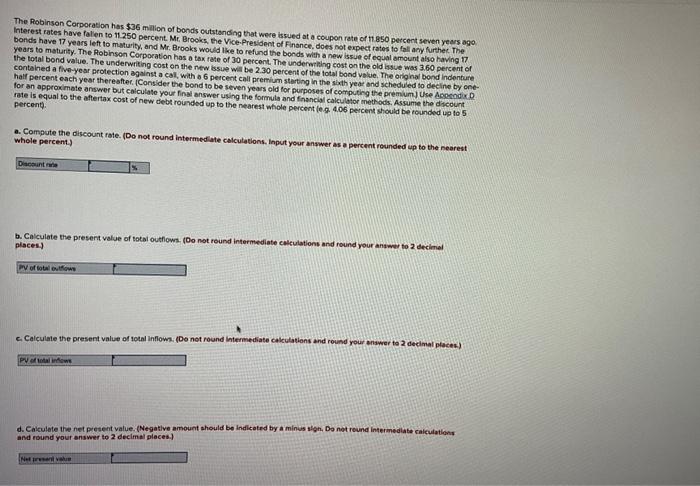

The Robinson Corporation has $36 milion of bonds cutstanding that weve issued at a coupon rate of th 850 percent seven years ago Interest rates have falen to 11250 percent. Mr. Brooks, the Vice.President of Finance, does not expect rates to fall any furthec. The bonds have 17 years left to maturity, and Mr. Brooks would like to refund the bonds with a new issue of equal amount also having 17 the tolal bond value. The underwriting cost on the tax rate of 30 percent. The undereilling cost on the old lisue was 3.60 percent of contalied a five-year protection against a cal the new issue will be 2.30 percent of the total bond value. The oilghal bond indenture half percent each year theresfter. (Consider the bond to be went call premium sterting in the sixth year ond schedued to decine by onefor an appraximate answer but calculate your fingl answer seven years old for purposes of computing the premum) Use Aceradix. D. rate is equal to the aftertax cost of new debe rounded up to the the formula and fnancial calculator meethods. Assume the dicount percent. a. Compute the discount rate. (Do not round intermedlate calculations, Input your answer as a percent rounded up to the nearest whole percent.) b. Caiculate the present value of total outfiows. (Do not round intermediate calculations and round your anzwer to 2 decimial places. c. Calculate the present value of total inflown. (Do not round intermediate calcutations and round your answer to 2 decimal ptoces) d. Calculete the net present value. (Negative amount ahould be indicoted by a minus slegh, Do not reund intermediate caiculations and round your answer to 2 decimal places.) The Robinson Corporation has $36 milion of bonds cutstanding that weve issued at a coupon rate of th 850 percent seven years ago Interest rates have falen to 11250 percent. Mr. Brooks, the Vice.President of Finance, does not expect rates to fall any furthec. The bonds have 17 years left to maturity, and Mr. Brooks would like to refund the bonds with a new issue of equal amount also having 17 the tolal bond value. The underwriting cost on the tax rate of 30 percent. The undereilling cost on the old lisue was 3.60 percent of contalied a five-year protection against a cal the new issue will be 2.30 percent of the total bond value. The oilghal bond indenture half percent each year theresfter. (Consider the bond to be went call premium sterting in the sixth year ond schedued to decine by onefor an appraximate answer but calculate your fingl answer seven years old for purposes of computing the premum) Use Aceradix. D. rate is equal to the aftertax cost of new debe rounded up to the the formula and fnancial calculator meethods. Assume the dicount percent. a. Compute the discount rate. (Do not round intermedlate calculations, Input your answer as a percent rounded up to the nearest whole percent.) b. Caiculate the present value of total outfiows. (Do not round intermediate calculations and round your anzwer to 2 decimial places. c. Calculate the present value of total inflown. (Do not round intermediate calcutations and round your answer to 2 decimal ptoces) d. Calculete the net present value. (Negative amount ahould be indicoted by a minus slegh, Do not reund intermediate caiculations and round your answer to 2 decimal places.)