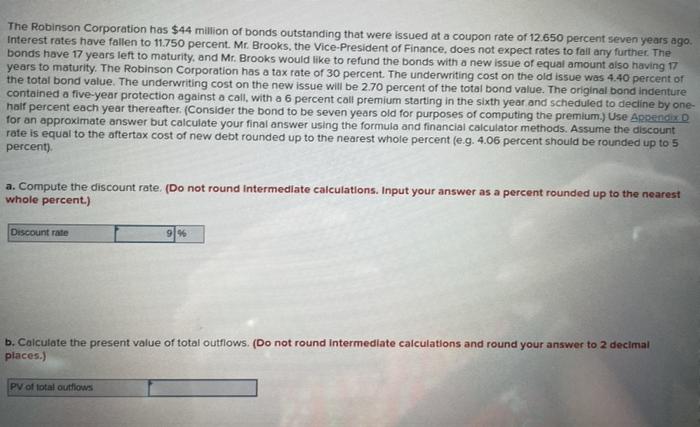

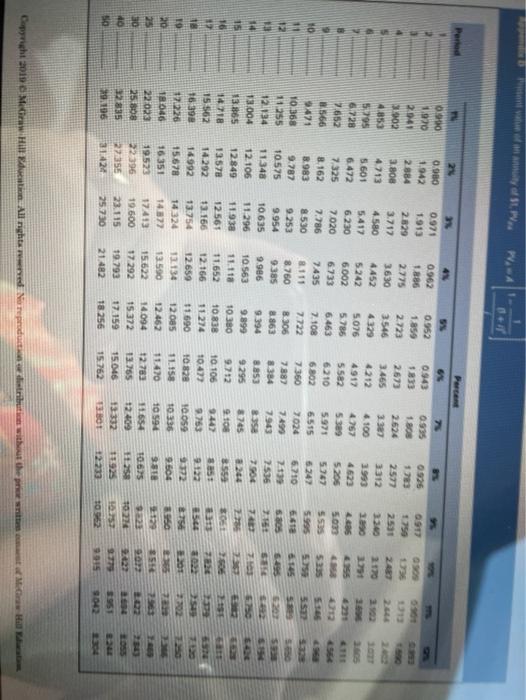

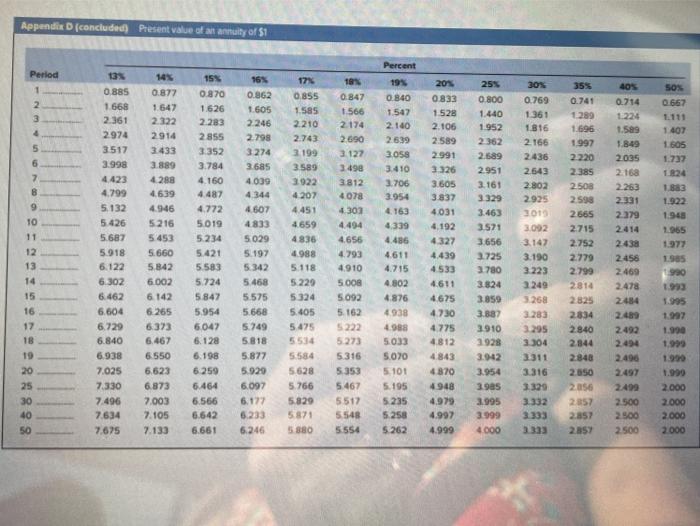

The Robinson Corporation has $44 million of bonds outstanding that were issued at a coupon rate of 12.650 percent seven years ago Interest rates have fallen to 11.750 percent. Mr. Brooks, the Vice-President of Finance, does not expect rates to fall any further. The bonds have 17 years left to maturity, and Mr. Brooks would like to refund the bonds with a new issue of equal amount also having 17 years to maturity. The Robinson Corporation has a tax rate of 30 percent. The underwriting cost on the old issue was 4.40 percent of the total bond value. The underwriting cost on the new issue will be 2.70 percent of the total bond value. The original bond indenture contained a five-year protection against a call, with a 6 percent call premium starting in the sixth year and scheduled to decline by one- half percent each year thereafter. (Consider the bond to be seven years old for purposes of computing the premium.) Use Appendix D for an approximate answer but calculate your final answer using the formula and financial calculator methods. Assume the discount rate is equal to the aftertax cost of new debt rounded up to the nearest whole percent (e.9. 4.06 percent should be rounded up to 5 percent) a. Compute the discount rate. (Do not round Intermediate calculations. Input your answer as a percent rounded up to the nearest whole percent.) Discount rate 96 b. Calculate the present value of total outflows. (Do not round Intermediate calculations and round your answer to 2 decimal places.) PV of total outflows Period Percent 1750 4 5 0.900 1920 20:41 1902 4.853 5.795 6.728 7.652 0925 13 2577 3312 1129 0.943 1833 2673 3465 4212 4917 5582 6.210 6.802 7360 5205 50m 5505 5767 1 808 2624 2.327 4.100 4757 5389 5.971 6.515 7024 7.490 7.943 5.235 HO 11 12 2 0.00 1.942 2.884 3.800 4713 5601 6.472 7325 8.162 8.983 9.787 10575 11.348 12.106 12849 1357 14.292 14.992 15678 16 351 19523 22 396 27 356 31:42 4N 0.962 1886 2.775 3630 4452 5242 6002 6733 7435 8.111 8.760 9.385 9.986 10 563 11.118 11.652 12.166 12659 1134 13.500 151622 17.292 19.793 21.482 0.971 1.913 2.829 3.717 4.580 5.417 6.230 7020 7.786 8.530 9.253 9.954 10635 11.296 11.938 12565 13.166 13.754 14 324 14877 17413 19.500 23.115 25.730 63cs 0.952 1859 2.723 3546 4.329 5076 5.785 6.463 