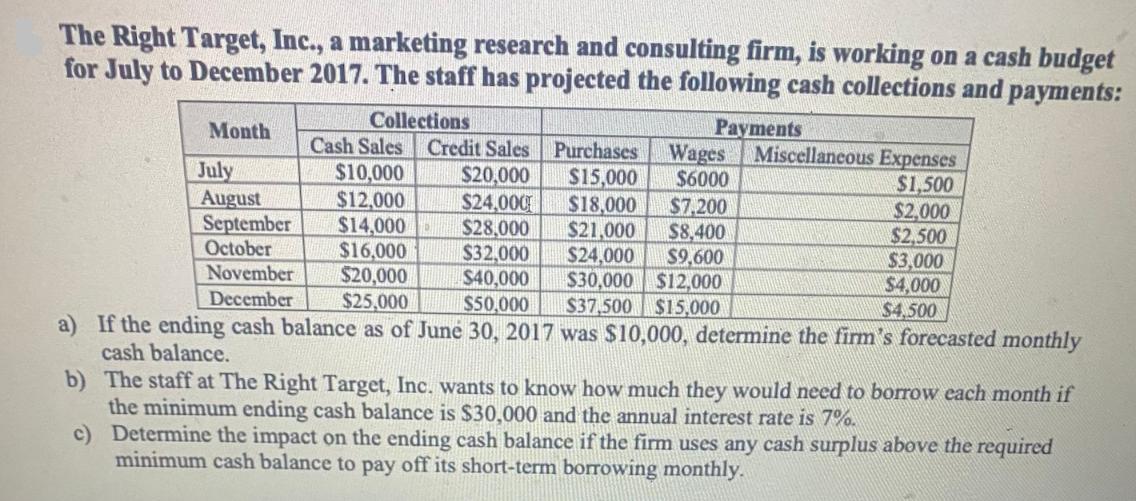

The Right Target, Inc., a marketing research and consulting firm, is working on a cash budget for July to December 2017. The staff has

The Right Target, Inc., a marketing research and consulting firm, is working on a cash budget for July to December 2017. The staff has projected the following cash collections and payments: Collections Payments Month Cash Sales $10,000 $12,000 $14,000 $16,000 $20,000 Credit Sales Purchases Wages Miscellaneous Expenses $6000 $1,500 $2,000 $2,500 $3,000 $4,000 $4,500 July $20,000 $24,000 $28,000 August September October November $32,000 $40,000 December $25,000 $50,000 a) If the ending cash balance as of June 30, 2017 was $10,000, determine the firm's forecasted monthly cash balance. $15,000 $18,000 $7.200 $21,000 $8,400 $24,000 $9,600 $30,000 $12,000 $37,500 $15,000 b) The staff at The Right Target, Inc. wants to know how much they would need to borrow each month if the minimum ending cash balance is $30,000 and the annual interest rate is 7%. c) Determine the impact on the ending cash balance if the firm uses any cash surplus above the required minimum cash balance to pay off its short-term borrowing monthly.

Step by Step Solution

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a To determine the firms forecasted monthly cash balance well start with the ending cash balance as of June 30 2017 which is 10000 and then add or sub... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards