Answered step by step

Verified Expert Solution

Question

1 Approved Answer

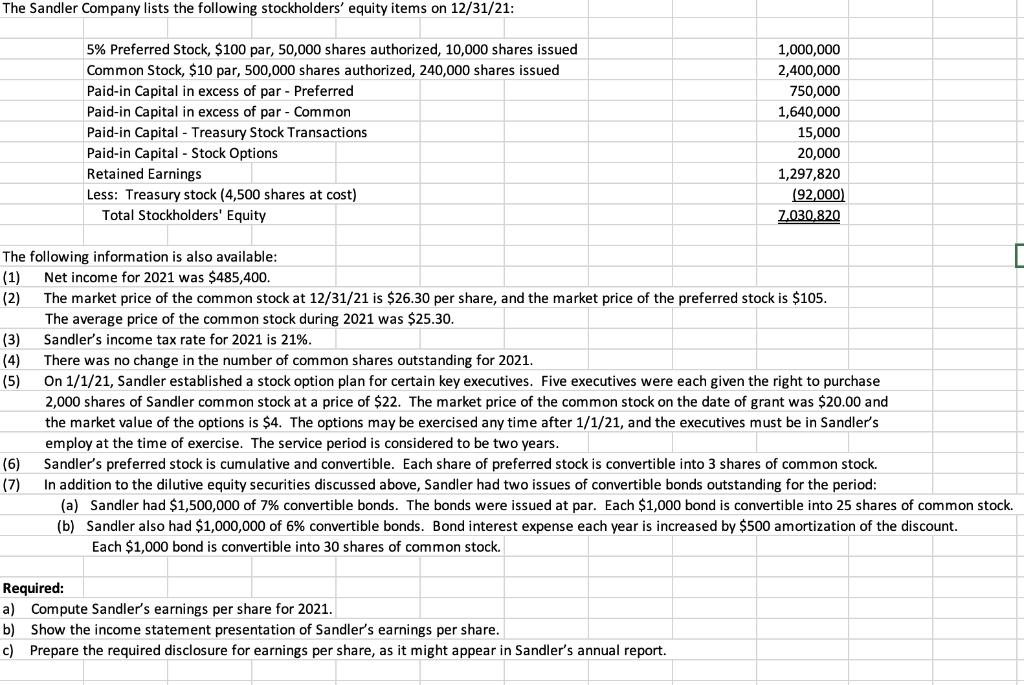

The Sandler Company lists the following stockholders' equity items on 12/31/21: (3) (4) (5) 5% Preferred Stock, $100 par, 50,000 shares authorized, 10,000 shares

The Sandler Company lists the following stockholders' equity items on 12/31/21: (3) (4) (5) 5% Preferred Stock, $100 par, 50,000 shares authorized, 10,000 shares issued Common Stock, $10 par, 500,000 shares authorized, 240,000 shares issued Paid-in Capital in excess of par - Preferred Paid-in Capital in excess of par - Common Paid-in Capital - Treasury Stock Transactions Paid-in Capital - Stock Options Retained Earnings (6) (7) Less: Treasury stock (4,500 shares at cost) Total Stockholders' Equity The following information is also available: (1) Net income for 2021 was $485,400. (2) The market price of the common stock at 12/31/21 is $26.30 per share, and the market price of the preferred stock is $105. The average price of the common stock during 2021 was $25.30. Sandler's income tax rate for 2021 is 21%. 1,000,000 2,400,000 750,000 1,640,000 15,000 20,000 1,297,820 (92,000) 7.030,820 Required: a) Compute Sandler's earnings per share for 2021. b) Show the income statement presentation of Sandler's earnings per share. c) Prepare the required disclosure for earnings per share, as it might appear in Sandler's annual report. There was no change in the number of common shares outstanding for 2021. On 1/1/21, Sandler established a stock option plan for certain key executives. Five executives were each given the right to purchase 2,000 shares of Sandler common stock at a price of $22. The market price of the common stock on the date of grant was $20.00 and the market value of the options is $4. The options may be exercised any time after 1/1/21, and the executives must be in Sandler's employ at the time of exercise. The service period is considered to be two years. Sandler's preferred stock is cumulative and convertible. Each share of preferred stock is convertible into 3 shares of common stock. In addition to the dilutive equity securities discussed above, Sandler had two issues of convertible bonds outstanding for the period: (a) Sandler had $1,500,000 of 7% convertible bonds. The bonds were issued at par. Each $1,000 bond is convertible into 25 shares of common stock. (b) Sandler also had $1,000,000 of 6% convertible bonds. Bond interest expense each year is increased by $500 amortization of the discount. Each $1,000 bond is convertible into 30 shares of common stock.

Step by Step Solution

★★★★★

3.50 Rating (180 Votes )

There are 3 Steps involved in it

Step: 1

Basic earning per share Common stock outstanding Employee stock option Preferred convertible stock C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started