Answered step by step

Verified Expert Solution

Question

1 Approved Answer

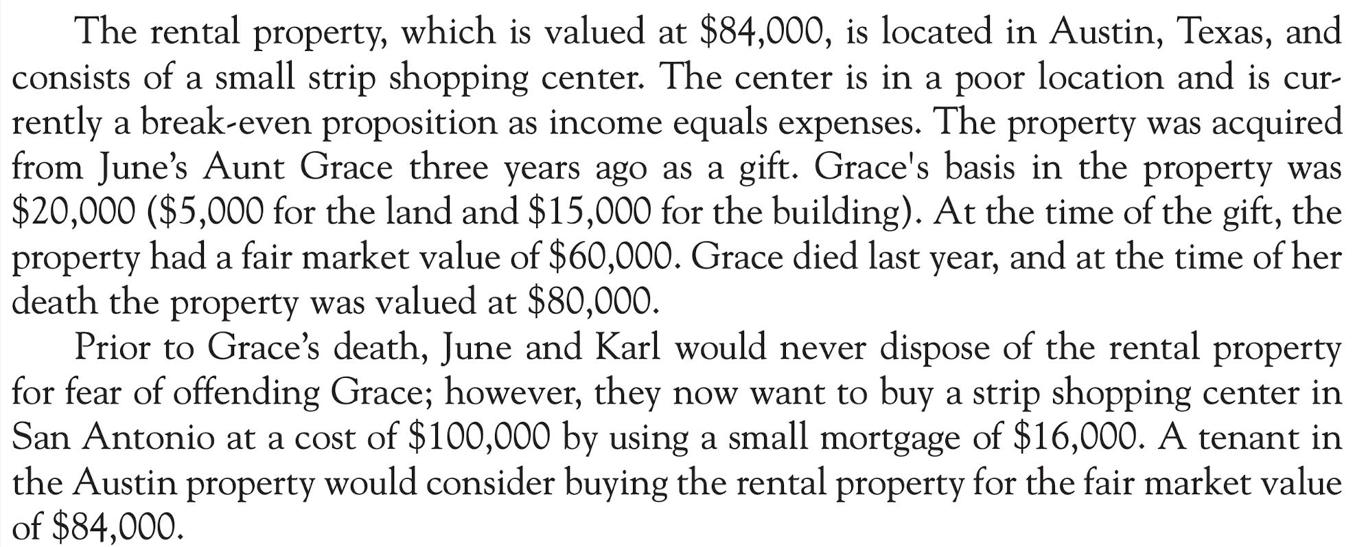

The rental property, which is valued at $84,000, is located in Austin, Texas, and consists of a small strip shopping center. The center is

