Question

The Road agency is planning to build a new bridge and is considering two distinct configurations. The initial costs and annual costs and benefits

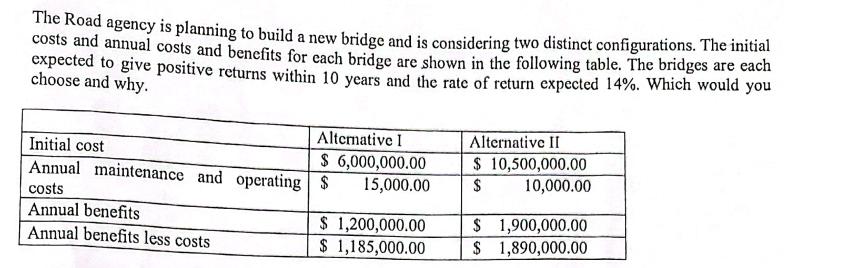

The Road agency is planning to build a new bridge and is considering two distinct configurations. The initial costs and annual costs and benefits for each bridge are shown in the following table. The bridges are each expected to give positive returns within 10 years and the rate of return expected 14%. Which would you choose and why. Initial cost Alternative I $ 6,000,000.00 15,000.00 Annual maintenance and operating $ costs Annual benefits Annual benefits less costs Alternative II $ 10,500,000.00 10,000.00 $ $ 1,200,000.00 $ 1,185,000.00 $ 1,900,000.00 $ 1,890,000.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine which bridge to choose we need to calculate the Net Present Value NPV for each a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Business Statistics

Authors: Norean Sharpe, Richard Veaux, Paul Velleman

3rd Edition

978-0321944726, 321925831, 9780321944696, 321944720, 321944690, 978-0321925831

Students also viewed these General Management questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App