Answered step by step

Verified Expert Solution

Question

1 Approved Answer

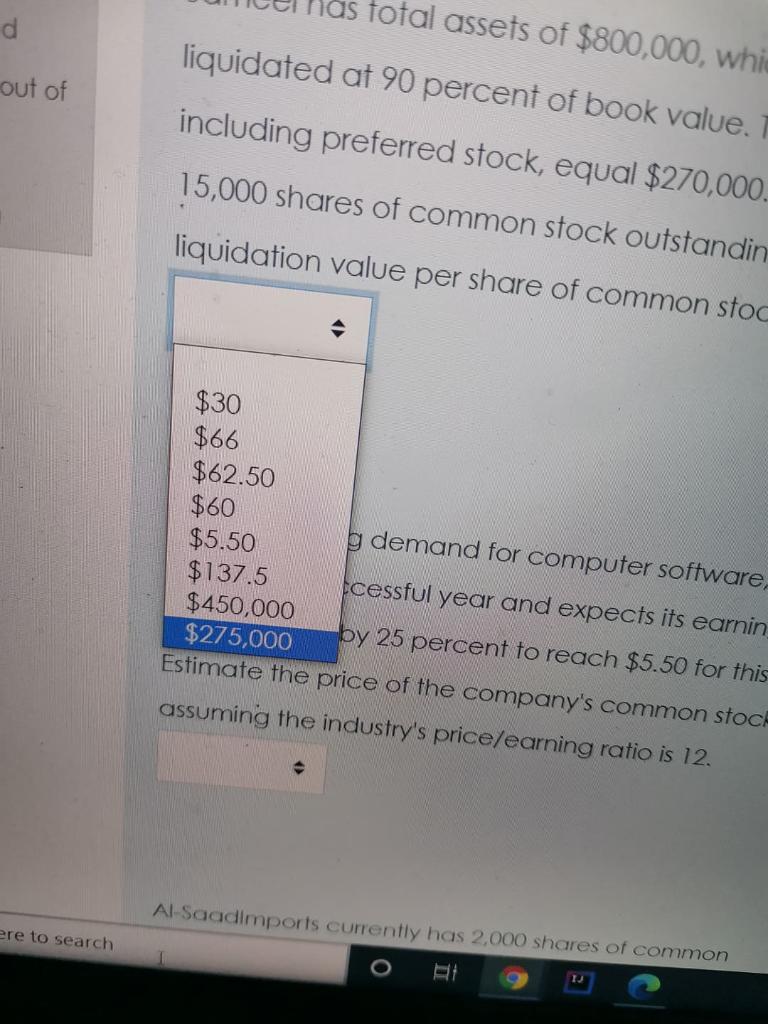

the same choice for all the question Jameel has total assets of $800,000, which can be liquidated at 90 percent of book value. Total liabilities,

the same choice for all the question

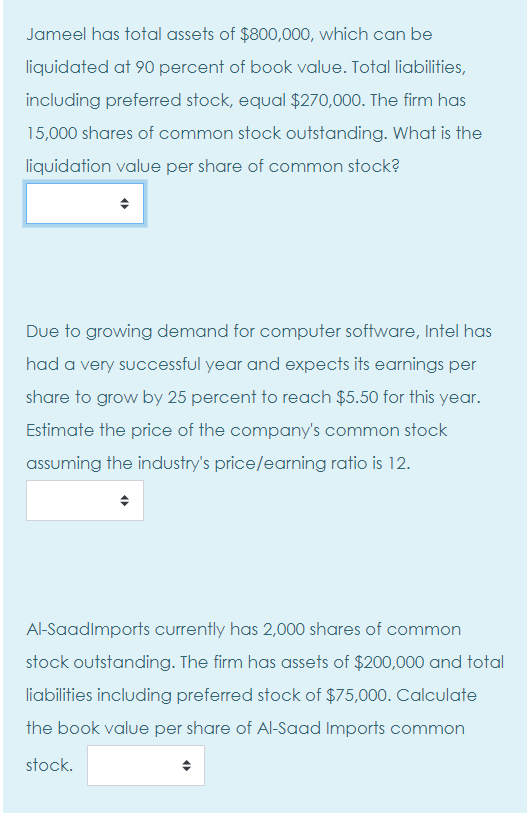

Jameel has total assets of $800,000, which can be liquidated at 90 percent of book value. Total liabilities, including preferred stock, equal $270,000. The firm has 15,000 shares of common stock outstanding. What is the liquidation value per share of common stock? Due to growing demand for computer software, Intel has had a very successful year and expects its earnings per share to grow by 25 percent to reach $5.50 for this year. Estimate the price of the company's common stock assuming the industry's price/earning ratio is 12. Al-Saadlmports currently has 2,000 shares of common stock outstanding. The firm has assets of $200,000 and total liabilities including preferred stock of $75,000. Calculate the book value per share of Al-Saad Imports common > stock. d as total assets of $800,000, whi liquidated at 90 percent of book value. T including preferred stock, equal $270,000. out of 15,000 shares of common stock outstandin liquidation value per share of common stoc $30 $66 $62.50 $60 $5.50 g demand for computer software, $137.5 cessful year and expects its earnin $450,000 $275,000 by 25 percent to reach $5.50 for this Estimate the price of the company's common stock assuming the industry's price/earning ratio is 12. Al-Saadimports currently has 2,000 shares of common ere to search TJStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started