Answered step by step

Verified Expert Solution

Question

1 Approved Answer

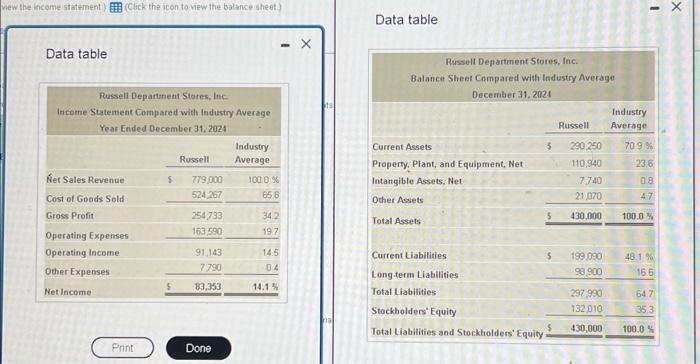

The Russell Department Stores, Inc. chief executive officer (CEO) has asked you to compare the company's profit performance and financial position with the averages for

The Russell Department Stores, Inc. chief executive officer (CEO) has asked you to compare the company's profit performance and financial position with the averages for the industry. The CEO has given you the company's income statement and balance sheet as well as the industry average data for retailers.

Data:

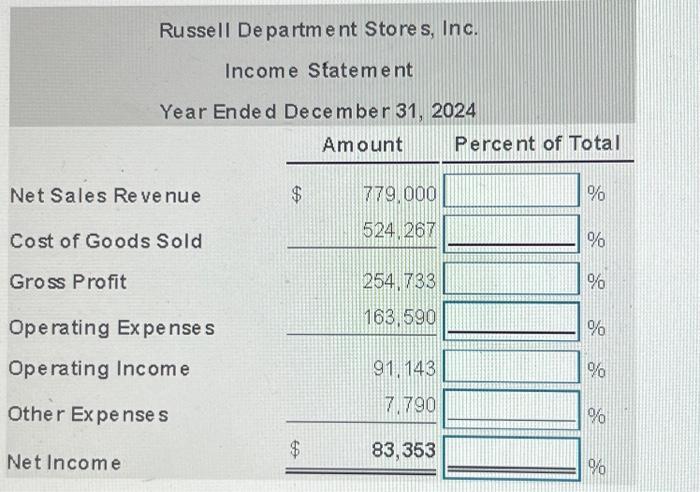

Requirement 1. Prepare a vertical analysis for Russell for both its income statement and balance sheet. Begin by preparing a vertical analysis for Russell for its income statement. (Round the percent of total amounts to one decimal place, X.X, and do not enter the %. For example, enter 10.1% as 10.1.)

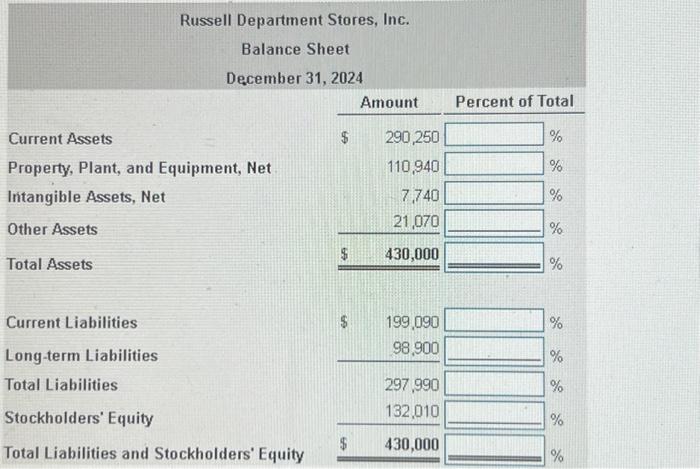

Prepare a vertical analysis for Russell for its balance sheet. (Round the percent of total amounts to one decimal place, X.X, and do not enter the %. For example, enter 10.1% as 10.1.)

Requirement 2. Compare the company's profit performance and financial position with the average for the industry.

a. Russell's gross profit percentage and profit margin ratio are both (1) ______ the industry average, which indicates a(n) (2) ______ profit performance as compared with the industry.

(1)

higher than

less than

the same as

(2)

comparable

favorable

unfavorable

b.The company showed a slightly (3) ______ investment in fixed and intangible assets than the industry average. The company's percentage of debt to total assets is (4) _______ than the industry, which would generally indicate a (5) _________ financial position than the average for the industry.

(3)

higher

lower

(4)

higher

lower

(5)

stronger

weaker

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started