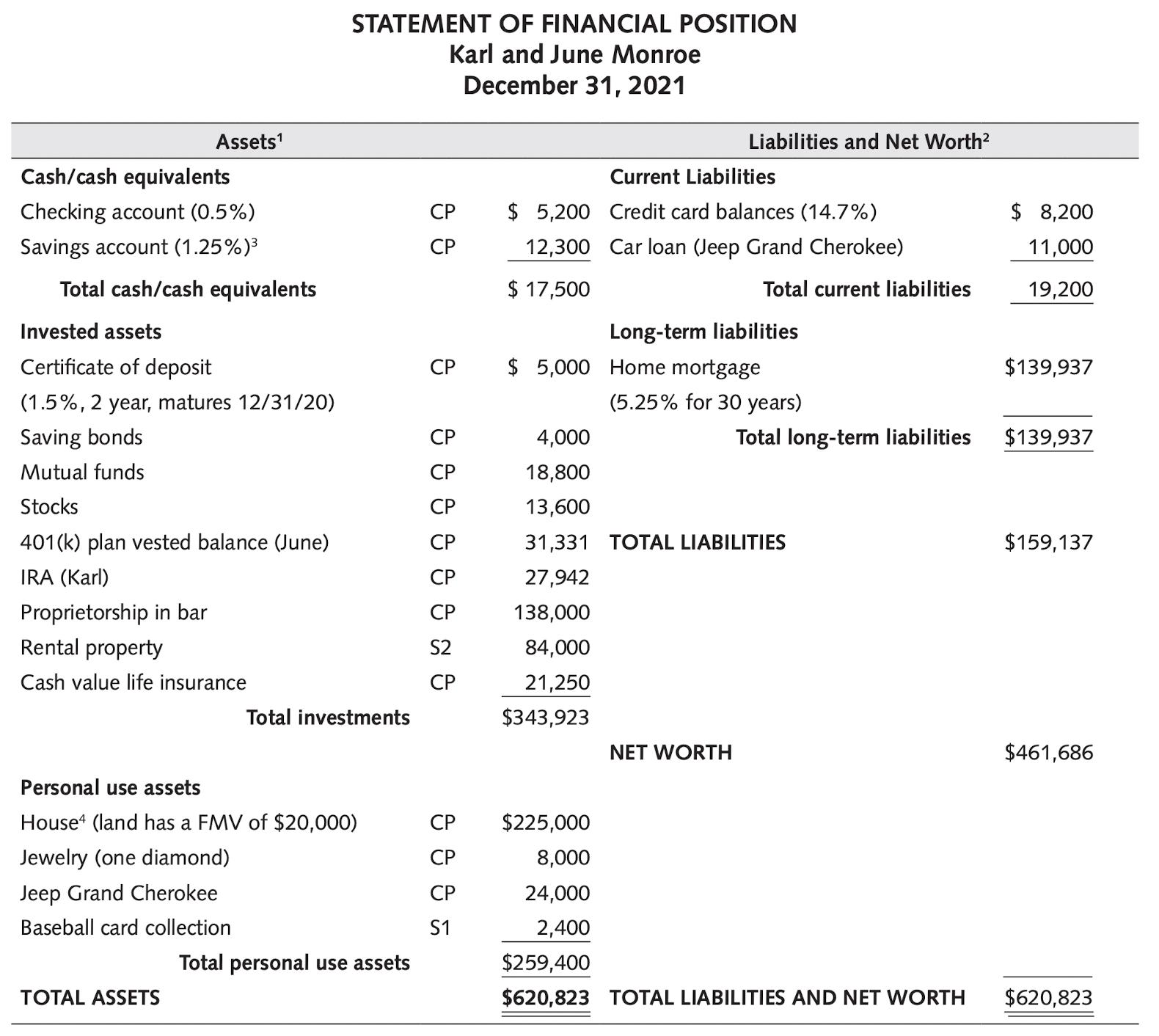

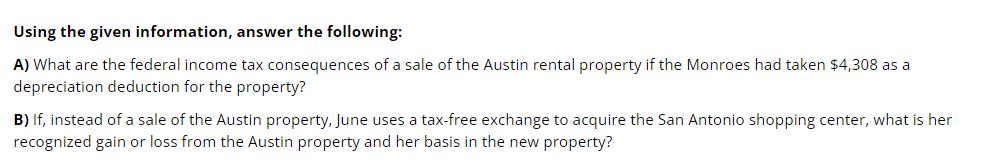

The rental property, which is valued at $84,000, is located in Austin, Texas, and consists of a small strip shopping center. The center is in a poor location and is cur- rently a break-even proposition as income equals expenses. The property was acquired from June's Aunt Grace three years ago as a gift. Grace's basis in the property was $20,000 ($5,000 for the land and $15,000 for the building). At the time of the gift, the property had a fair market value of $60,000. Grace died last year, and at the time of her death the property was valued at $80,000. Prior to Grace's death, June and Karl would never dispose of the rental property for fear of offending Grace; however, they now want to buy a strip shopping center in San Antonio at a cost of $100,000 by using a small mortgage of $16,000. A tenant in the Austin property would consider buying the rental property for the fair market value of $84,000. Assets Cash/cash equivalents Checking account (0.5%) Savings account (1.25%) Total cash/cash equivalents Invested assets Certificate of deposit (1.5%, 2 year, matures 12/31/20) Saving bonds Mutual funds Stocks 401(k) plan vested balance (June) IRA (Karl) Proprietorship in bar Rental property Cash value life insurance TOTAL ASSETS STATEMENT OF FINANCIAL POSITION Karl and June Monroe December 31, 2021 Total investments Personal use assets House4 (land has a FMV of $20,000) Jewelry (one diamond) Jeep Grand Cherokee Baseball card collection Total personal use assets CP CP CP CP CP CP CP S2 CP CP CP CP S1 $5,200 12,300 $ 17,500 Liabilities and Net Worth Current Liabilities Credit card balances (14.7%) Car loan (Jeep Grand Cherokee) $225,000 8,000 24,000 2,400 $5,000 Home mortgage Long-term liabilities Total current liabilities (5.25% for 30 years) 4,000 18,800 13,600 31,331 TOTAL LIABILITIES 27,942 138,000 84,000 21,250 $343,923 NET WORTH Total long-term liabilities $ 8,200 11,000 19,200 $139,937 $139,937 $159,137 $461,686 $259,400 $620,823 TOTAL LIABILITIES AND NET WORTH $620,823 Using the given information, answer the following: A) What are the federal income tax consequences of a sale of the Austin rental property if the Monroes had taken $4,308 as a depreciation deduction for the property? B) If, instead of a sale of the Austin property, June uses a tax-free exchange to acquire the San Antonio shopping center, what is her recognized gain or loss from the Austin property and her basis in the new property?

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

A To determine the federal income tax consequences of a sale of the Austin rental property we need to calculate the taxable gain or loss The taxable g...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started