Answered step by step

Verified Expert Solution

Question

1 Approved Answer

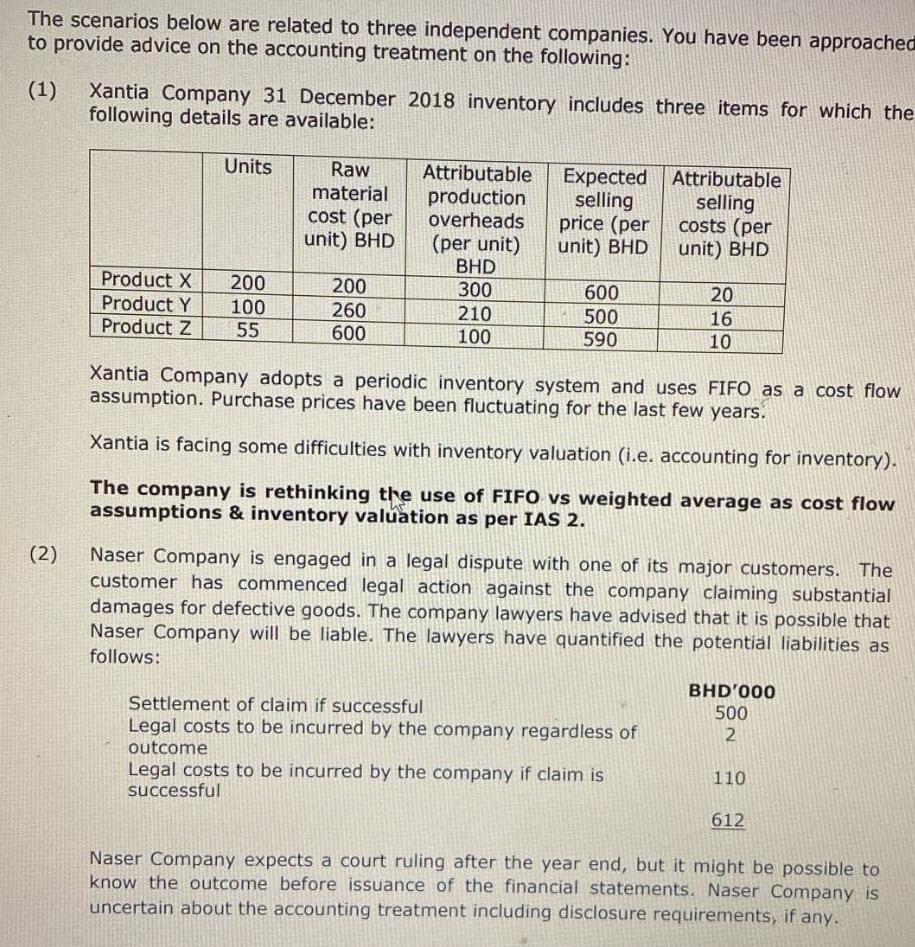

The scenarios below are related to three independent companies. You have been approached to provide advice on the accounting treatment on the following: (1)

The scenarios below are related to three independent companies. You have been approached to provide advice on the accounting treatment on the following: (1) Xantia Company 31 December 2018 inventory includes three items for which the following details are available: (2) Units Product X 200 Product Y 100 Product Z 55 Raw material cost (per unit) BHD 200 260 600 Attributable Expected production selling overheads (per unit) BHD 300 210 100 price (per unit) BHD 600 500 590 Attributable selling costs (per unit) BHD 20 16 10 Xantia Company adopts a periodic inventory system and uses FIFO as a cost flow assumption. Purchase prices have been fluctuating for the last few years. Settlement of claim if successful Legal costs to be incurred by the company regardless of outcome Legal costs to be incurred by the company if claim is successful Xantia is facing some difficulties with inventory valuation (i.e. accounting for inventory). The company is rethinking the use of FIFO vs weighted average as cost flow assumptions & inventory valuation as per IAS 2. Naser Company is engaged in a legal dispute with one of its major customers. The customer has commenced legal action against the company claiming substantial damages for defective goods. The company lawyers have advised that it is possible that Naser Company will be liable. The lawyers have quantified the potential liabilities as follows: BHD'000 500 2 110 612 Naser Company expects a court ruling after the year end, but it might be possible to know the outcome before issuance of the financial statements. Naser Company is uncertain about the accounting treatment including disclosure requirements, if any.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Xantia Companys Inventory Valuation Dilemma Xantia Company should carefully consider the accounting treatment for its inventory The decision between ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started