Answered step by step

Verified Expert Solution

Question

1 Approved Answer

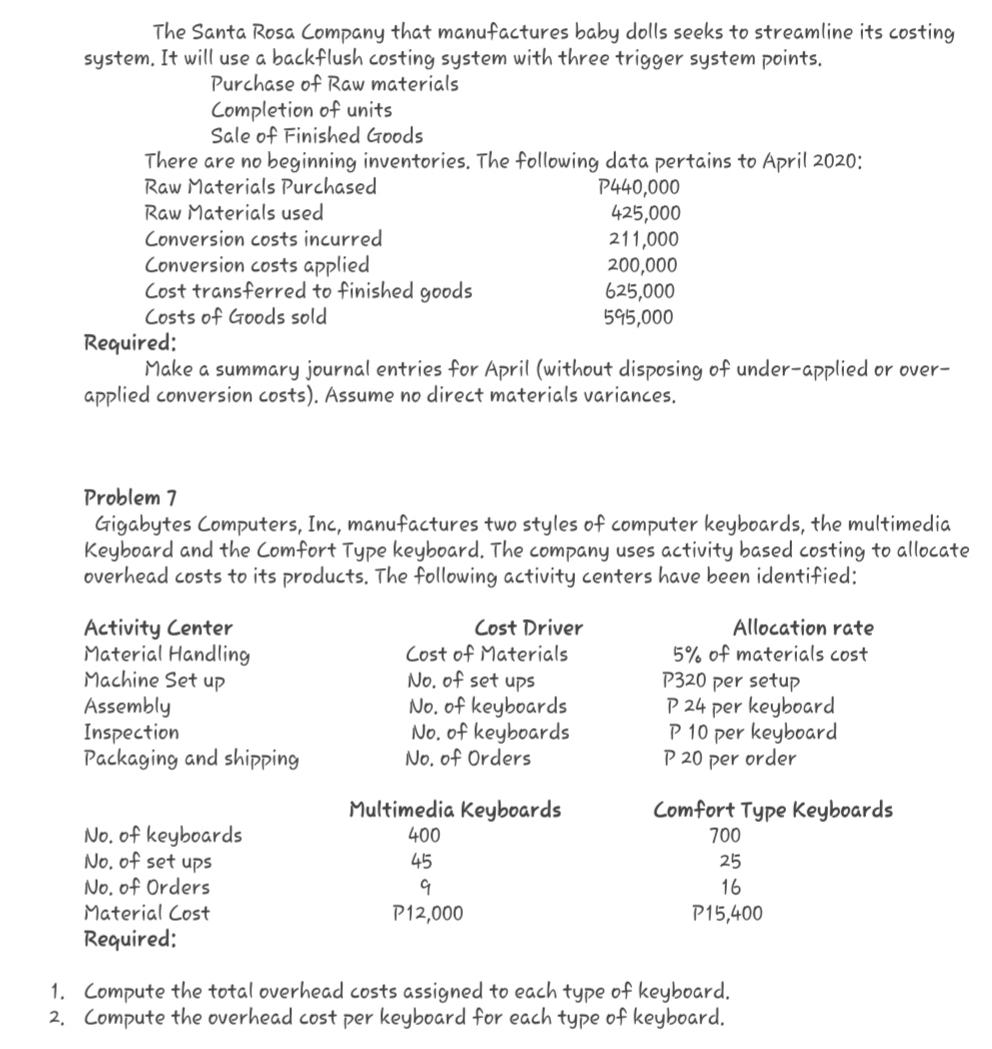

The Santa Rosa Company that manufactures baby dolls seeks to streamline its costing system. It will use a backflush costing system with three trigger

