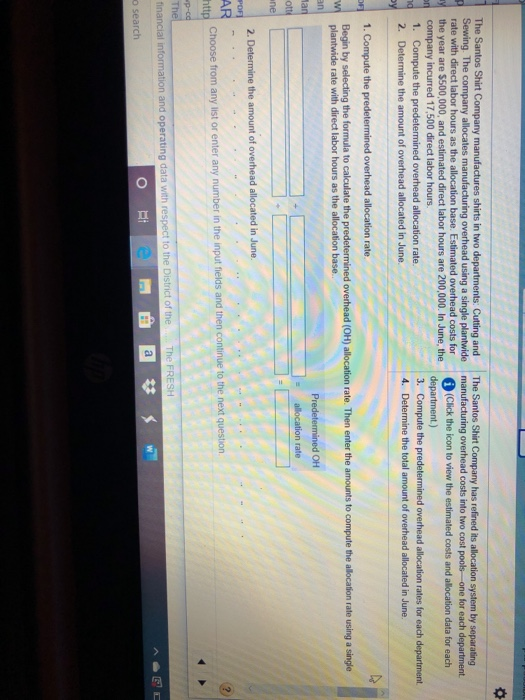

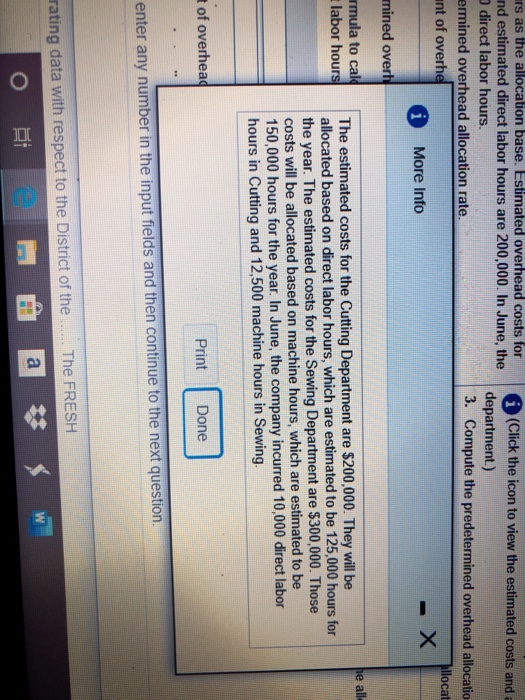

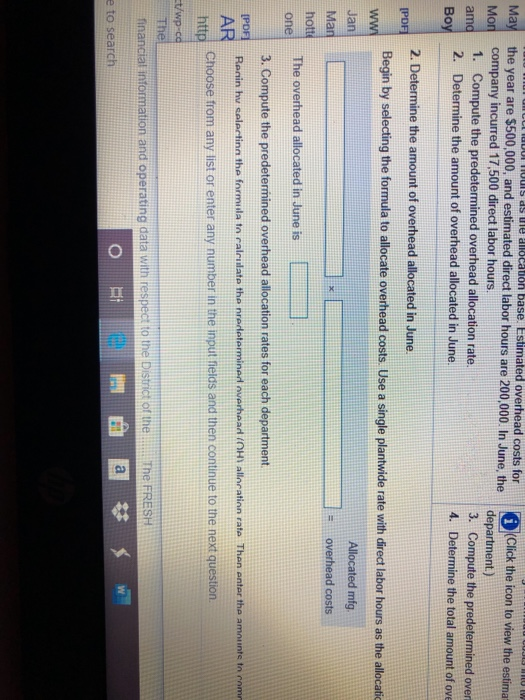

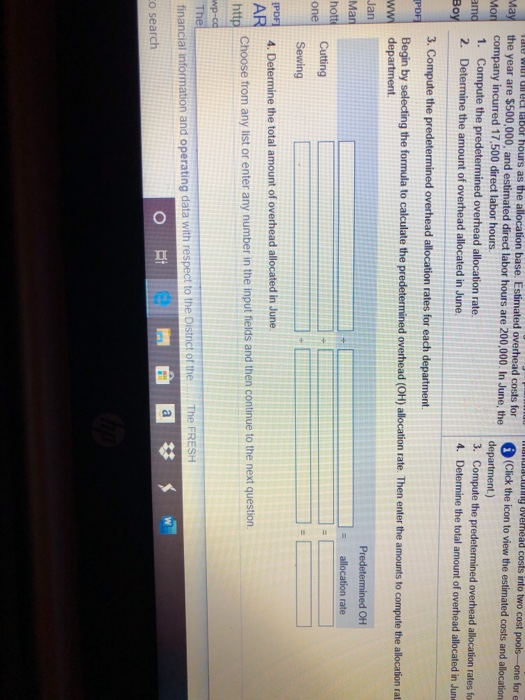

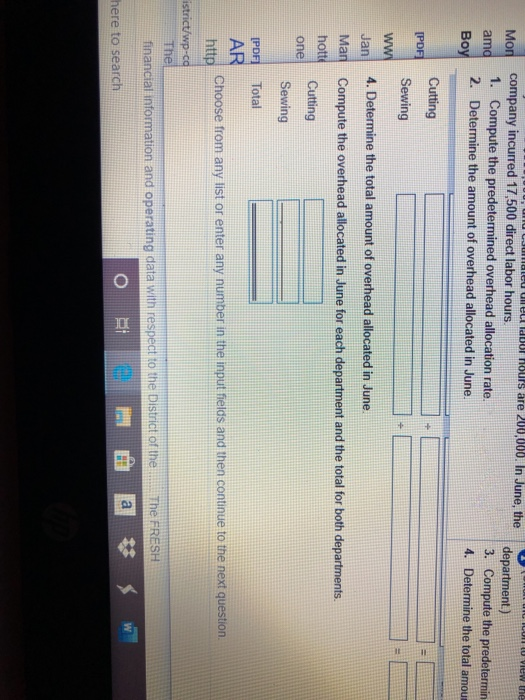

The Santos Shirt Company manufactures shirts in two departments Cutting and Sewing. The company allocates manufacturing overhead using a single plantwide rate with direct labor hours as the allocation base. Estimated overhead costs for the year are $500,000, and estimated direct labor hours are 200,000. In June, the company incurred 17,500 direct labor hours. 1. Compute the predetermined overhead allocation rate. ! 2. Determine the amount of overhead allocated in June. The Santos Shirt Company has refined its allocation system by separating manufacturing overhead costs into two cost pools one for each department Click the icon to view the estimated costs and allocation data for each department.) 3. Compute the predetermined overhead allocation rates for each department 4. Determine the total amount of overhead allocated in June. A 1. Compute the predetermined overhead allocation rate. Begin by selecting the formula to calculate the predetermined overhead (OH) allocation rate. Then enter the amounts to compute the allocation rate using a single plantwide rate with direct labor hours as the allocation base. Predetermined OH allocation rate ane 2. Determine the amount of overhead allocated in June. POF1 AR htts Choose from any list or enter any number in the input fields and then continue to the next question http wp-co The The FRESH financial information and operating data with respect to the District of the o search urs as the allocation base. Estimated overhead costs for ind estimated direct labor hours are 200,000. In June, the direct labor hours. ermined overhead allocation rate. ant of overhe i More Info mined overh (Click the icon to view the estimated costs and department.) 