on December 31, 2023. Note: List multiple debits (when applicable) in alphabetical order and list multiple credits (when applicable) in alphabetical order. Note: If the journal entry includes an extra line that is not required, select "N/A" as the account name and leave the Dr. and Cr. answers blank (zero) in the very last row of the journal entry. a. Date Dec. 31, 2020 b. Date Dec. 31, 2021 C. Date Dec. 31, 2022 d. Date Dec 31, 2023 Account Name Account Name Account Name Account Name + + = # + = + + # + + # + # Dr. Dr. Dr. Dr. Cr. Cr. Cr. Cr. Journal Entries Financial Statement Presentation e. Prepare the income tax section of the income statement for 2020 and provide the disclosure of current and deferred tax expense. f. Indicate the deferred income tax amount that would be recognized on the balance sheet at December 31, 2020. . Note: Do not use negative signs with your answers. e. Partial Income Statement For the year ended December 31, 2020 Income before income taxes Income tax expense Net income Financial Statement Disclosure Current tax expense Total income tax expense f. Balance Sheet, Dec. 31 Check + $ $ $ 2020 2020

Step by Step Solution

★★★★★

3.45 Rating (174 Votes )

There are 3 Steps involved in it

Step: 1

a Date Dec 31 2020 Date Dec 31 2021 Date Dec 31 2022 d Date Dec 31 2023 Taxable income Depreciation ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started