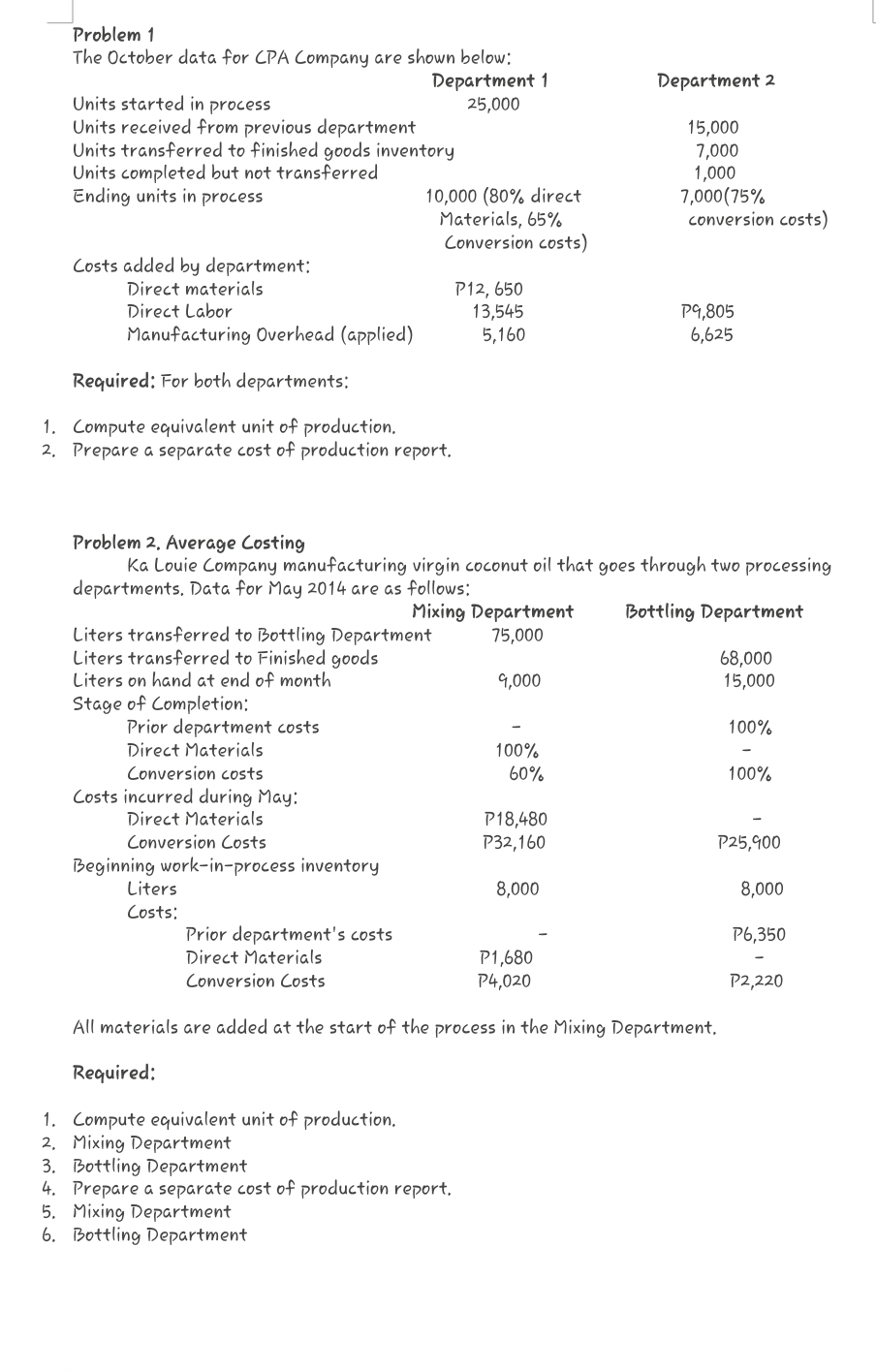

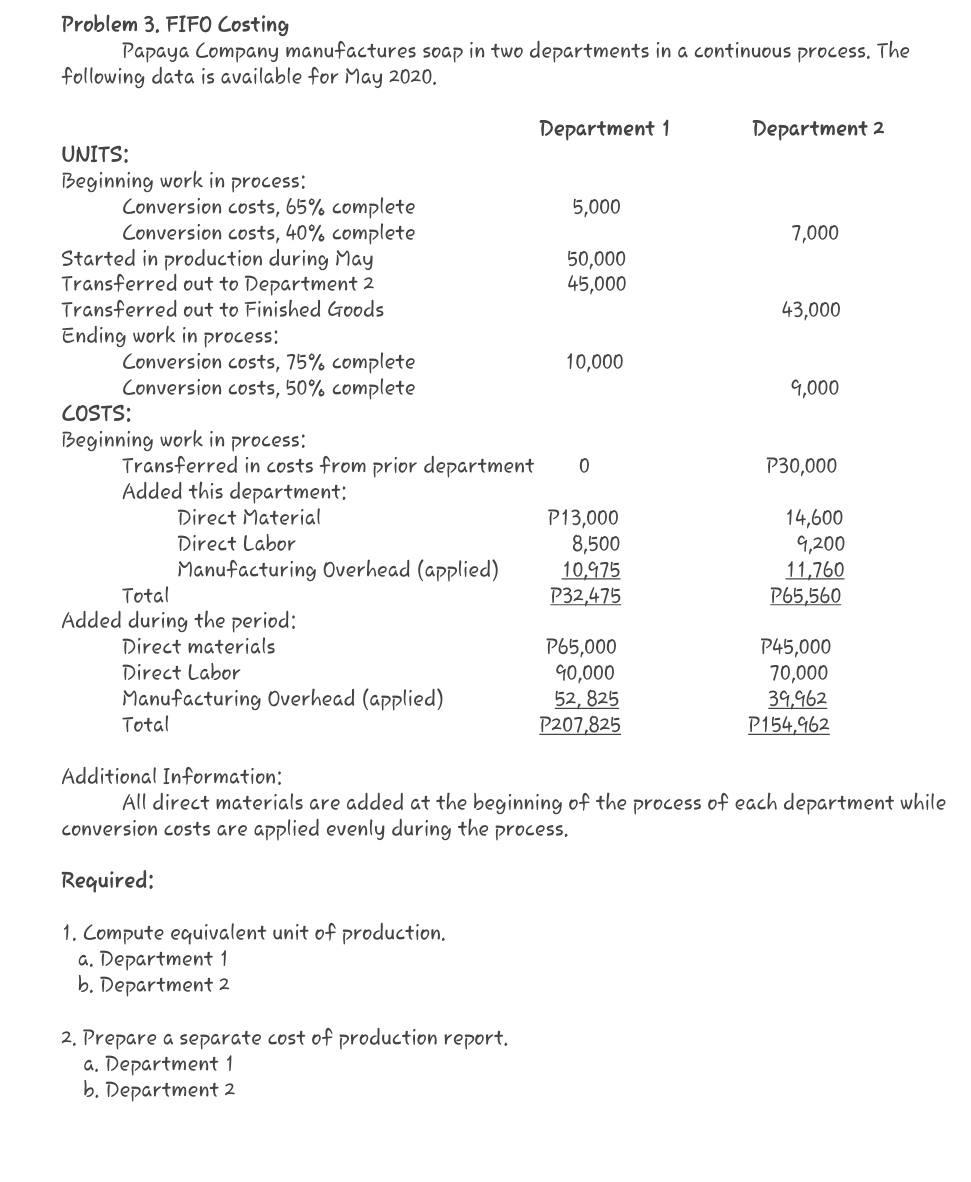

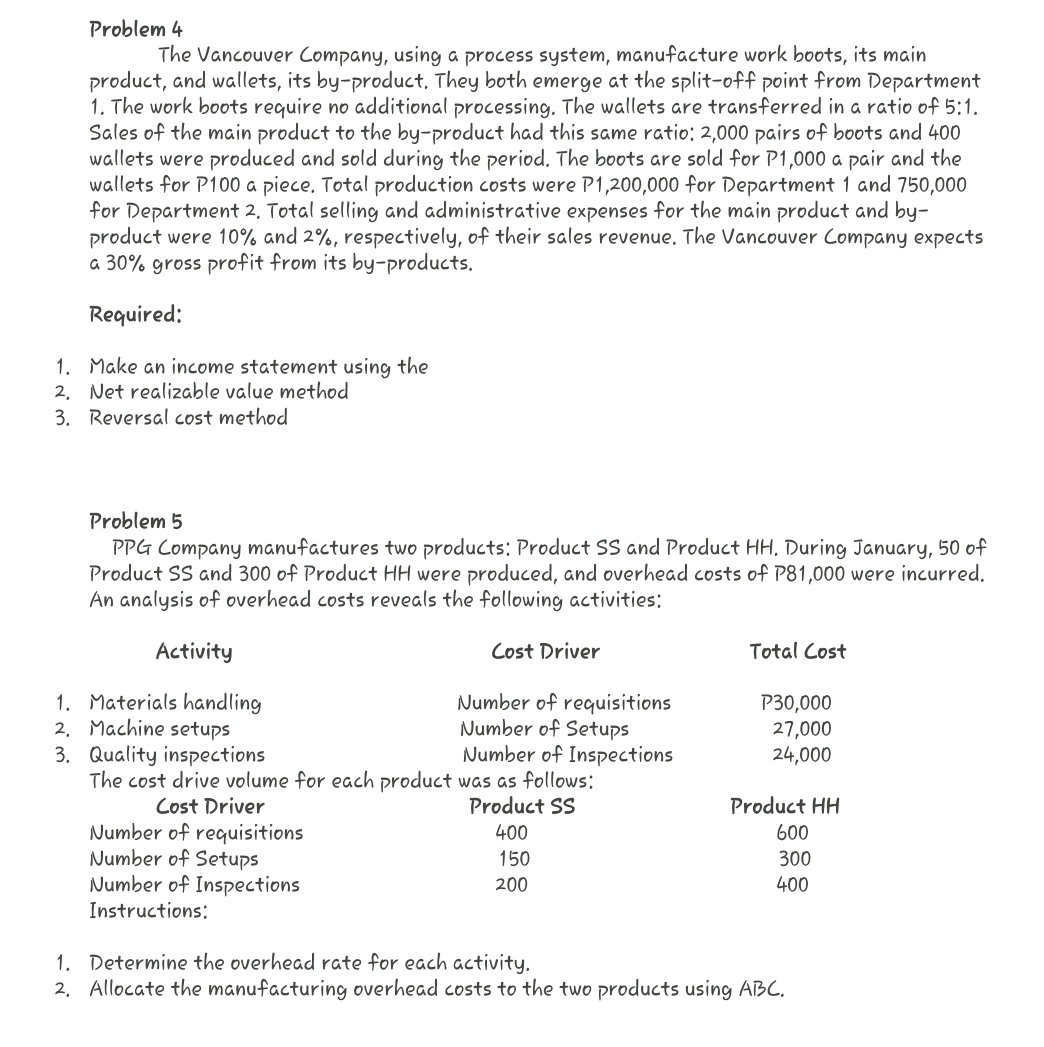

The Santa Rosa Company that manufactures baby dolls seeks to streamline its costing system. It will use a backflush costing system with three trigger system points. Purchase of Raw materials Completion of units Sale of Finished Goods There are no beginning inventories. The following data pertains to April 2020: Raw Materials Purchased Raw Materials used Conversion costs incurred Conversion costs applied Cost transferred to finished goods Costs of Goods sold Required: 2440,000 425,000 211,000 200,000 625,000 595,000 Make a summary journal entries for April (without disposing of under-applied or over- applied conversion costs). Assume no direct materials variances. Problem 7 Gigabytes Computers, Inc, manufactures two styles of computer keyboards, the multimedia Keyboard and the Comfort Type keyboard. The company uses activity based costing to allocate overhead costs to its products. The following activity centers have been identified: Activity Center Material Handling Machine Set up Assembly Inspection Packaging and shipping No. of keyboards No. of set ups No. of Orders Material Cost Required: Cost Driver Cost of Materials No. of set ups No. of keyboards No. of keyboards No. of Orders Multimedia Keyboards 400 45 9 P12,000 Allocation rate 5% of materials cost P320 per setup P 24 per keyboard P 10 per keyboard P20 per order Comfort Type Keyboards 700 25 16 P15,400 1. Compute the total overhead costs assigned to each type of keyboard. 