Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using this example below for reference 1. Please complete this accrual sheet below: 2. Please complete the income statement based on the answers on the

Using this example below for reference

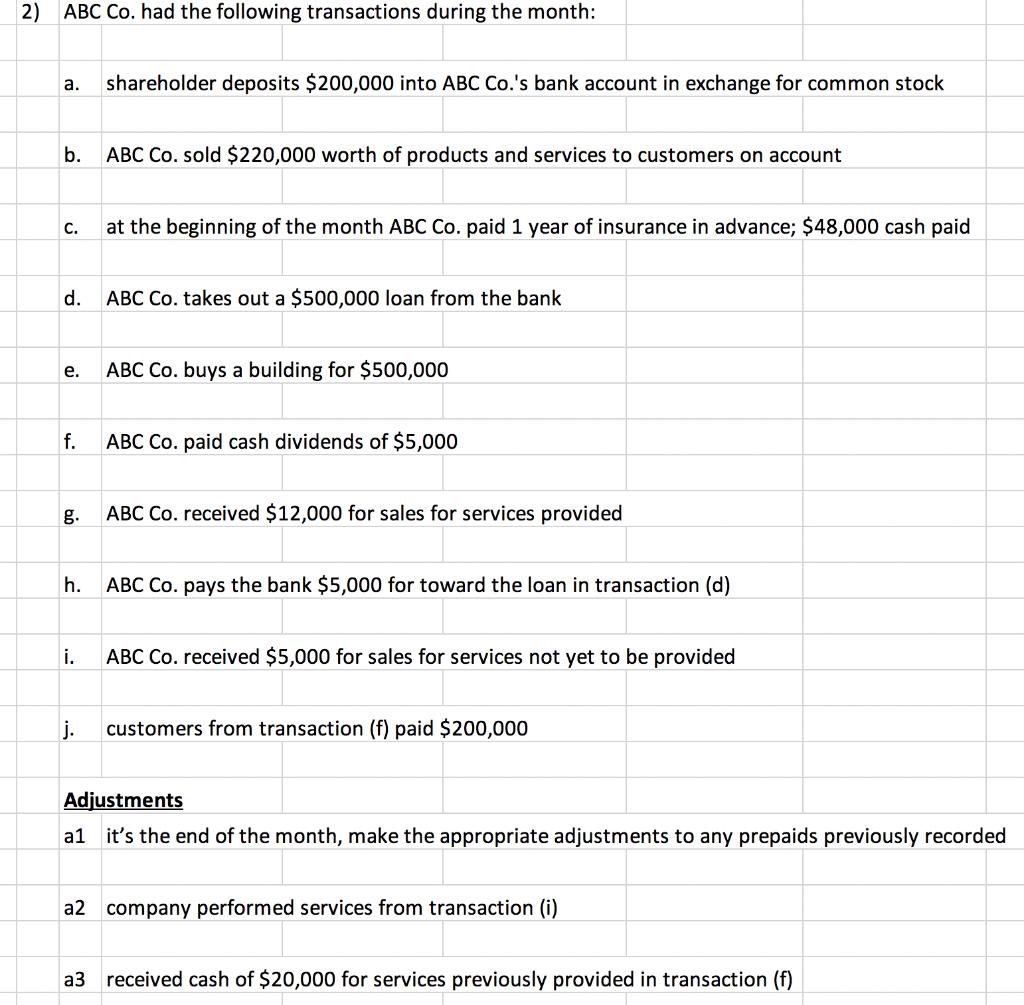

1. Please complete this accrual sheet below:

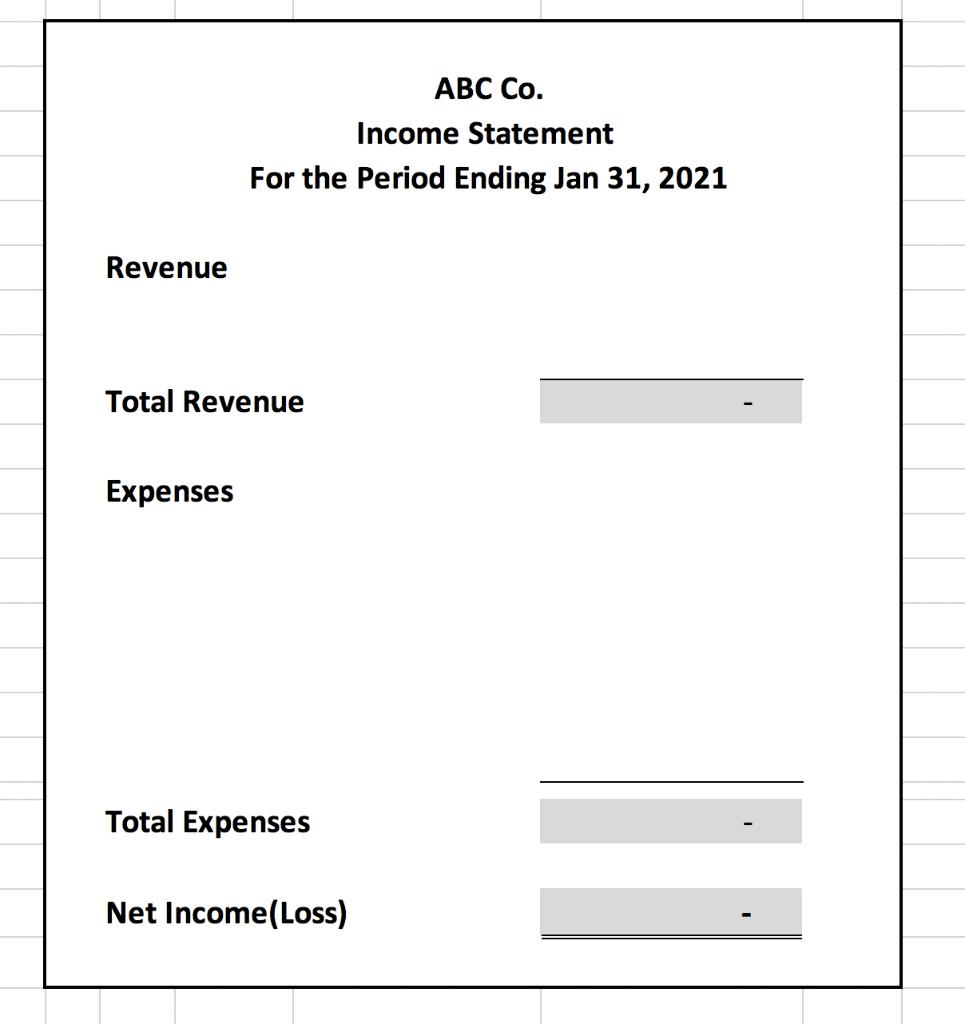

2. Please complete the income statement based on the answers on the accrual sheet:

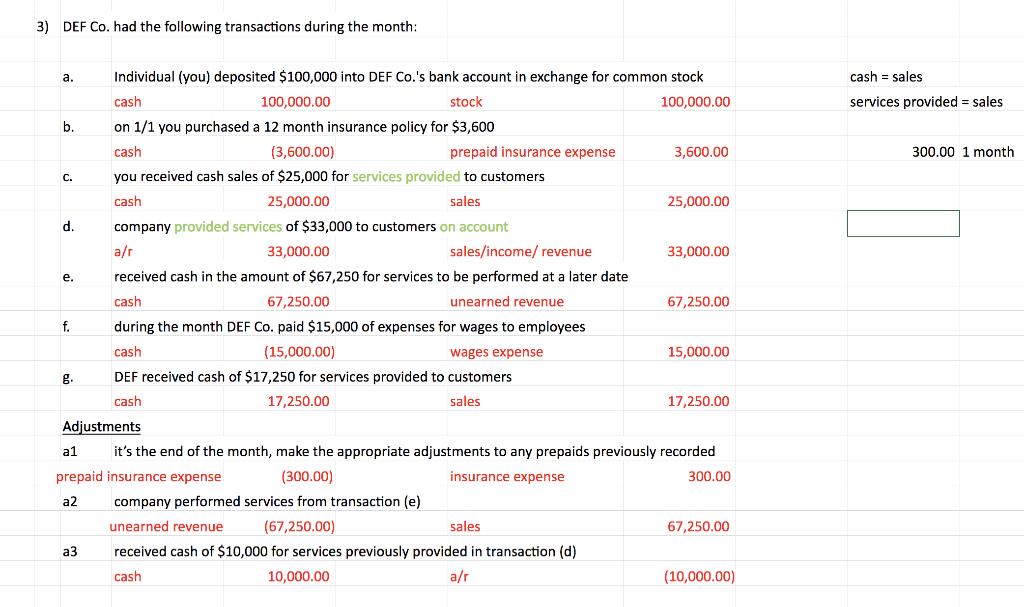

3) DEF Co. had the following transactions during the month: a. b. C. d. e. f. g. Individual (you) deposited $100,000 into DEF Co.'s bank account in exchange for common stock cash 100,000.00 stock 100,000.00 on 1/1 you purchased a 12 month insurance policy for $3,600 cash (3,600.00) you received cash sales of $25,000 for services provided to customers cash 25,000.00 sales company provided services of $33,000 to customers on account a/r 33,000.00 sales/income/ revenue received cash in the amount of $67,250 for services to be performed at a later date cash 67,250.00 unearned revenue during the month DEF Co. paid $15,000 of expenses for wages to employees cash (15,000.00) wages expense DEF received cash of $17,250 for services provided to customers cash 17,250.00 sales a3 prepaid insurance expense 3,600.00 25,000.00 33,000.00 67,250.00 15,000.00 17,250.00 Adjustments a1 it's the end of the month, make the appropriate adjustments to any prepaids previously recorded prepaid insurance expense (300.00) insurance expense a2 company performed services from transaction (e) unearned revenue (67,250.00) sales received cash of $10,000 for services previously provided in transaction (d) cash 10,000.00 a/r 300.00 67,250.00 (10,000.00) cash = sales services provided = sales 300.00 1 month

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 Posting of journal entries and adjusting entries ITEM a b c d e f g h i j ITEM al a2 a3 ACCOUNTS T...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started