Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the same choice for all question Choose the correct answer Juvani has a beta of 1.50, the risk-free rate of interest is currently 12 percent,

the same choice for all question

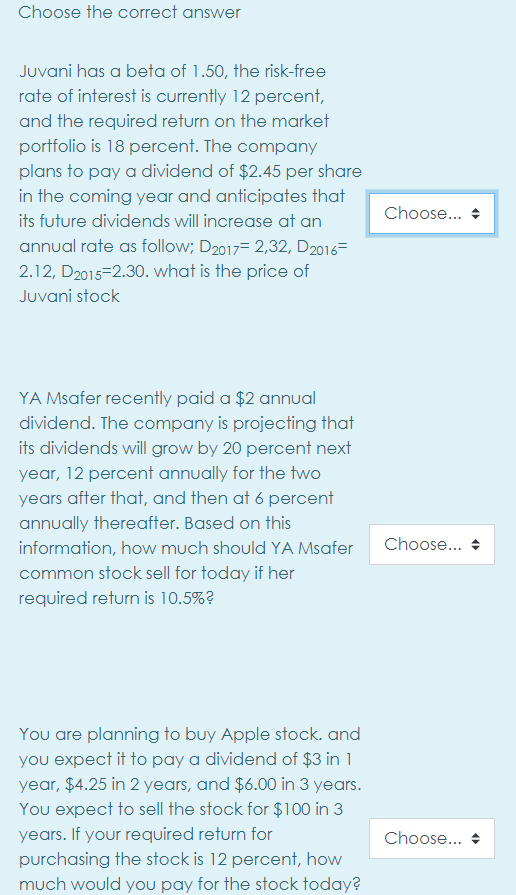

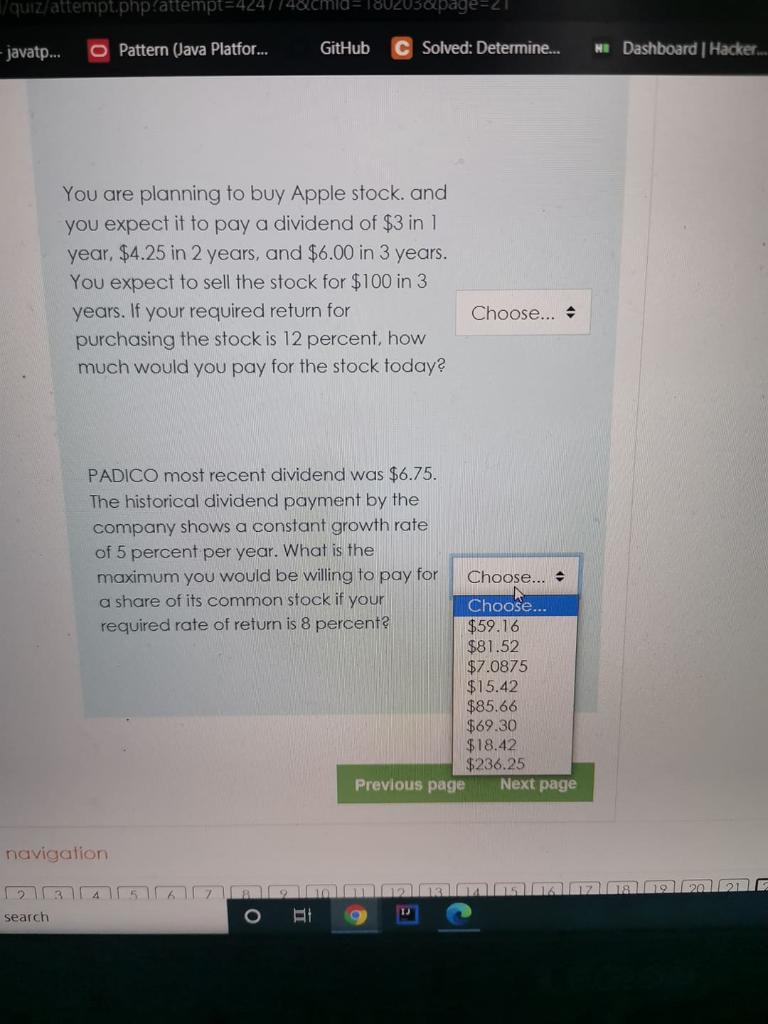

Choose the correct answer Juvani has a beta of 1.50, the risk-free rate of interest is currently 12 percent, and the required return on the market portfolio is 18 percent. The company plans to pay a dividend of $2.45 per share in the coming year and anticipates that its future dividends will increase at an annual rate as follow; D2017= 2,32, D2016= 2.12, D2015=2.30. what is the price of Juvani stock Choose... YA Msafer recently paid a $2 annual dividend. The company is projecting that its dividends will grow by 20 percent next year, 12 percent annually for the two years after that, and then at 6 percent annually thereafter. Based on this information, how much should YA Msafer common stock sell for today if her required return is 10.5%? Choose... You are planning to buy Apple stock. and you expect it to pay a dividend of $3 in 1 year, $4.25 in 2 years, and $6.00 in 3 years. You expect to sell the stock for $100 in 3 years. If your required return for purchasing the stock is 12 percent, how much would you pay for the stock today? Choose... quiz attempt.php?attempt=4247/48cmid=180203&page=21 javatp... O Pattern (Java Platfor... GitHub Solved: Determine... H Dashboard | Hacker... You are planning to buy Apple stock. and you expect it to pay a dividend of $3 in 1 year. $4.25 in 2 years, and $6.00 in 3 years. You expect to sell the stock for $100 in 3 years. If your required return for purchasing the stock is 12 percent, how much would you pay for the stock today? Choose... PADICO most recent dividend was $6.75. The historical dividend payment by the company shows a constant growth rate of 5 percent per year. What is the maximum you would be willing to pay for Choose... - a share of its common stock if your Choose... required rate of