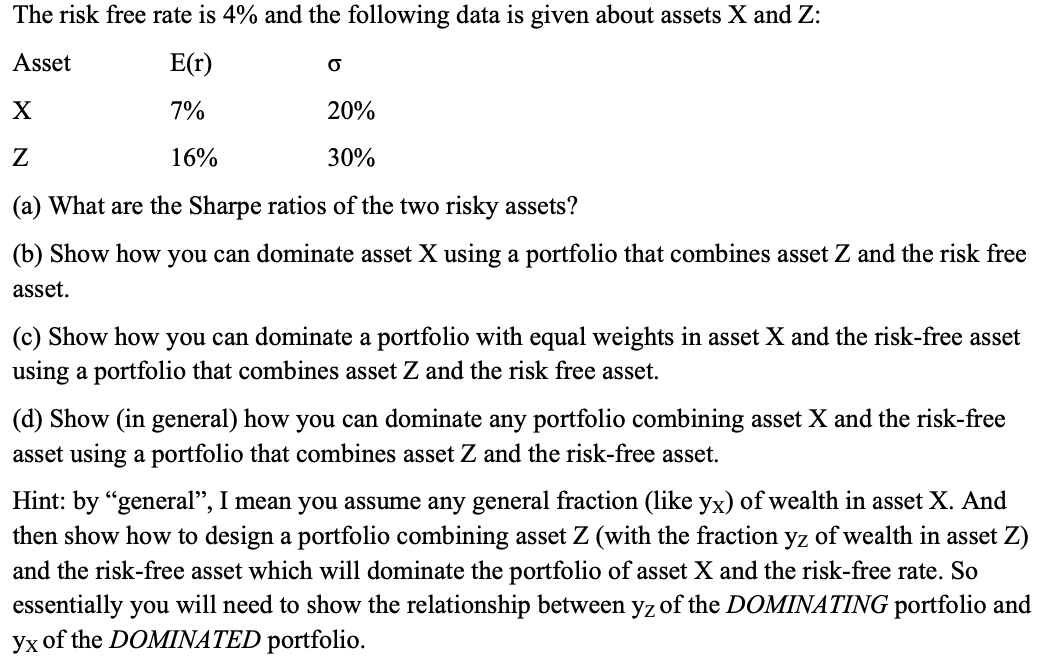

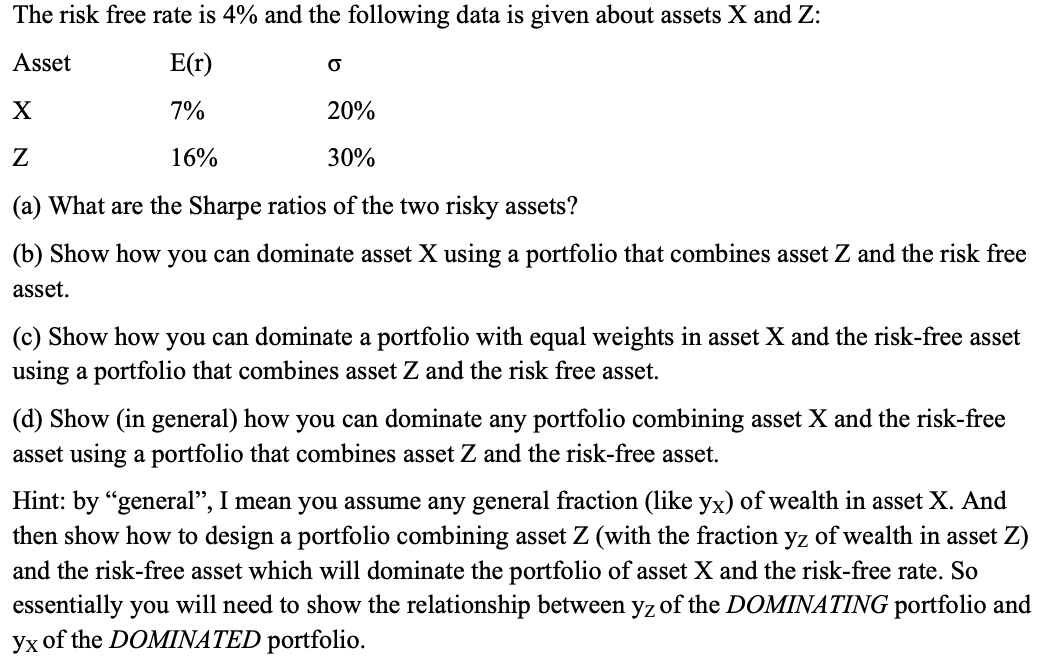

The risk free rate is 4% and the following data is given about assets X and Z: Asset E(r) X 7% 20% Z 16% 30% (a) What are the Sharpe ratios of the two risky assets? (b) Show how you can dominate asset X using a portfolio that combines asset Z and the risk free asset. (c) Show how you can dominate a portfolio with equal weights in asset X and the risk-free asset using a portfolio that combines asset Z and the risk free asset. (d) Show (in general) how you can dominate any portfolio combining asset X and the risk-free asset using a portfolio that combines asset Z and the risk-free asset. Hint: by general, I mean you assume any general fraction (like yx) of wealth in asset X. And then show how to design a portfolio combining asset Z (with the fraction yz of wealth in asset Z) and the risk-free asset which will dominate the portfolio of asset X and the risk-free rate. So essentially you will need to show the relationship between yz of the DOMINATING portfolio and Yx of the DOMINATED portfolio. The risk free rate is 4% and the following data is given about assets X and Z: Asset E(r) X 7% 20% Z 16% 30% (a) What are the Sharpe ratios of the two risky assets? (b) Show how you can dominate asset X using a portfolio that combines asset Z and the risk free asset. (c) Show how you can dominate a portfolio with equal weights in asset X and the risk-free asset using a portfolio that combines asset Z and the risk free asset. (d) Show (in general) how you can dominate any portfolio combining asset X and the risk-free asset using a portfolio that combines asset Z and the risk-free asset. Hint: by general, I mean you assume any general fraction (like yx) of wealth in asset X. And then show how to design a portfolio combining asset Z (with the fraction yz of wealth in asset Z) and the risk-free asset which will dominate the portfolio of asset X and the risk-free rate. So essentially you will need to show the relationship between yz of the DOMINATING portfolio and Yx of the DOMINATED portfolio