Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The remaining options have a more compressed range of EUAC values, even though their first costs and annual savings are different. Take the remaining

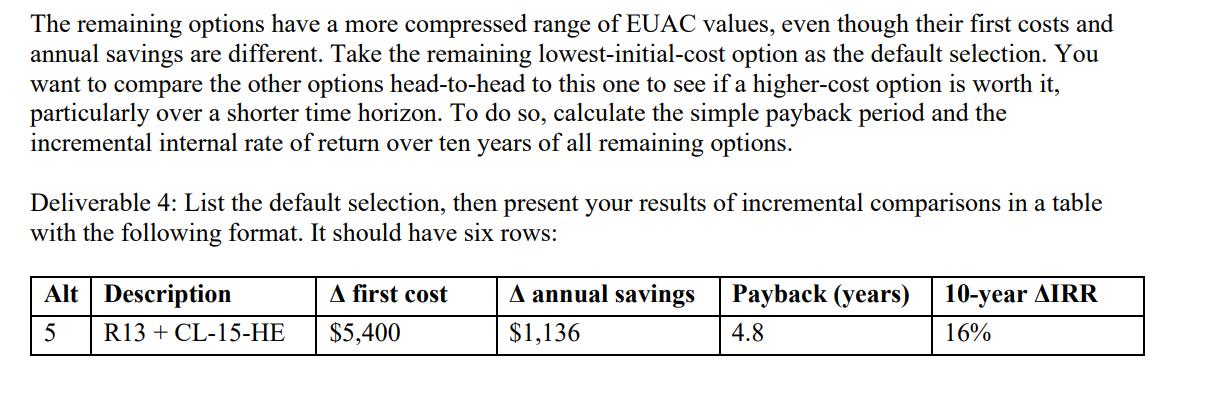

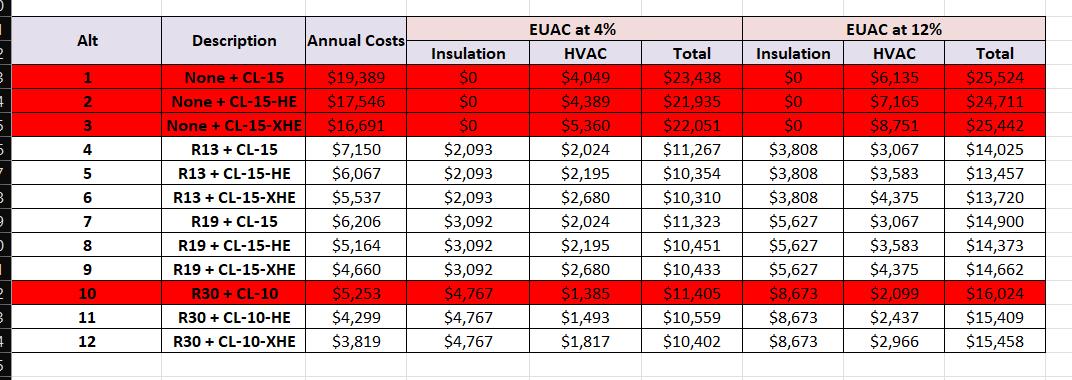

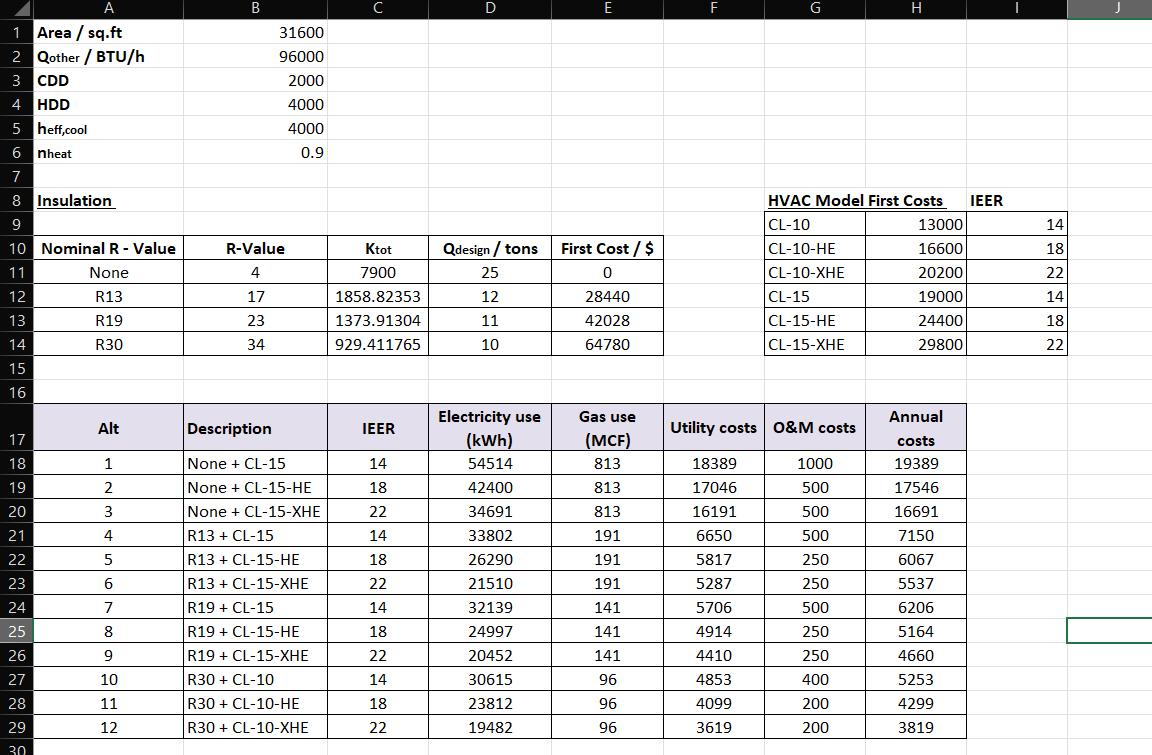

The remaining options have a more compressed range of EUAC values, even though their first costs and annual savings are different. Take the remaining lowest-initial-cost option as the default selection. You want to compare the other options head-to-head to this one to see if a higher-cost option is worth it, particularly over a shorter time horizon. To do so, calculate the simple payback period and the incremental internal rate of return over ten years of all remaining options. Deliverable 4: List the default selection, then present your results of incremental comparisons in a table with the following format. It should have six rows: Alt Description 5 R13 + CL-15-HE A first cost $5,400 A annual savings $1,136 Payback (years) 4.8 10-year AIRR 16% 1 5 Alt 1 NEASC09 4 10 11 12 Description None + CL-15 None + CL-15-HE None + CL-15-XHE R13 + CL-15 R13 + CL-15-HE R13 + CL-15-XHE R19 + CL-15 R19 + CL-15-HE R19 + CL-15-XHE R30+ CL-10 R30 + CL-10-HE R30+ CL-10-XHE Annual Costs $19,389 $17,546 $16,691 $7,150 $6,067 $5,537 $6,206 $5,164 $4,660 $5,253 $4,299 $3,819 Insulation $0 $0 $0 $2,093 $2,093 $2,093 $3,092 $3,092 $3,092 $4,767 $4,767 $4,767 EUAC at 4% HVAC $4,049 $4,389 $5,360 $2,024 $2,195 $2,680 $2,024 $2,195 $2,680 $1,385 $1,493 $1,817 