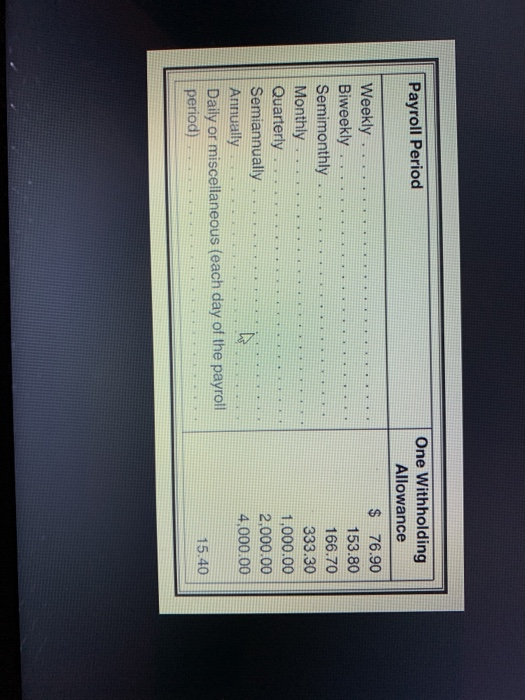

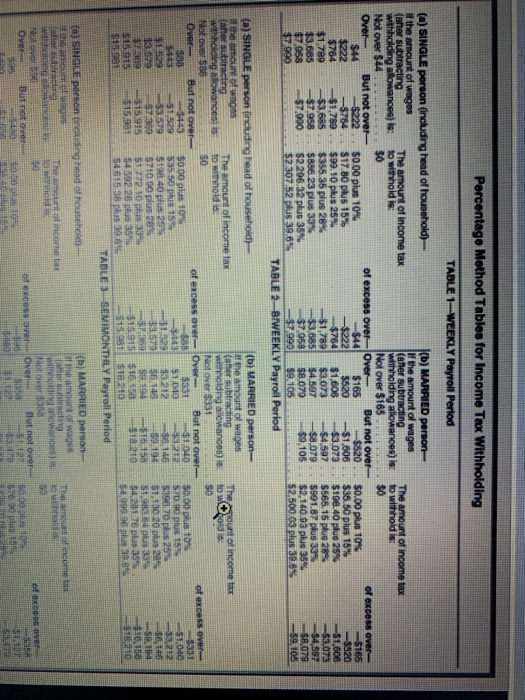

The San Bernardino County Fair hires about 105 people during fair time. Their wages range from $5.60 to $740. California has a state income tax of 9% Sandy Denny earns $7.40 per hour, George Barney earns $5.60 per hour. They both worked 38 hours this week. Both are married, however, Sandy claims 2 exemptions and George claims 1 exemption. Assume a rate of 6.2% on $118,500 for Social Security and 1.45% for Medicare. a. What is Sandy's net pay after FIT (use the Table 71 and Table 7.2), Social Security tax, state income tax, and Medicare have been taken out? (Round your answer to the nearest cent.) Sandy's net pay after FIT b. What is George's net pay after the same deductions? (Round your answer to the nearest cent.) George's net pay after FIT Payroll Period Weekly .. Biweekly Semimonthly Monthly Quarterly Semiannually Annually Daily or miscellaneous (each day of the payroll period) One Withholding Allowance $ 76.90 153.80 166.70 333.30 1,000.00 2,000.00 4,000.00 15.40 Porcentage Method Tables for Income Tax Withholding TABLE 1WEEKLY Payroll Period (a) SINGLE person (including head of household) (6) MARRIED person- the amount of wages If the amount of wages (after subtracting The amount of income tax (after subtracting The amount of income tax withholding allowances) to minhold is: withholding allowances) is to withholdis: Not over $44........ Not over $165 Over But not over- of excess over Over But not over of excess over $44 -$222 $0.00 plus 10% $165 $520 $0.00 plus 10% $165 $222 -5784. . $17.80 plus 15% -$222 $520 -$1,606 $35.50 plus 15% $520 $784 -$1,789 $99.10 plus 25% $1.606 - $3.073 . $198.40 plus 25% $1,606 $1.789 $3,685 $355 35 plus 28% $3.073 -$4,597 $566.15 plus 28% --$3.073 $3.685 =$7.958 $836.23 plus 33% 3.055 $4.597 -$8.0795991.87 plus 33% -$4,597 $7.958 $7.990 $2296.32 plus 35% $7.958 $8.079 $0,105 $2,140.93 plus 35% $8.079 $7.990 $2 307,52 plus 39.6% $9,105 52,500.03 plus 39.6% -$9,105 TABLE 2-BIWEEKLY Payroll Period -$44 The mount of income tax to w holds of excess over 585 (a) SINGLE person including head of household) (b) MARRIED person- il the amount of wages of the amount of wages fader subtracting The amount of income tax (after subtracting withholding Blowance is 10 w hold withholding allowances) Noter $86 Not Over $331 Over B ut not over- of excess over Over But not over 33 $0.00 plus 10% $331 FOND 535,50 plis 15 51010 22 $1.529 33,579 $198.40 plus 25 $3212 $11.16 13 579 $7,360 $710.0 plus 28 HERR 579 96146 39. 1940 7359 $15.915 S1772.10 plus 339 190 516,158 $15.915 $15.981 34.592.28 plus 355 $16.158 $18210 54 615 38 plus 39.65 -515,98 $1 210 TABLE 3-SEMIMONTHLY Payroll Period 50.00 plus 100 S70.40 plus 15% $390.70 plus 25 $1,130 20 plus 28 S164 plus 339 $4.281.76 plus 35% $4.999.96 plus 39.6% $1,040 3.2 - 56,146 31529 10.15 $18,210 (a) SINGLE person including head of household) rubiracting come tax The who mount of income old w w (b) MARRIED person If there was atbracing ing Nota 35 but not over SES $1. 