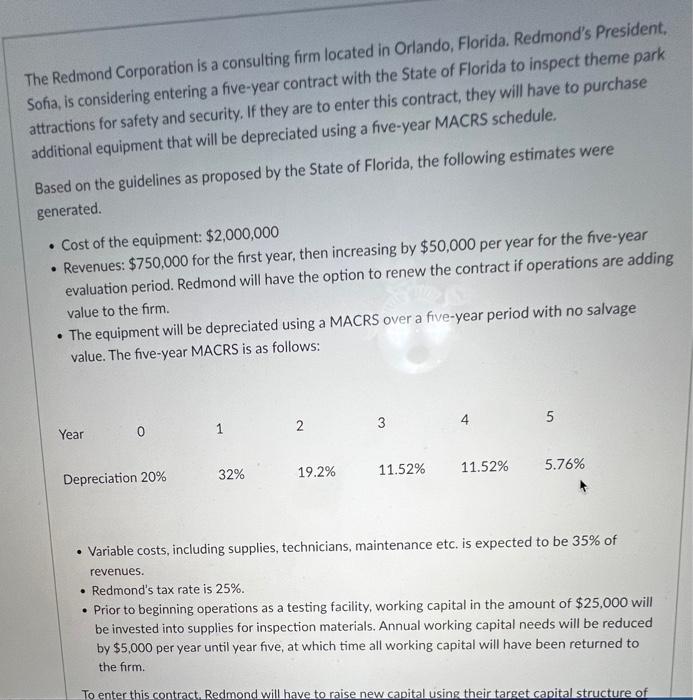

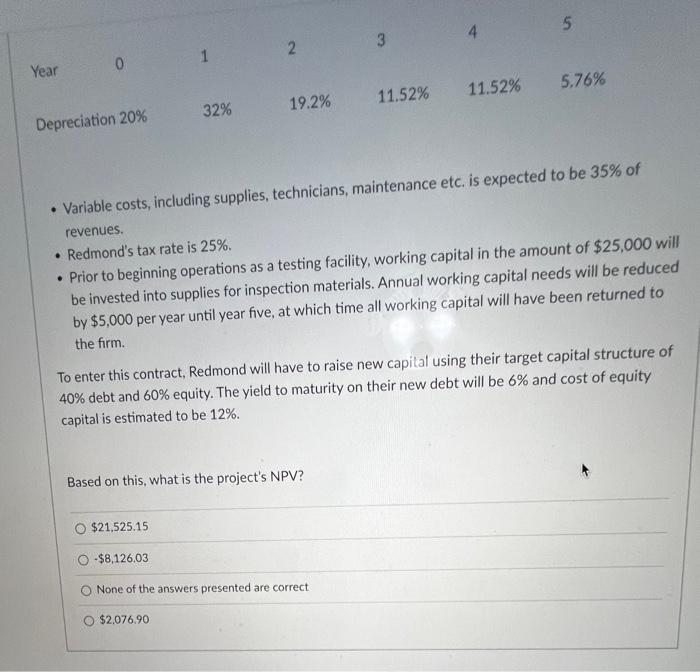

The Redmond Corporation is a consulting firm located in Orlando, Florida. Redmond's President, Soha, is considering entering a five-year contract with the State of Florida to inspect theme park attractions for safety and security. If they are to enter this contract, they will have to purchase additional equipment that will be depreciated using a five-year MACRS schedule, Based on the guidelines as proposed by the State of Florida, the following estimates were generated. Cost of the equipment: $2,000,000 Revenues: $750,000 for the first year, then increasing by $50,000 per year for the five-year evaluation period. Redmond will have the option to renew the contract if operations are adding value to the firm. The equipment will be depreciated using a MACRS over a five-year period with no salvage value. The five-year MACRS is as follows: 4 5 Year 0 2 1 32% 19.2% 11.52% 11.52% 5.76% Depreciation 20% Variable costs, including supplies, technicians, maintenance etc. is expected to be 35% of revenues. Redmond's tax rate is 25%. . Prior to beginning operations as a testing facility, working capital in the amount of $25,000 will be invested into supplies for inspection materials. Annual working capital needs will be reduced by $5,000 per year until year five, at which time all working capital will have been returned to the form To enter this contract, Redmond will have to raise new capital using their target capital structure of 5 3 2 0 1 Year 11.52% 5.76% 11.52% 32% 19.2% Depreciation 20% Variable costs, including supplies, technicians, maintenance etc. is expected to be 35% of revenues. Redmond's tax rate is 25%. . Prior to beginning operations as a testing facility, working capital in the amount of $25,000 will be invested into supplies for inspection materials. Annual working capital needs will be reduced by $5,000 per year until year five, at which time all working capital will have been returned to the firm. To enter this contract, Redmond will have to raise new capital using their target capital structure of 40% debt and 60% equity. The yield to maturity on their new debt will be 6% and cost of equity capital is estimated to be 12%. Based on this, what is the project's NPV? $21,525.15 -$8,126.03 O None of the answers presented are correct $2.076.90