Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Rice Solar Corp. has a new investment opportunity that generates cash flows of S50 million per year (in expectation) forever. The managers of

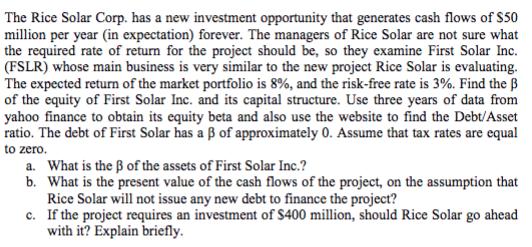

The Rice Solar Corp. has a new investment opportunity that generates cash flows of S50 million per year (in expectation) forever. The managers of Rice Solar are not sure what the required rate of return for the project should be, so they examine First Solar Inc. (FSLR) whose main business is very similar to the new project Rice Solar is evaluating. The expected return of the market portfolio is 8 % , and the risk-free rate is 3%. Find the B of the equity of First Solar Inc. and its capital structure. Use three years of data from yahoo finance to obtain its equity beta and also use the website to find the Debt/Asset ratio. The debt of First Solar has a B of approximately 0. Assume that tax rates are equal to zero a. What is the B of the assets of First Solar Inc.? b. What is the present value of the cash flows of the project, on the assumption that Rice Solar will not issue any new debt to finance the project? c. If the project requires an investment of $400 million, should Rice Solar go ahead with it? Explain bries

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a of the assets of First Solar Inc 127 source yahoo finance b To calculate present value we need to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started