2. Compute the overhead cost per keyboard for each type of keyboard. Problem 1 The October data for CPA Company are shown below: Units started in process Units received from previous department Units transferred to finished goods inventory. Units completed but not transferred Department 1 25,000 Department 2 15,000 7,000 Ending units in process Costs added by department: Direct materials Direct Labor Manufacturing Overhead (applied) Required; For both departments: 1. Compute equivalent unit of production. 10,000 (80% direct Materials, 65% Conversion costs) 2. Prepare a separate cost of production report. P12, 650 13,545 5,160 1,000 7,000(75% conversion costs) P9,805 6,625 Problem 2, Average Costing Ka Louie Company manufacturing virgin coconut oil that goes through two processing departments, Data for May 2014 are as follows: Liters on hand at end of month Stage of Completion: Prior department costs Direct Materials Conversion costs Mixing Department Liters transferred to Bottling Department Liters transferred to Finished goods 75,000 9,000 Bottling Department 68,000 15,000 100% 100% 60% 100% Costs incurred during May: Direct Materials P18,480 Conversion Costs P32,160 P25,900 Beginning work-in-process inventory Liters 8,000 8,000 Costs: Prior department's costs P6,350 Direct Materials P1,680 Conversion Costs P4,020 P2,220 All materials are added at the start of the process in the Mixing Department. Required: 1. Compute equivalent unit of production. 