Answered step by step

Verified Expert Solution

Question

1 Approved Answer

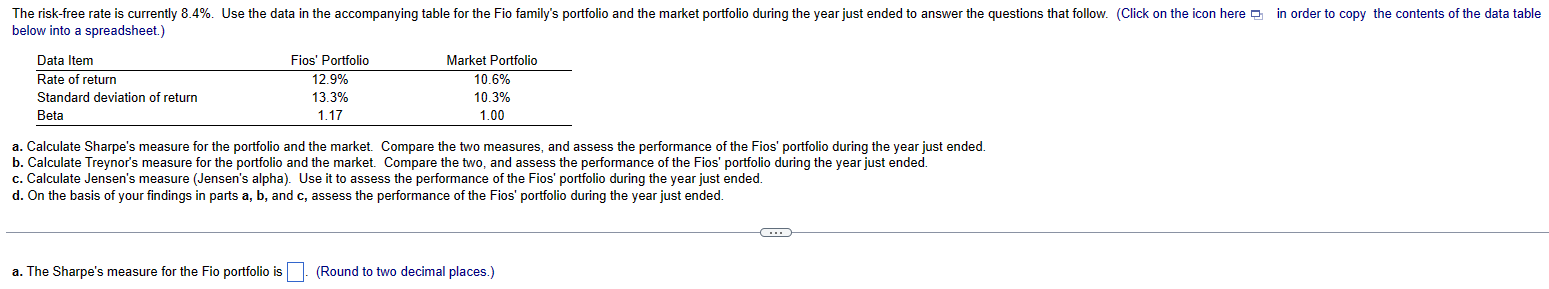

The risk-free rate is currently 8.4%. Use the data in the accompanying table for the Fio family's portfolio and the market portfolio during the

The risk-free rate is currently 8.4%. Use the data in the accompanying table for the Fio family's portfolio and the market portfolio during the year just ended to answer the questions that follow. (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Data Item Rate of return Fios' Portfolio Standard deviation of return Beta 12.9% 13.3% 1.17 Market Portfolio 10.6% 10.3% 1.00 a. Calculate Sharpe's measure for the portfolio and the market. Compare the two measures, and assess the performance of the Fios' portfolio during the year just ended. b. Calculate Treynor's measure for the portfolio and the market. Compare the two, and assess the performance of the Fios' portfolio during the year just ended. c. Calculate Jensen's measure (Jensen's alpha). Use it to assess the performance of the Fios' portfolio during the year just ended. d. On the basis of your findings in parts a, b, and c, assess the performance of the Fios' portfolio during the year just ended. a. The Sharpe's measure for the Fio portfolio is (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate Sharpes measure for the portfolio and the market we need the riskfree rate and the returns and standard deviations of the portfolio and t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started