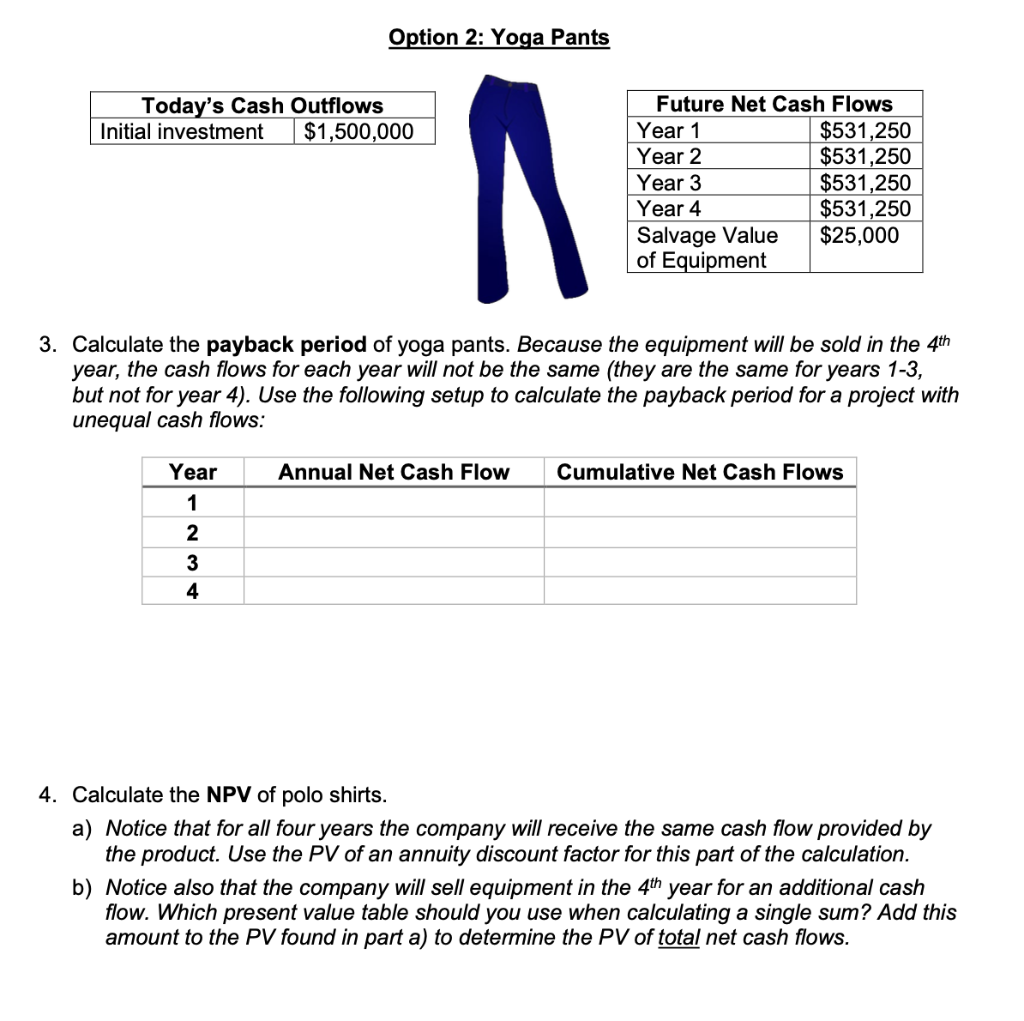

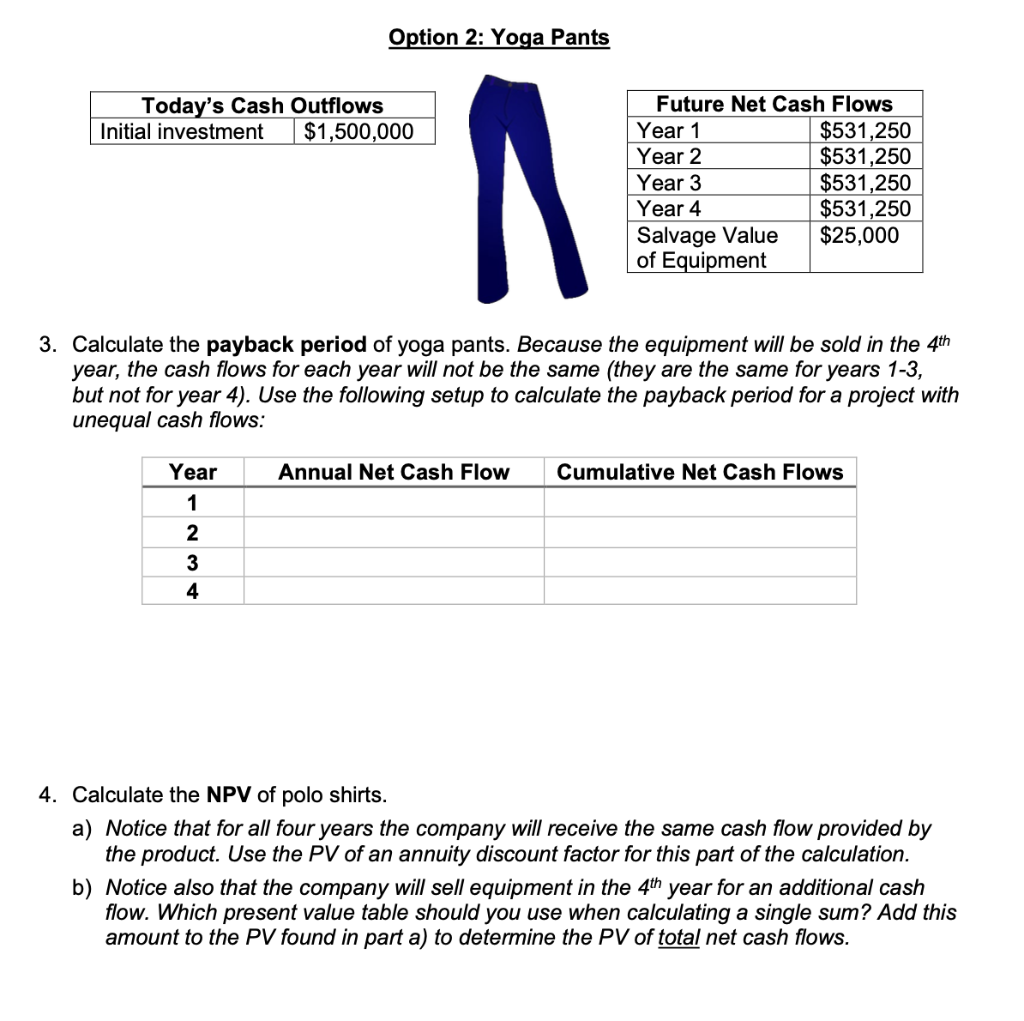

The Scenario: You work in the product development department of an athletic apparel company. Your company has decided to add a new product and is choosing between a polo tee, yoga pants, or running shoes. You have been asked to evaluate the financial profitability of each option. You have estimated that the company has $1,500,000 to invest in the project, and each product has the potential to bring in an estimated $2,125,000 of future cash flows, although the timing of the cash flows varies per product Additionally, two of the products would use equipment that could be sold at the end of the project cycle. In order to pay for the project, the company will have to finance at a 6% interest rate. Present value discount factors are listed as follows: Formulas: Payback period = cost of investment NPV=PV of total future net CF - initial cost (for same CF's) annual net CF's Requirements 1. Calculate the profitability of each project using - The payback method - Net present value (NPV) 2. Make a decision on which product to produce by answering the Pause and Reflect questions on page 5. Option 2: Yoga Pants 3. Calculate the payback period of yoga pants. Because the equipment will be sold in the 4th year, the cash flows for each year will not be the same (they are the same for years 1-3, but not for year 4). Use the following setup to calculate the payback period for a project with unequal cash flows: 4. Calculate the NPV of polo shirts. a) Notice that for all four years the company will receive the same cash flow provided by the product. Use the PV of an annuity discount factor for this part of the calculation. b) Notice also that the company will sell equipment in the 4th year for an additional cash flow. Which present value table should you use when calculating a single sum? Add this amount to the PV found in part a) to