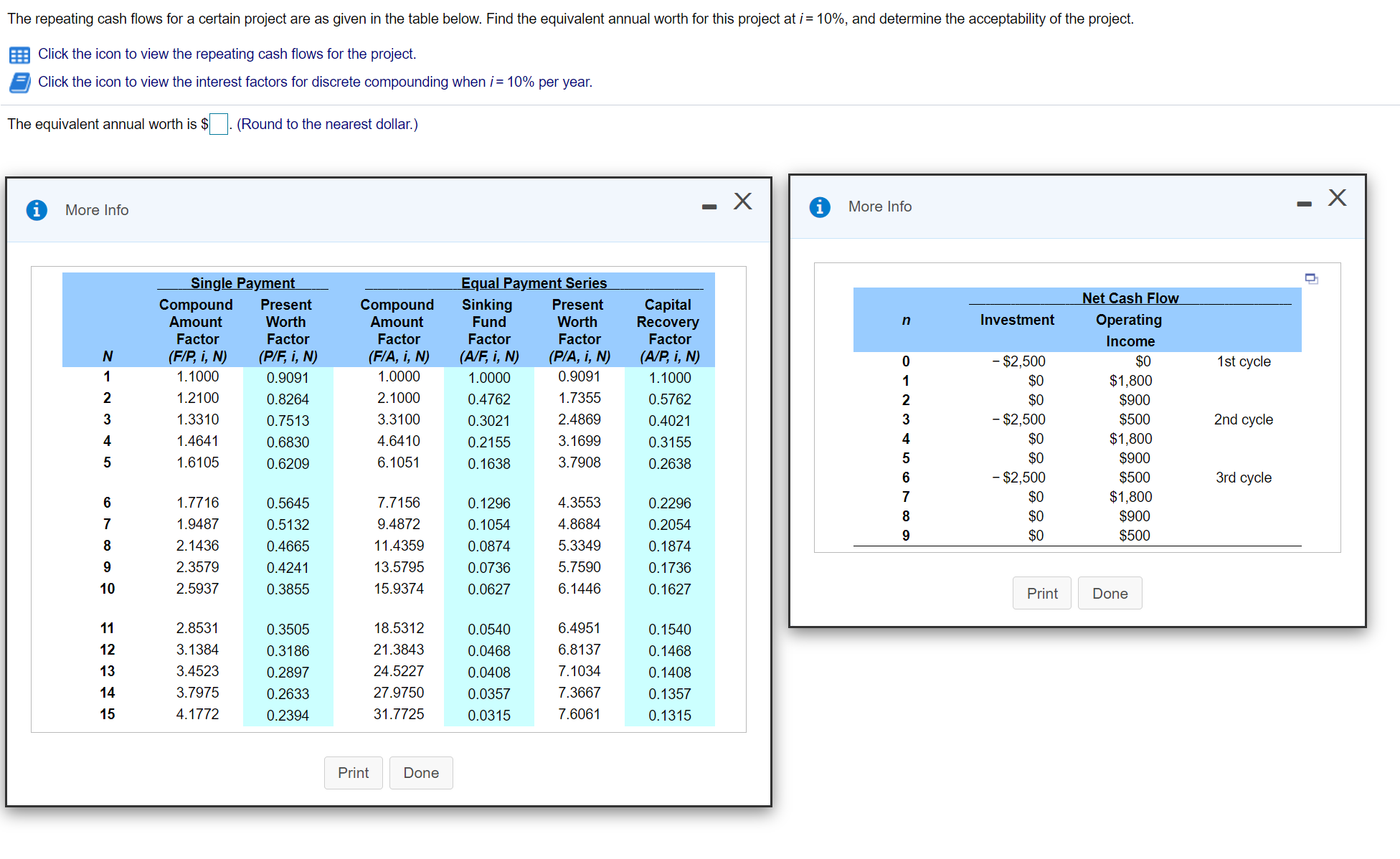

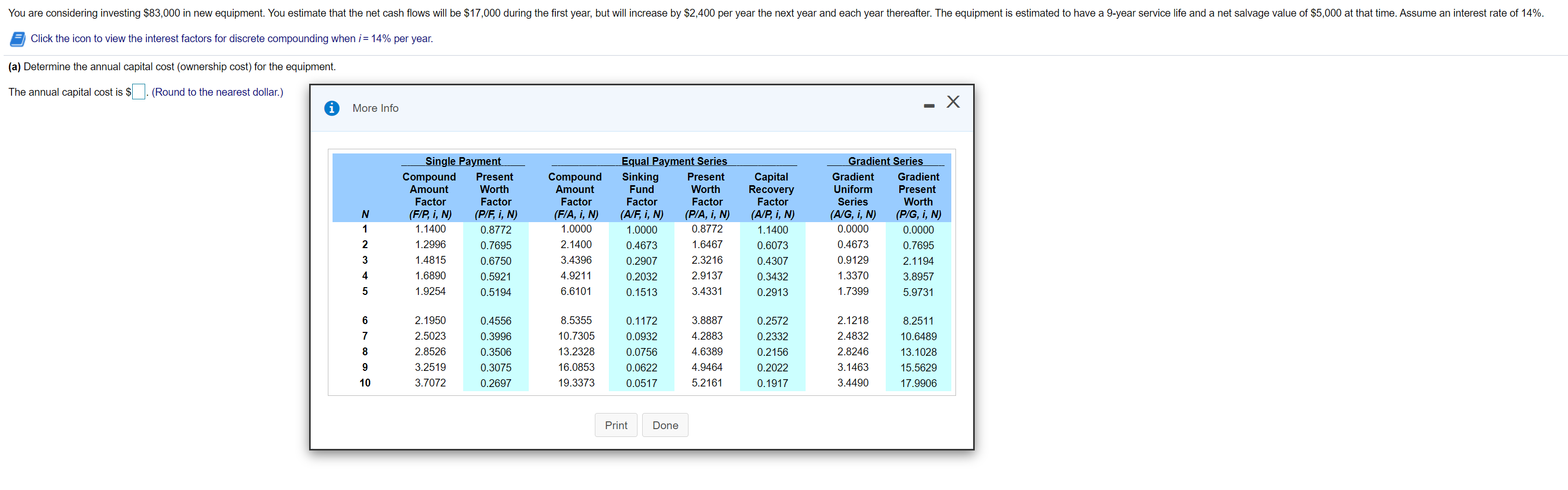

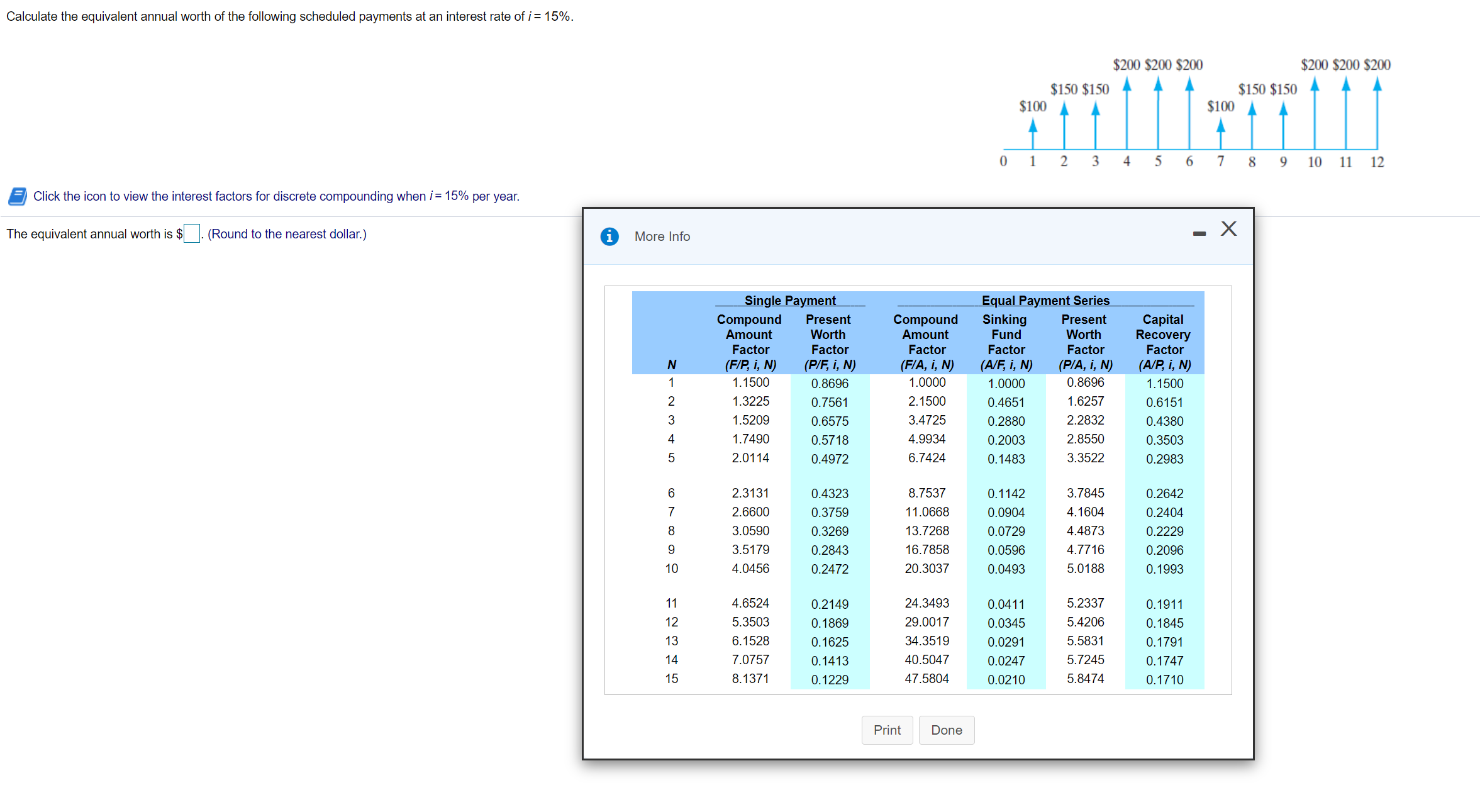

The repeating cash ows for a certain project are as given in the table below. Find the equivalent annual worth for this project at i= 10%, and determine the acceptability of the project. a Click the icon to View the repeating cash ows for the project. a Click the icon to view the interest factors for discrete compounding when i= 10% per year. The equivalent annual worth is $ . (Round to the nearest dollar.) o More Info $2,500 $0 1st cycle $0 $1 ,800 $0 $900 - $2,500 $500 2nd cycle $0 $1 ,800 $0 $900 $2,500 $500 3rd cycle $0 $1 ,800 $0 $900 $0 $500 1.0000 2.1000 3.3100 4.6410 6.1051 7.7156 9.4872 11.4359 13.5795 15-9374 ' Print H Done ' Bu'JaU't#UM\\= 18.5312 21.3843 24.5227 27.9750 31.7725 ' Print H Done ' You are considering investing $83,000 in new equipment. You estimate that the net cash flows will be $17,000 during the first year, but will increase by $2,400 per year the next year and each year thereafter. The equipment is estimated to have a 9-year service life and a net salvage value of $5,000 at that time. Assume an interest rate of 14%. Click the icon to view the interest factors for discrete compounding when i = 14% per year. (a) Determine the annual capital cost (ownership cost) for the equipment. The annual capital cost is $ . (Round to the nearest dollar.) X i More Info Single Payment Equal Payment Series Gradient Series Compound Present Compound Sinking Present Capital Gradient Gradient Uniform Present Amount Worth Amoun Fund Worth Recovery Factor Factor Worth Factor Factor Factor Factor Series (P/G, i, N) (F/P, i, N) (P/F, i, N) F/A, i, N) (A/F, i, N) P/A, I, N) (A/P, i, N) (A/G, i, N) 0.000 0.0000 1.140 0.8772 1.000 1.0000 0.8772 1.1400 2.1400 0.4673 1.6467 0.6073 0.4673 0.7695 1.2996 0.7695 U A W N - Z 1.4815 0.6750 3.4396 0.2907 2.3216 0.4307 0.9129 2. 1194 1.6890 0.5921 4.9211 0.2032 2.9137 0.3432 1.3370 3.8957 6.6101 0.1513 1.7399 5.9731 1.9254 0.5194 3.4331 0.2913 2. 1950 0.4556 8.5355 0.1172 3.8887 0.2572 2.1218 8.2511 .3996 10.7305 0.0932 4.2883 0.2332 2.4832 10.6489 2.5023 2.8526 .3506 13.2328 0.0756 4.6389 0.2156 2.8246 13.1028 .3075 0.0622 4.9464 0.2022 3.1463 3.2519 16.0853 15.5629 3.7072 0.2697 19.3373 0.0517 5.2161 0.1917 3.4490 17.9906 Print DoneCalculate the equivalent annual worth of the following scheduled payments at an interest rate of i = 15%. 32m 3200 $200 $200 3200 3200 $150 $150 I 3150 $150 4 5 6 SIMTT SIMTT 0123 789101112 5 Click the icon to view the interest factors for discrete compounding when i = 15% per year. The equivalent annual worth is $ , (Round to the nearest dollar.) 0 More Info 1 .0000 2.1500 3.4725 4.9934 6.7424 8.7537 1 1 .0668 13.7268 16.7858 20.3037 24.3493 29.001 7 34.351 9 40.5047 47.5604 ' Print ' Done