Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The requirement of Aduana should have a net book value of P120,000. Required: a. Compute the capital account balance of Aduana and Pantaden prior

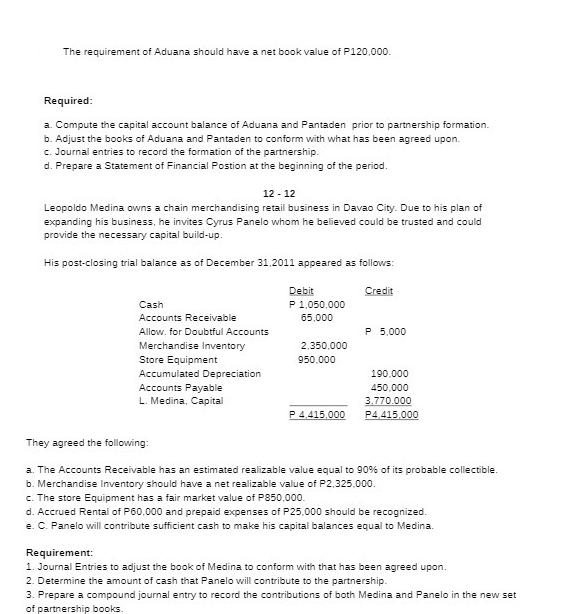

The requirement of Aduana should have a net book value of P120,000. Required: a. Compute the capital account balance of Aduana and Pantaden prior to partnership formation. b. Adjust the books of Aduana and Pantaden to conform with what has been agreed upon. c. Journal entries to record the formation of the partnership. d. Prepare a Statement of Financial Postion at the beginning of the period. 12-12 Leopoldo Medina owns a chain merchandising retail business in Davao City. Due to his plan of expanding his business, he invites Cyrus Panelo whom he believed could be trusted and could provide the necessary capital build-up. His post-closing trial balance as of December 31,2011 appeared as follows: Credit Cash Accounts Receivable Allow. for Doubtful Accounts Merchandise Inventory Store Equipment Accumulated Depreciation Accounts Payable L. Medina, Capital Debit P 1,050,000 65,000 2,350,000 950.000 P 4.415.000 P 5,000 190.000 450,000 3.770.000 P4.415.000 They agreed the following: a. The Accounts Receivable has an estimated realizable value equal to 90% of its probable collectible. b. Merchandise Inventory should have a net realizable value of P2,325,000. c. The store Equipment has a fair market value of P850,000. d. Accrued Rental of P60,000 and prepaid expenses of P25,000 should be recognized. e. C. Panelo will contribute sufficient cash to make his capital balances equal to Medina. Requirement: 1. Journal Entries to adjust the book of Medina to conform with that has been agreed upon. 2. Determine the amount of cash that Panelo will contribute to the partnership. 3. Prepare a compound journal entry to record the contributions of both Medina and Panelo in the new set of partnership books. The requirement of Aduana should have a net book value of P120,000. Required: a. Compute the capital account balance of Aduana and Pantaden prior to partnership formation. b. Adjust the books of Aduana and Pantaden to conform with what has been agreed upon. c. Journal entries to record the formation of the partnership. d. Prepare a Statement of Financial Postion at the beginning of the period. 12-12 Leopoldo Medina owns a chain merchandising retail business in Davao City. Due to his plan of expanding his business, he invites Cyrus Panelo whom he believed could be trusted and could provide the necessary capital build-up. His post-closing trial balance as of December 31,2011 appeared as follows: Credit Cash Accounts Receivable Allow. for Doubtful Accounts Merchandise Inventory Store Equipment Accumulated Depreciation Accounts Payable L. Medina, Capital Debit P 1,050,000 65,000 2,350,000 950.000 P 4.415.000 P 5,000 190.000 450,000 3.770.000 P4.415.000 They agreed the following: a. The Accounts Receivable has an estimated realizable value equal to 90% of its probable collectible. b. Merchandise Inventory should have a net realizable value of P2,325,000. c. The store Equipment has a fair market value of P850,000. d. Accrued Rental of P60,000 and prepaid expenses of P25,000 should be recognized. e. C. Panelo will contribute sufficient cash to make his capital balances equal to Medina. Requirement: 1. Journal Entries to adjust the book of Medina to conform with that has been agreed upon. 2. Determine the amount of cash that Panelo will contribute to the partnership. 3. Prepare a compound journal entry to record the contributions of both Medina and Panelo in the new set of partnership books.

Step by Step Solution

★★★★★

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1 Journal Entries to adjust the book of Medina to conform with what has been agreed upon a Adjusting ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started