Answered step by step

Verified Expert Solution

Question

1 Approved Answer

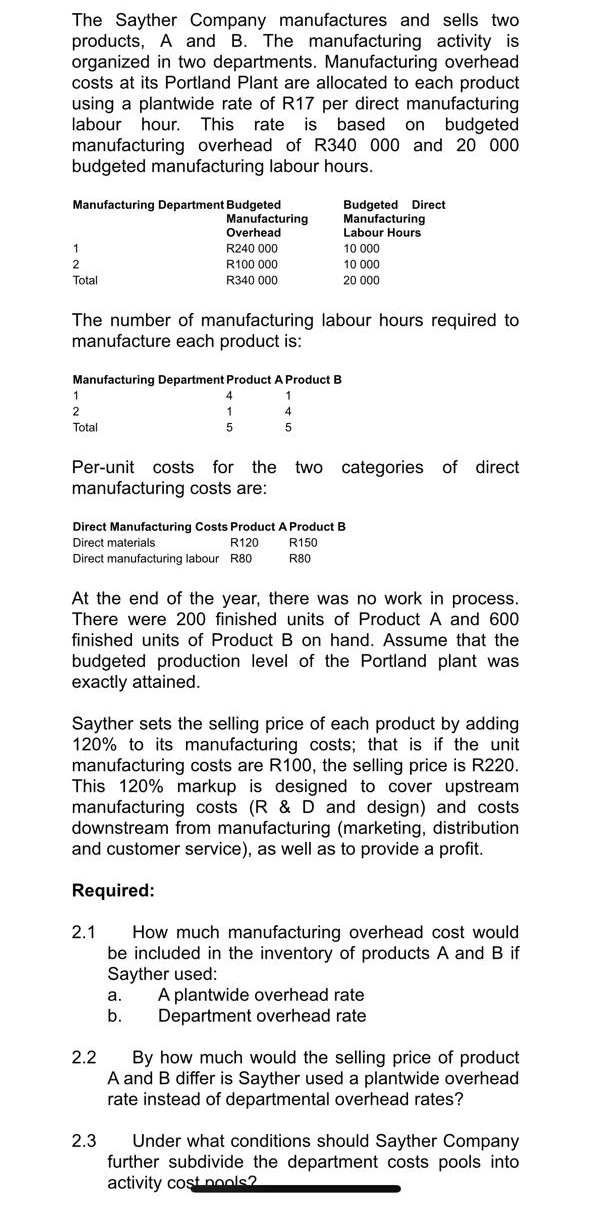

The Sayther Company manufactures and sells two products, A and B . The manufacturing activity is organized in two departments. Manufacturing overhead costs at its

The Sayther Company manufactures and sells two products, A and B The manufacturing activity is organized in two departments. Manufacturing overhead costs at its Portland Plant are allocated to each product using a plantwide rate of R per direct manufacturing labour hour. This rate is based on budgeted manufacturing overhead of R and budgeted manufacturing labour hours.

tableManutableBudgetedManufacturingOverheadtableBudgeted DirectManufacturingLabour HoursRRTotalR

The number of manufacturing labour hours required to manufacture each product is:

tableManufacturing Department Product A Product BTotal

Perunit costs for the two categories of direct manufacturing costs are:

Direct Manufacturing Costs Product A Product B

Direct materials

Direct manufacturing labour

At the end of the year, there was no work in process. There were finished units of Product A and finished units of Product on hand. Assume that the budgeted production level of the Portland plant was exactly attained.

Sayther sets the selling price of each product by adding to its manufacturing costs; that is if the unit manufacturing costs are R the selling price is R This markup is designed to cover upstream manufacturing costs & D and design and costs downstream from manufacturing marketing distribution and customer service as well as to provide a profit.

Required:

How much manufacturing overhead cost would be included in the inventory of products A and if Sayther used:

a A plantwide overhead rate

b Department overhead rate

By how much would the selling price of product A and differ is Sayther used a plantwide overhead rate instead of departmental overhead rates?

Under what conditions should Sayther Company further subdivide the department costs pools into activity cost pools?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started