Answered step by step

Verified Expert Solution

Question

1 Approved Answer

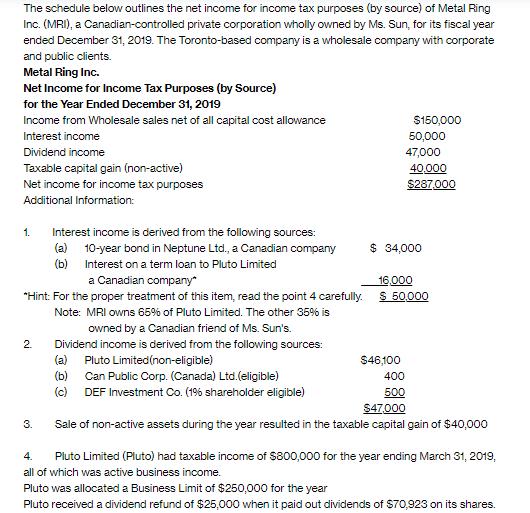

The schedule below outlines the net income for income tax purposes (by source) of Metal Ring Inc. (MRI), a Canadian-controlled private corporation wholly owned

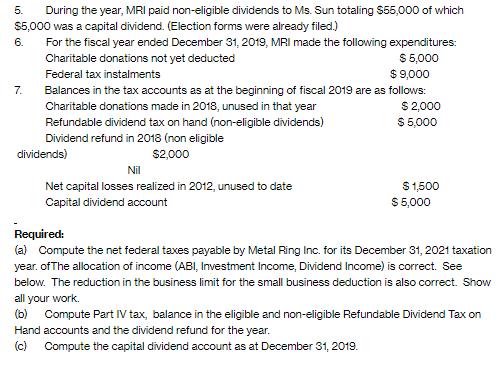

The schedule below outlines the net income for income tax purposes (by source) of Metal Ring Inc. (MRI), a Canadian-controlled private corporation wholly owned by Ms. Sun, for its fiscal year ended December 31, 2019. The Toronto-based company is a wholesale company with corporate and public clients. Metal Ring Inc. Net Income for Income Tax Purposes (by Source) for the Year Ended December 31, 2019 Income from Wholesale sales net of all capital cost allowance Interest income Dividend income Taxable capital gain (non-active) Net income for income tax purposes Additional Information: Interest income is derived from the following sources: 10-year bond in Neptune Ltd., a Canadian company Interest on a term loan to Pluto Limited a Canadian company* *Hint: For the proper treatment of this item, read the point 4 carefully. Note: MRI owns 65% of Pluto Limited. The other 35% is owned by a Canadian friend of Ms. Sun's. Dividend income is derived from the following sources: Pluto Limited (non-eligible) Can Public Corp. (Canada) Ltd.(eligible) DEF Investment Co. (1% shareholder eligible) 1. 2. 3. (a) (b) (a) (b) (c) $150,000 50,000 47,000 $46,100 400 500 40,000 $287.000 $ 34,000 16,000 $ 50,000 $47,000 Sale of non-active assets during the year resulted in the taxable capital gain of $40,000 4. Pluto Limited (Pluto) had taxable income of $800,000 for the year ending March 31, 2019, all of which was active business income. Pluto was allocated a Business Limit of $250,000 for the year Pluto received a dividend refund of $25,000 when it paid out dividends of $70,923 on its shares. 5. During the year, MRI paid non-eligible dividends to Ms. Sun totaling $55,000 of which $5,000 was a capital dividend. (Election forms were already filed.) 6. For the fiscal year ended December 31, 2019, MRI made the following expenditures: Charitable donations not yet deducted $5,000 Federal tax instalments $ 9,000 $ 2,000 Balances in the tax accounts as at the beginning of fiscal 2019 are as follows: Charitable donations made in 2018, unused in that year Refundable dividend tax on hand (non-eligible dividends) Dividend refund in 2018 (non eligible $ 5,000 dividends) $2,000 7. Nil Net capital losses realized in 2012, unused to date Capital dividend account $1,500 $ 5,000 Required: (a) Compute the net federal taxes payable by Metal Ring Inc. for its December 31, 2021 taxation year. of The allocation of income (ABI, Investment Income, Dividend Income) is correct. See below. The reduction in the business limit for the small business deduction is also correct. Show all your work. (b) Compute Part IV tax, balance in the eligible and non-eligible Refundable Dividend Tax on Hand accounts and the dividend refund for the year. (c) Compute the capital dividend account as at December 31, 2019.

Step by Step Solution

★★★★★

3.37 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Lets calculate the net federal taxes payable by Metal Ring Inc MRI for its December 31 2019 taxation year a Compute the net federal taxes payable by M...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started