return is 8 percenta $59.16 $81.52 $7.0875 $15.42 $85.66 $69.30 $18.42 $236.25 Previous page Next page navigalion search O BE Choose the correct answer Juvani has a beta of 1.50, the risk-free rate of interest is currently 12 percent, and the required return on the market portfolio is 18 percent. The company plans to pay a dividend of $2.45 per share in the coming year and anticipates that its future dividends will increase at an annual rate as follow; D2017= 2,32, D2016= 2.12, D2015=2.30. what is the price of Juvani stock Choose... YA Msafer recently paid a $2 annual dividend. The company is projecting that its dividends will grow by 20 percent next year, 12 percent annually for the two years after that, and then at 6 percent annually thereafter. Based on this information, how much should YA Msafer common stock sell for today if her required return is 10.5%? Choose... You are planning to buy Apple stock. and you expect it to pay a dividend of $3 in 1 year, $4.25 in 2 years, and $6.00 in 3 years. You expect to sell the stock for $100 in 3 years. If your required return for purchasing the stock is 12 percent, how much would you pay for the stock today? Choose... quiz attempt.php?attempt=4247/48cmid=180203&page=21 javatp... O Pattern (Java Platfor... GitHub Solved: Determine... H Dashboard | Hacker... You are planning to buy Apple stock. and you expect it to pay a dividend of $3 in 1 year. $4.25 in 2 years, and $6.00 in 3 years. You expect to sell the stock for $100 in 3 years. If your required return for purchasing the stock is 12 percent, how much would you pay for the stock today? Choose... PADICO most recent dividend was $6.75. The historical dividend payment by the company shows a constant growth rate of 5 percent per year. What is the maximum you would be willing to pay for Choose... - a share of its common stock if your Choose... required rate of return is 8 percenta $59.16 $81.52 $7.0875 $15.42 $85.66 $69.30 $18.42 $236.25 Previous page Next page navigalion search O BEStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started