Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The sales figures below are before deduction of discounts. 40% of sales are on credit, with payment received after 1 month. 60% of sales are

The sales figures below are before deduction of discounts. 40% of sales are on credit, with payment received after 1 month. 60% of sales are for cash, with a discount of 4% being given. Payment for purchases is made in the month of purchase, with a cash discount of 4% being taken. The expenses figures include depreciation of £1,300 per month: the remaining expenses are all cash items and paid for in the month in which they are charged. Loan interest for the whole year is payable at the beginning of June. Such loan interest includes the relevant accrual in the balance sheet at 31 March 20X5 as well as a further £800.

Prepare the monthly cash budget for each of the next three months i.e., April to June 20X5. All figures should be rounded off to whole pounds.

Prepare the monthly cash budget for each of the next three months i.e., April to June 20X5. All figures should be rounded off to whole pounds.

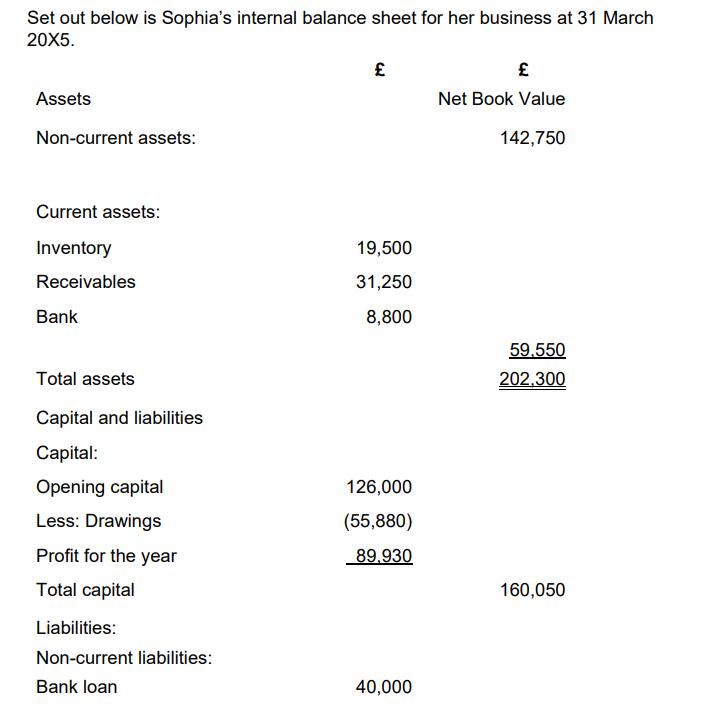

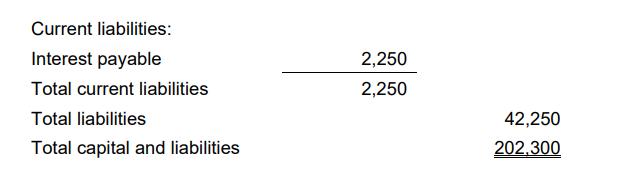

Set out below is Sophia's internal balance sheet for her business at 31 March 20X5. Assets Non-current assets: Current assets: Inventory Receivables Bank Total assets Capital and liabilities Capital: Opening capital Less: Drawings Profit for the year Total capital Liabilities: Non-current liabilities: Bank loan 19,500 31,250 8,800 126,000 (55,880) 89.930 40,000 Net Book Value 142,750 59,550 202,300 160,050

Step by Step Solution

★★★★★

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the monthly cash budget for each of the next three months April to June 20X5 we need to c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started