determine the PV of total net cash flows. The Scenario: You work in the product development department of an athletic apparel company. Your company has decided to add a new product and is choosing between a polo tee, yoga pants, or running shoes. You have been asked to evaluate the financial profitability of each option. You have estimated that the company has $1,500,000 to invest in the project, and each product has the potential to bring in an estimated $2,125,000 of future cash flows, although the timing of the cash flows varies per product Additionally, two of the products would use equipment that could be sold at the end of the project cycle. In order to pay for the project, the company will have to finance at a 6% interest rate. Present value discount factors are listed as follows: Formulas: Payback period = cost of investment NPV=PV of total future net CF - initial cost (for same CF's) annual net CF's Requirements 1. Calculate the profitability of each project using - The payback method - Net present value (NPV) 2. Make a decision on which product to produce by answering the Pause and Reflect questions on page 5. Option 2: Yoga Pants 3. Calculate the payback period of yoga pants. Because the equipment will be sold in the 4th year, the cash flows for each year will not be the same (they are the same for years 1-3, but not for year 4). Use the following setup to calculate the payback period for a project with unequal cash flows: 4. Calculate the NPV of polo shirts. a) Notice that for all four years the company will receive the same cash flow provided by the product. Use the PV of an annuity discount factor for this part of the calculation. b) Notice also that the company will sell equipment in the 4th year for an additional cash flow. Which present value table should you use when calculating a single sum? Add this amount to the PV found in part a) to determine the PV of total net cash flows