Answered step by step

Verified Expert Solution

Question

1 Approved Answer

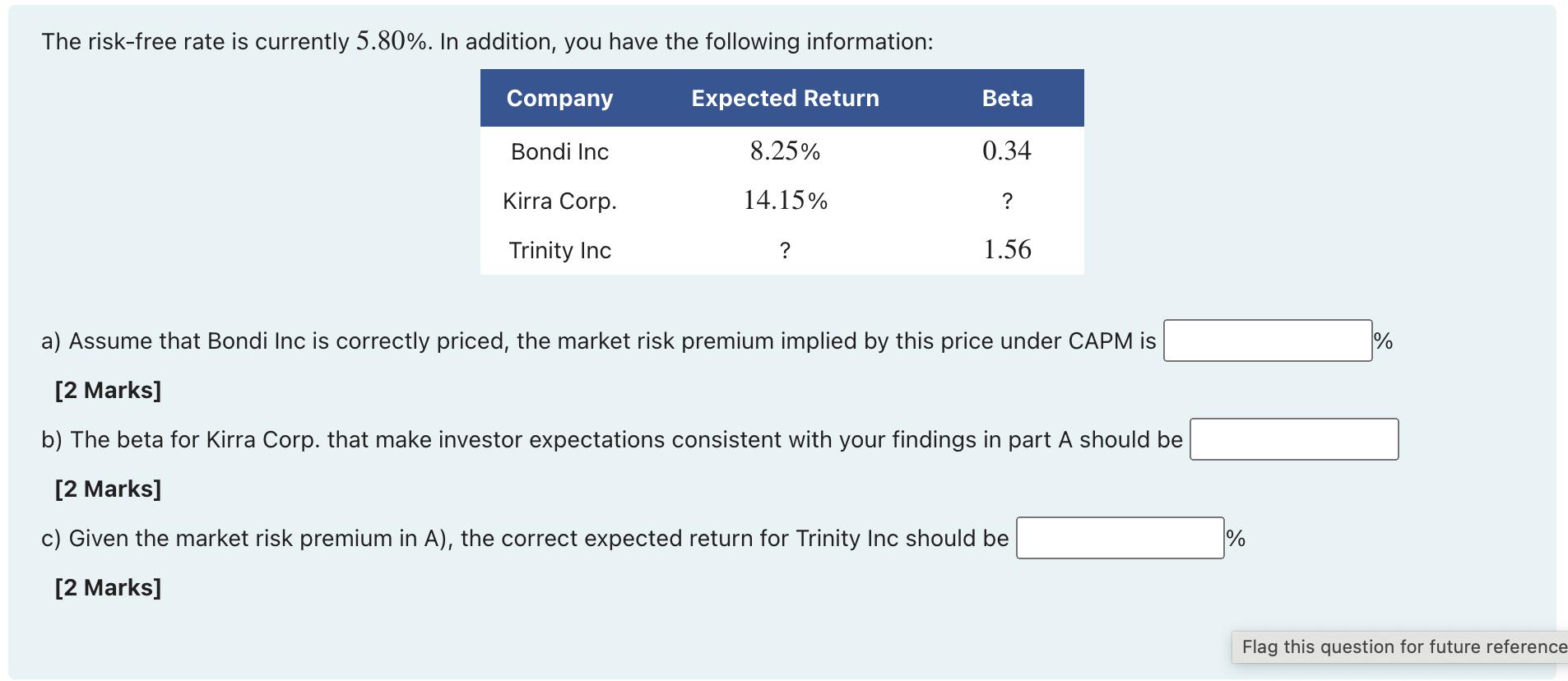

The risk-free rate is currently 5.80%. In addition, you have the following information: Expected Return Company Bondi Inc Kirra Corp. Trinity Inc 8.25% 14.15%

