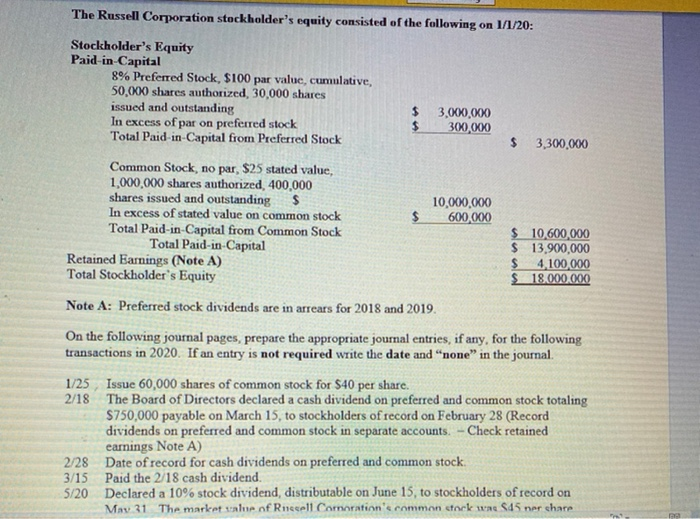

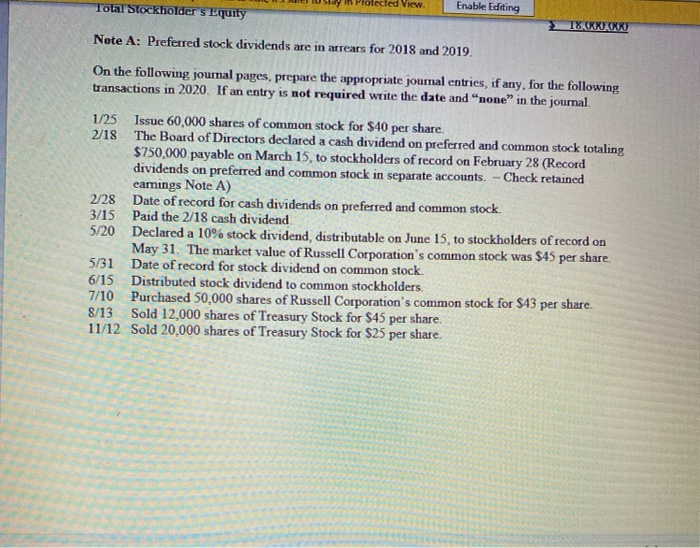

The Russell Corporation stockholder's equity consisted of the following on 1/1/20: Stockholder's Equity Paid in Capital 8% Preferred Stock, $100 par value, cumulative, 50.000 shares authorized, 30,000 shares issued and outstanding $ 3,000,000 In excess of par on preferred stock $ 300,000 Total Paid-in-Capital from Preferred Stock $ 3,300,000 Common Stock, no par, $25 stated value, 1,000,000 shares authorized 400.000 shares issued and outstanding 10,000,000 In excess of stated value on common stock $ 600.000 Total Paid-in-Capital from Common Stock $ 10,600,000 Total Paid-in-Capital $ 13,900,000 Retained Earnings (Note A) $ 4,100,000 Total Stockholder's Equity $ 18.000.000 Note A: Preferred stock dividends are in arrears for 2018 and 2019. On the following journal pages, prepare the appropriate journal entries, if any, for the following transactions in 2020. If an entry is not required write the date and "none" in the journal 1/25 Issue 60,000 shares of common stock for $40 per share. 2/18 The Board of Directors declared a cash dividend on preferred and common stock totaling $750,000 payable on March 15, to stockholders of record on February 28 (Record dividends on preferred and common stock in separate accounts. - Check retained earnings Note A) 2/28 Date of record for cash dividends on preferred and common stock 3/15 Paid the 2/18 cash dividend. 5/20 Declared a 10% stock dividend, distributable on June 15, to stockholders of record on May 31 The market value of neeell Comoration's common stock wa $45 ner share Total Stockholders Equity View Enable Editing 18.XXXX Note A: Preferred stock dividends are in arrears for 2018 and 2019. On the following journal pages, prepare the appropriate joumal entries, if any, for the following transactions in 2020. If an entry is not required write the date and "none" in the journal 1/25 Issue 60,000 shares of common stock for $40 per share. 2/18 The Board of Directors declared a cash dividend on preferred and common stock totaling $750,000 payable on March 15, to stockholders of record on February 28 (Record dividends on preferred and common stock in separate accounts. - Check retained eamings Note A) 2/28 Date of record for cash dividends on preferred and common stock. 3/15 Paid the 2/18 cash dividend 5/20 Declared a 10% stock dividend, distributable on June 15, to stockholders of record on May 31. The market value of Russell Corporation's common stock was $45 per share. 5/31 Date of record for stock dividend on common stock. 6/15 Distributed stock dividend to common stockholders. 7/10 Purchased 50,000 shares of Russell Corporation's common stock for $43 per share. 8/13 Sold 12,000 shares of Treasury Stock for $45 per share. 11/12 Sold 20,000 shares of Treasury Stock for $25 per share