7.108 7.722 8.306 8.863 9.394 9.899 10 380 10 838 11.274 11 690 12085 127462 14.094 15372 17.159 18.256 6.710 21 7.536 8.566 9471 YO.368 11.255 121134 13.004 13.865 14718 15 562 16398 170226 18046 22023 25.08 32835 29.196 14 3264 15 16 12 8745 9.10 9442 BE 254 18 19 8.384 8.853 9.295 9.712 10.106 10:47 10828 11158 11470 12.783 122.765 15.046 15.762 972 12.05 10.336 10 594 11654 10.675 40 50 12233 Copyright 2018 MeGraw Hill Education. All rights reproduction entributions without the price will be Appendix D (concluded Present value of an annuity of $1 Percent 15% 19% Period 1 2 50% 0667 4 1407 1 605 1.737 5 6 7 8 9 0.885 1668 2.361 2.974 3517 3.998 4.423 4.799 5.132 5 426 5.687 5.918 6.122 6302 6.462 6.604 6.729 6.840 6.938 7.025 7.330 7.496 7.634 7.675 0.877 1.647 2.322 2.914 3.433 3.889 4288 4.639 4.946 5216 5453 5.660 5,842 6.002 6 142 6.265 6.373 6.467 6.550 6.623 6.873 7.003 7.105 7.133 1883 1.922 1.948 1.965 0.870 1.626 2.283 2855 3.352 3.784 4.160 4.487 4.772 5019 5234 5.421 5583 5.724 5.847 5.954 6047 6.128 6.198 6.259 6.464 6.566 6.642 6.661 0.862 1.605 2.246 2.798 3274 3.685 4039 4 344 4.607 4833 5029 5.197 5.342 5.468 5.575 5.668 5.749 5818 5.877 5.929 6.097 6.177 5.233 6.246 10 11 12 13 14 15 16 17 18 19 20 25 30 40 50 17 0.855 1.585 2.210 2.743 2199 3589 2922 4207 4.451 4.659 4836 4.988 5.118 5.229 5324 5.405 5.475 5514 5584 5.628 5.766 5.829 5871 5880 18 0.847 1.566 2.174 2.690 3.127 3.490 3.812 4078 4.303 4.494 4,656 4.793 4.910 500B 5.092 5.162 5222 5273 5316 5.353 5.467 5517 5548 5.554 30% 0.769 1361 1816 2.166 2436 2.643 2.802 2.925 2019 3.092 3.147 3.190 3223 3249 3.268 3.283 0.840 1.547 2.140 2.639 3058 3.410 3.706 3.954 4.163 4,339 4.486 4611 4.715 4802 4.876 4938 4988 5.033 5.070 5101 5.195 5.235 5.258 5.262 20% 0.833 1528 2.106 2.589 2.991 3326 3.605 3.837 4031 4.192 4327 4.439 4533 4.611 4.675 4.730 4.775 4812 4843 4820 4948 4.979 4.997 4.999 25% 0.800 1.440 1.952 2362 2.689 2.951 3.161 3.329 3.463 3571 3.656 2725 3.780 3.824 3.859 3.887 3910 2928 3.942 3.954 3.9as 3.995 3.999 4000 35% 0.741 1289 1.696 1997 2220 2385 2508 2.598 2665 2.715 2.752 2.779 2.799 2814 2825 2834 2.840 2844 405 0.714 1.224 1.589 1.849 2035 2.168 2.263 2.331 2.379 2414 2438 2.456 2469 2.478 2.484 2.489 2.492 2.494 1.985 1990 1.997 1.990 1.999 3.304 3311 3.316 3.329 3.332 3333 2.650 2056 2357 2.857 285 2499 2.500 2.900 2.500 2.000 2.000 2.000 2.000