Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Righter Shoe Store Company prepares monthly financial statements for its bank. The November 30 and December 31, 2024, trial balances contained the following

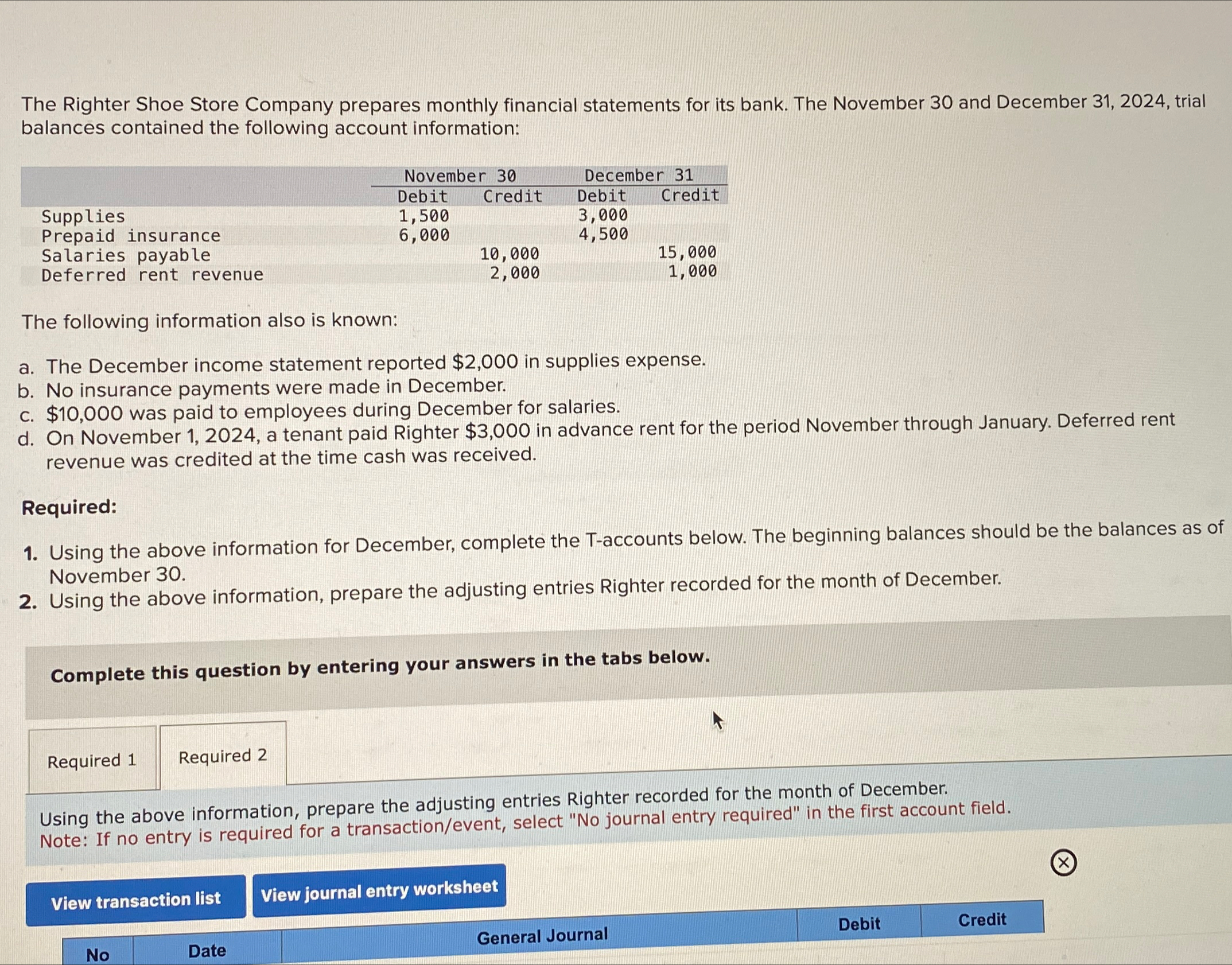

The Righter Shoe Store Company prepares monthly financial statements for its bank. The November 30 and December 31, 2024, trial balances contained the following account information: Supplies Prepaid insurance Salaries payable Deferred rent revenue November 30 Debit Credit 1,500 6,000 December 31 Debit Credit 3,000 4,500 10,000 2,000 15,000 1,000 The following information also is known: a. The December income statement reported $2,000 in supplies expense. b. No insurance payments were made in December. c. $10,000 was paid to employees during December for salaries. d. On November 1, 2024, a tenant paid Righter $3,000 in advance rent for the period November through January. Deferred rent revenue was credited at the time cash was received. Required: 1. Using the above information for December, complete the T-accounts below. The beginning balances should be the balances as of November 30. 2. Using the above information, prepare the adjusting entries Righter recorded for the month of December. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Using the above information, prepare the adjusting entries Righter recorded for the month of December. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list View journal entry worksheet No Date General Journal Debit Credit

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Required 1 Supplies Nov 30 Balance 1500 Dec Expense 2000 Dec 31 Balance 3500 Prepaid Insurance ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started