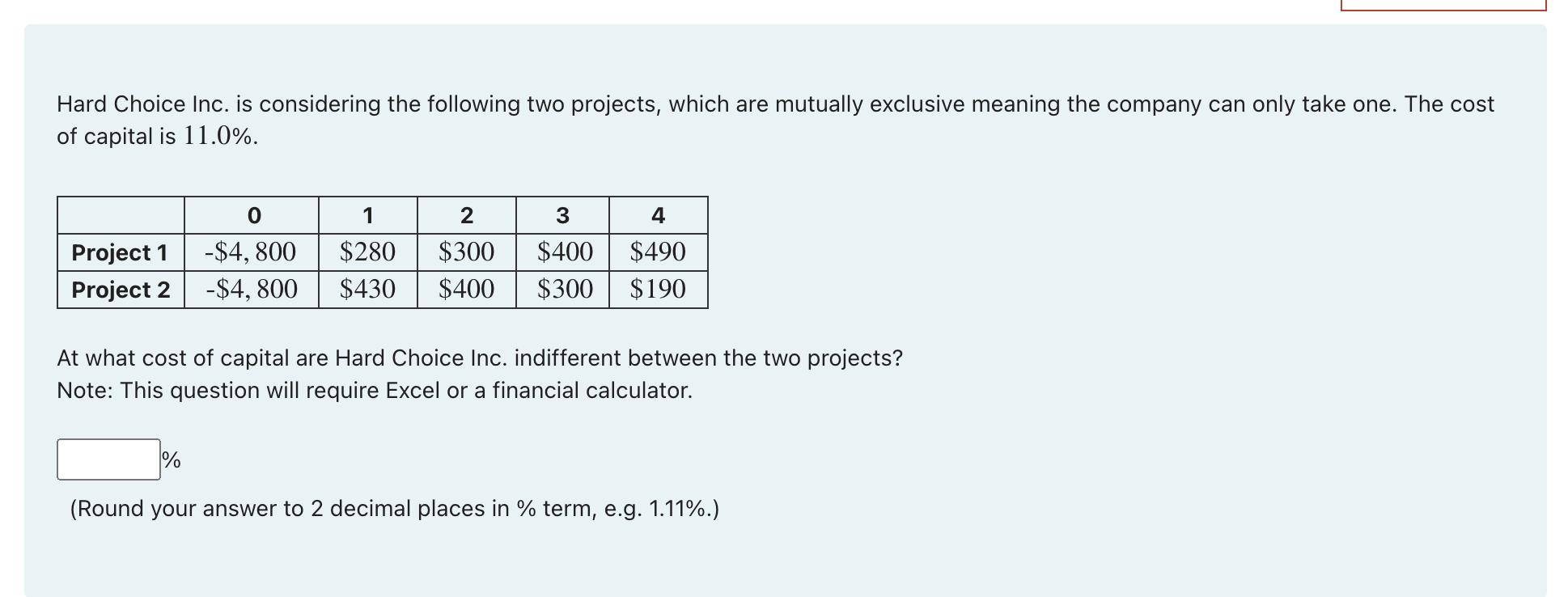

The risk-free rate is currently 5.80%. In addition, you have the following information: Expected Return Company Bondi Inc Kirra Corp. Trinity Inc 8.25% 14.15% ? Beta 0.34 ? 1.56 a) Assume that Bondi Inc is correctly priced, the market risk premium implied by this price under CAPM is [2 marks] b) The beta for Kirra Corp. that make investor expectations consistent with your findings in part A should be [2 marks] c) Given the market risk premium in A), the correct expected return for Trinity Inc should be [2 marks] % % Flag this question for future reference Hard Choice Inc. is considering the following two projects, which are mutually exclusive meaning the company can only take one. The cost of capital is 11.0%. Project 1 Project 2 0 -$4, 800 -$4, 800 % 1 2 3 $280 $300 $400 $430 $400 $300 4 $490 $190 At what cost of capital are Hard Choice Inc. indifferent between the two projects? Note: This question will require Excel or a financial calculator. (Round your answer to 2 decimal places in % term, e.g. 1.11%.)

Step by Step Solution

★★★★★

3.37 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started