Total $23,438 $21,935 $22,051 $11,267 $10,354 $10,310 $11,323 $10,451 $10,433 $11,405 $10,559 $10,402 Insulation $0 $0 $0 $3,808 $3,808 $3,808 $5,627 $5,627 $5,627 $8,673 $8,673 $8,673 EUAC at 12% HVAC $6,135 $7,165 $8,751 $3,067 $3,583 $4,375 $3,067 $3,583 $4,375 $2,099 $2,437 $2,966 Total $25,524 $24,711 $25,442 $14,025 $13,457 $13,720 $14,900 $14,373 $14,662 $16,024 $15,409 $15,458 A 1 Area / sq.ft 2 Qother / BTU/h 3 CDD 4 HDD 5 heff,cool 6 nheat 7 8 Insulation 9 10 Nominal R - Value 11 None 12 R13 13 R19 14 R30 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 Alt 1 2 3 4 5 6 7 8 9 10 11 12 B 31600 96000 2000 4000 4000 0.9 R-Value 4 17 23 34 Description None + CL-15 None + CL-15-HE None + CL-15-XHE R13 + CL-15 R13 + CL-15-HE R13 + CL-15-XHE R19 + CL-15 R19 + CL-15-HE R19 + CL-15-XHE R30+ CL-10 R30+ CL-10-HE R30 + CL-10-XHE Ktot 7900 1858.82353 1373.91304 929.411765 IEER 14 18 22 14 18 22 14 18 22 14 18 22 D Qdesign/tons 25 12 11 10 Electricity use (kWh) 54514 42400 34691 33802 26290 21510 32139 24997 20452 30615 23812 19482 E First Cost / $ 0 28440 42028 64780 Gas use (MCF) 813 813 813 191 191 191 141 141 141 96 96 96 F 18389 17046 16191 G 6650 5817 5287 5706 4914 4410 4853 4099 3619 Utility costs O&M costs HVAC Model First Costs CL-10 CL-10-HE CL-10-XHE CL-15 CL-15-HE CL-15-XHE H 1000 500 500 500 250 250 500 250 250 400 200 200 13000 16600 20200 19000 24400 29800 Annual costs 19389 17546 16691 7150 6067 5537 6206 5164 4660 5253 4299 3819 IEER 14 18 22 14 18 22 J

Step by Step Solution

★★★★★

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started