127 COES OVE Ove But not 000 Hus 10 570199 The San Bernardino County Fair hires about 105 people during fair time. Their wages range from $5.60 to $740. California has a state income tax of 9% Sandy Denny earns $7.40 per hour, George Barney earns $5.60 per hour. They both worked 38 hours this week. Both are married, however, Sandy claims 2 exemptions and George claims 1 exemption. Assume a rate of 6.2% on $118,500 for Social Security and 1.45% for Medicare. a. What is Sandy's net pay after FIT (use the Table 71 and Table 7.2), Social Security tax, state income tax, and Medicare have been taken out? (Round your answer to the nearest cent.) Sandy's net pay after FIT b. What is George's net pay after the same deductions? (Round your answer to the nearest cent.) George's net pay after FIT Payroll Period Weekly .. Biweekly Semimonthly Monthly Quarterly Semiannually Annually Daily or miscellaneous (each day of the payroll period) One Withholding Allowance $ 76.90 153.80 166.70 333.30 1,000.00 2,000.00 4,000.00 15.40 Porcentage Method Tables for Income Tax Withholding TABLE 1WEEKLY Payroll Period (a) SINGLE person (including head of household) (6) MARRIED person- the amount of wages If the amount of wages (after subtracting The amount of income tax (after subtracting The amount of income tax withholding allowances) to minhold is: withholding allowances) is to withholdis: Not over $44........ Not over $165 Over But not over- of excess over Over But not over of excess over $44 -$222 $0.00 plus 10% $165 $520 $0.00 plus 10% $165 $222 -5784. . $17.80 plus 15% -$222 $520 -$1,606 $35.50 plus 15% $520 $784 -$1,789 $99.10 plus 25% $1.606 - $3.073 . $198.40 plus 25% $1,606 $1.789 $3,685 $355 35 plus 28% $3.073 -$4,597 $566.15 plus 28% --$3.073 $3.685 =$7.958 $836.23 plus 33% 3.055 $4.597 -$8.0795991.87 plus 33% -$4,597 $7.958 $7.990 $2296.32 plus 35% $7.958 $8.079 $0,105 $2,140.93 plus 35% $8.079 $7.990 $2 307,52 plus 39.6% $9,105 52,500.03 plus 39.6% -$9,105 TABLE 2-BIWEEKLY Payroll Period -$44 The mount of income tax to w holds of excess over 585 (a) SINGLE person including head of household) (b) MARRIED person- il the amount of wages of the amount of wages fader subtracting The amount of income tax (after subtracting withholding Blowance is 10 w hold withholding allowances) Noter $86 Not Over $331 Over B ut not over- of excess over Over But not over 33 $0.00 plus 10% $331 FOND 535,50 plis 15 51010 22 $1.529 33,579 $198.40 plus 25 $3212 $11.16 13 579 $7,360 $710.0 plus 28 HERR 579 96146 39. 1940 7359 $15.915 S1772.10 plus 339 190 516,158 $15.915 $15.981 34.592.28 plus 355 $16.158 $18210 54 615 38 plus 39.65 -515,98 $1 210 TABLE 3-SEMIMONTHLY Payroll Period 50.00 plus 100 S70.40 plus 15% $390.70 plus 25 $1,130 20 plus 28 S164 plus 339 $4.281.76 plus 35% $4.999.96 plus 39.6% $1,040 3.2 - 56,146 31529 10.15 $18,210 (a) SINGLE person including head of household) rubiracting come tax The who mount of income old w w (b) MARRIED person If there was atbracing ing Nota 35 but not over SES $1. 127 COES OVE Ove But not 000 Hus 10 570199