Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The sales tax is 5% of the selling price, which does not include the cost of the winch. Taylor Construction purchased a truck for $64,000

The sales tax is 5% of the selling price, which does not include the cost of the winch.

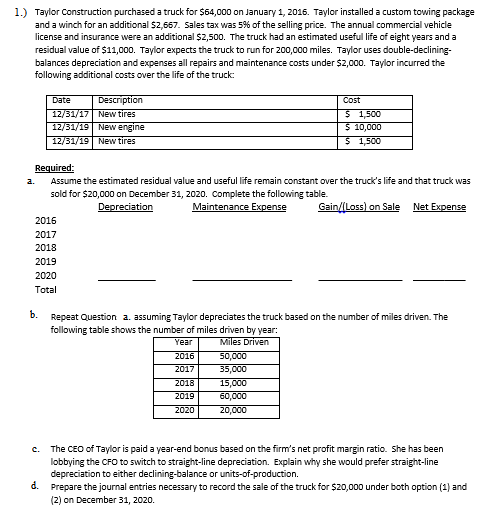

Taylor Construction purchased a truck for $64,000 on January 1, 2016. Taylor installed a custom towing package and a winch for an additional $2,657. Sales tax was 5% of the selling price. The annual commercial vehicle license 3nd insurance were an additional $2.500. The truck had an estimated useful life of eight years and a residual value of $11,000. Taylor expects the truck to run for 200,000 miles. Taylor uses double-declining-balances depreciation and expenses all repairs and maintenance costs under $2,000. Taylor incurred the following additional costs over the life of the truck: Assume the estimated residual value and useful life remain constant over the truck's life and that truck was sold for $20,000 on December 31,2020. Complete the following table. Repeat Question a. assuming Taylor depreciates the truck based on the number of miles driven. The following table shows the number of miles driven by year: The CEC of Taylor is paid a year-end bonus based on the firm's net profit margin ratio. She has been lobbying the CFC to switch to straight-line depredation. Explain why she would prefer straight-line depreciation to either declining-balance or units-of-production. Prepare the journal entries necessary to record the sale of the truck for $20,000 under both option (1) and (2) on December 31, 2020Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started