2. Mixing Department 3. Bottling Department 4. Prepare a separate cost of production report. 5. Mixing Department 6. Bottling Department Problem 3. FIFO Costing Papaya Company manufactures soap in two departments in a continuous process. The following data is available for May 2020. UNITS: Department 1 Department 2 Beginning work in process: Conversion costs, 65% complete 5,000 Conversion costs, 40% complete 7,000 Started in production during May Transferred out to Department 2 Transferred out to Finished Goods Ending work in process: 50,000 45,000 43,000 Conversion costs, 75% complete 10,000 Conversion costs, 50% complete 9,000 COSTS: Beginning work in process: Transferred in costs from prior department 0 P30,000 Added this department: Direct Material P13,000 14,600 Direct Labor 8,500 9,200 Manufacturing Overhead (applied) 10,975 11,760 Total P32,475 P65,560 Added during the period: Direct materials P65,000 P45,000 Direct Labor 90,000 70,000 Manufacturing Overhead (applied) 52,825 39,962 Total P207,825 P154,962 Additional Information: All direct materials are added at the beginning of the process of each department while conversion costs are applied evenly during the process. Required: 1. Compute equivalent unit of production. a. Department 1 b. Department 2 2. Prepare a separate cost of production report. a. Department 1 b. Department 2 Problem 4 The Vancouver Company, using a process system, manufacture work boots, its main product, and wallets, its by-product. They both emerge at the split-off point from Department 1. The work boots require no additional processing. The wallets are transferred in a ratio of 5:1. Sales of the main product to the by-product had this same ratio: 2,000 pairs of boots and 400 wallets were produced and sold during the period. The boots are sold for P1,000 a pair and the wallets for P100 a piece. Total production costs were P1,200,000 for Department 1 and 750,000 for Department 2. Total selling and administrative expenses for the main product and by- product were 10% and 2%, respectively, of their sales revenue. The Vancouver Company expects a 30% gross profit from its by-products. Required: 1. Make an income statement using the 2. Net realizable value method 3. Reversal cost method Problem 5 PPG Company manufactures two products: Product SS and Product HH. During January, 50 of Product SS and 300 of Product HH were produced, and overhead costs of P81,000 were incurred. An analysis of overhead costs reveals the following activities: Activity 1. Materials handling Cost Driver Total Cost Number of requisitions P30,000 2. Machine setups Number of Setups 27,000 3. Quality inspections Cost Driver Number of requisitions Number of Setups Number of Inspections Instructions: Number of Inspections 24,000 The cost drive volume for each product was as follows: Product SS 400 150 200 Product HH 600 300 400 1. Determine the overhead rate for each activity. 2. Allocate the manufacturing overhead costs to the two products using ABC.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started