3. Compute the predetermined overhead allocatio allocat he alla rmula to cald labor hours The estimated costs for the Cutting Department are $200,000. They will be allocated based on direct labor hours, which are estimated to be 125,000 hours for the year. The estimated costs for the Sewing Department are $300,000. Those costs will be allocated based on machine hours, which are estimated to be 150,000 hours for the year. In June, the company incurred 10,000 direct labor hours in Cutting and 12,500 machine hours in Sewing. of overhead Print Done enter any number in the input fields and then continue to the next question. rating data with respect to the District of the... The FRESH O W May Mon amo Boy 10 MT NCC UDINUS ds lle allocation base. Estimated overhead costs for the year are $500,000, and estimated direct labor hours are 200,000. In June, the company incurred 17,500 direct labor hours. 1. Compute the predetermined overhead allocation rate. 2. Determine the amount of overhead allocated in June. Click the icon to view the estima department.) 3. Compute the predetermined over 4. Determine the total amount of ove 2. Determine the amount of overhead allocated in June. [PDF Begin by selecting the formula to allocate overhead costs. Use a single plantwide rate with direct labor hours as the allocatic Allocated mfg. overhead costs hott The overhead allocated in June is 3. Compute the predetermined overhead allocation rates for each department Renin hu selecting the formula ta ralculate the nredetermined verhead H allocation rate Then enter the amount to rem Choose from any list or enter any number in the input fields and then continue to the next question