Answered step by step

Verified Expert Solution

Question

1 Approved Answer

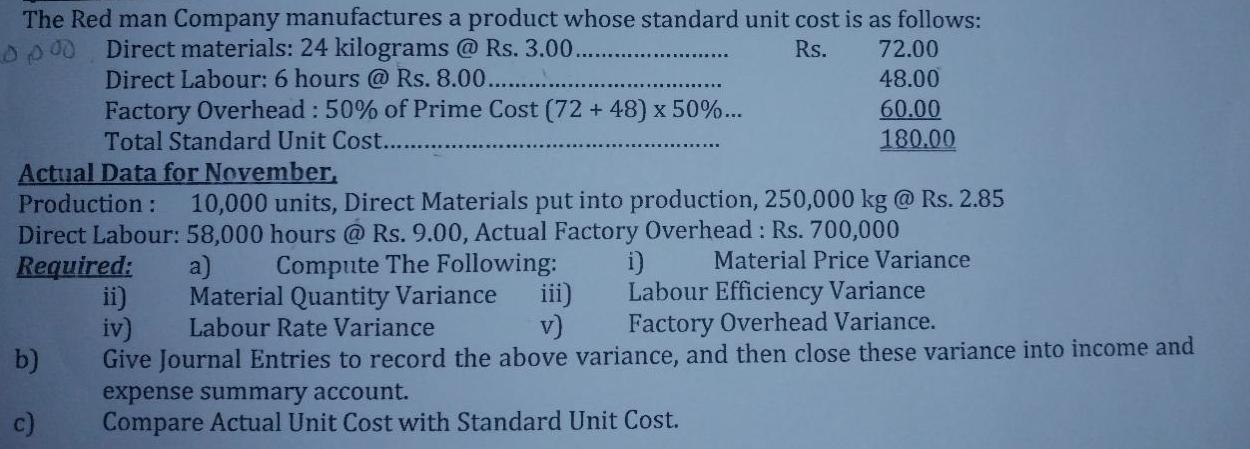

The Red man Company manufactures a product whose standard unit cost is as follows: 000 Direct materials: 24 kilograms @ Rs. 3.00.. Rs. Direct

The Red man Company manufactures a product whose standard unit cost is as follows: 000 Direct materials: 24 kilograms @ Rs. 3.00.. Rs. Direct Labour: 6 hours @ Rs. 8.00...... Factory Overhead: 50% of Prime Cost (72 +48) x 50%... Total Standard Unit Cost........ Actual Data for November, b) 72.00 48.00 60.00 180.00 Production: 10,000 units, Direct Materials put into production, 250,000 kg @ Rs. 2.85 Direct Labour: 58,000 hours @ Rs. 9.00, Actual Factory Overhead: Rs. 700,000 Required: a) Compute The Following: i) Material Price Variance ii) Material Quantity Variance iii) Labour Efficiency Variance iv) Labour Rate Variance v) Factory Overhead Variance. Give Journal Entries to record the above variance, and then close these variance into income and expense summary account. Compare Actual Unit Cost with Standard Unit Cost.

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

aCompute the Following 1 Material Price variance Actual quantity purchased 250000 kg Actual price Rs 285 per kg Standard quantity allowed 10000 units ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started